(ATF) Taiwan Semiconductor Manufacturing Company (TSMC) raised its 2020 revenue forecast for a second time this year, supported by robust demand for 5G mobile devices like Apple’s new iPhones and high-performance computing (HPC).

CC Wei, chief executive of the world’s largest contract chipmaker, told investors on the company’s third quarter earnings call last Thursday that the company expects to “outperform the industry” and grow by about 30% this year in dollar terms. The group had previously said after its second-quarter earnings that it expected 2020 revenues to grow 205.

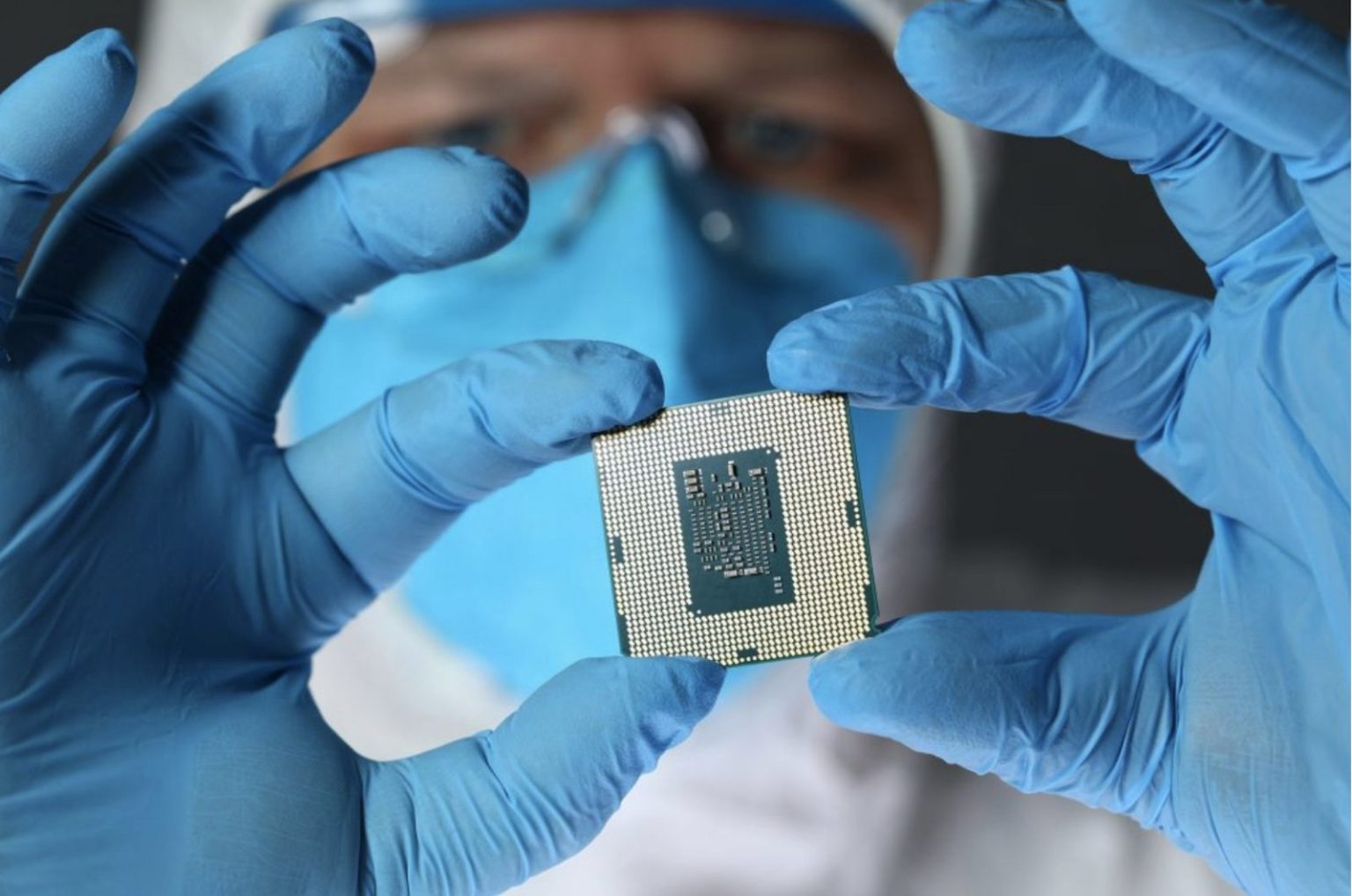

TSMC supplies more than half of the world’s made-to-order chips and is closely watched for signs of global electronics demand. The company’s earnings have continued to grow despite Covid-caused recession in the world’s big economies.

CHIP CRISIS: China acquires Japanese chipmaking machines for leap into 3G fabs

TSMC recorded revenue of $12.1 billion and net income of $4.8bn in the third quarter, which was up 29.2% and 16.9% year-on-year, respectively.

The chip sector has been one of the rare industries benefiting from the coronavirus pandemic with more people investing in premium devices as they spend longer hours at home and as corporations seek to add more bandwidth for remote workers.

“COVID has accelerated the digital transformation,” Chief Executive C.C. Wei told an online earnings briefing, adding that robust demand for smartphones and other electronics as well as 5G technologies had spurred orders for high-end chips.

Apple chips

The most-advanced 5-nanometer (nm) process technology – used to make Apple’s A14 chips – accounted for about 8% of total revenue during the quarter, while 7nm and 16nm made up 35% and 18%, respectively.

By business segment, TSMC’s smartphone business expanded 12%, while HPC posted the strongest growth, up 25%.

The company expects a strong fourth quarter with revenues between $12.4bn and $12.7bn. Gross profit margin is expected to be between 51.5% and 53.5%, it said.

TSMC’s chip orders received a boost in the second and third quarters as China’s tech giant Huawei raced to stock up on semiconductors before US sanctions prohibiting it from buying chips made with US technology took effect in mid-September. Huawei accounted for 14% of TSMC’s 2019 sales with chip outsourcing orders for mobile phones, base stations, servers and other equipment.

TSMC stopped chip shipments to Huawei in mid-September, and its spokespeople have denied speculation that it may have received licenses to supply the Chinese company.

Analysts said TSMC’s bullish outlook indicated that demand from TSMC’s customers was broad-based and went beyond a rush of orders from Huawei.

TSMC has a large range of customers. Among them is Apple, which accounted for about 20% of its monthly revenue in 2019.

Last Tuesday, Apple unveiled its latest iPhone lineup, and said it expects to build at least 75 million new 5G handset this year. Apple has reportedly booked TSMC’s entire 5nm production capacity, which is believed to have filled the vacancy left by the withdrawal of Huawei orders.

“All countries and regions are preparing to build up (5G) infrastructure right now…a lot of 5G phones will be introduced and that created a higher percentage penetration rate,” Wei said.

- Additional reporting by Reuters