Analysts expect the US Federal Reserve will reduce its future interest rate hikes following a larger than expected drop in consumer inflation last month.

Data for October published on Thursday by the US Labor Department showed key items like rents rose by less than expected, while the price index for used cars declined by 2.4%, the fourth consecutive monthly drop. Prices for airfares, medical services, and apparel all declined.

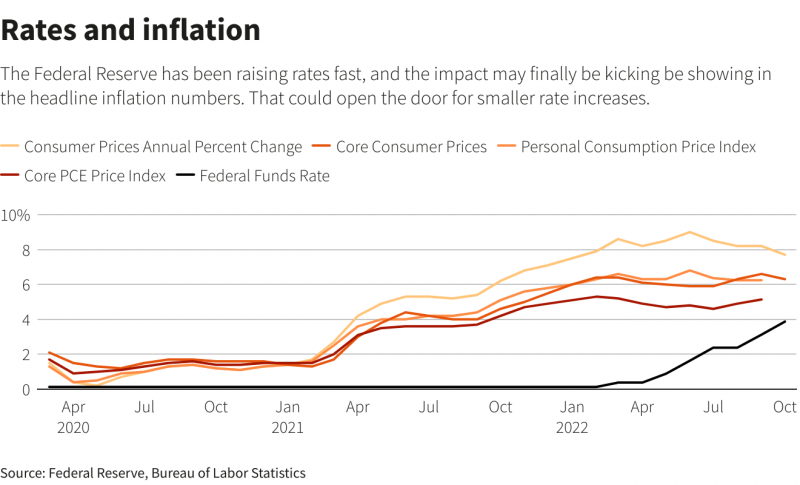

Though overall inflation remained high by historic standards, with prices increasing 7.7% from a year earlier, the monthly pace of “core” inflation that excludes volatile food and energy costs dropped by half, to 0.3% in October from 0.6% the month before.

The latest news suggests the Fed’s swift monetary tightening is beginning to have an impact. Some analysts said this may be the start of inflation being defused after emerging last year as a chief risk to the economy.

“This is not some kind of outlier,” wrote Omair Sharif of Inflation Insights. “This is the start… of lower prints.”

ALSO SEE:

China Markets Jump After Politburo Eases Covid Rules

US Stocks Soar

The report sent US stocks soaring, with the S&P 500 up more than 4% in late morning trading on hopes the Fed, while not expected to turn dovish anytime soon, may at least not be forced into a more aggressive posture.

The yield on the 2-year US Treasury note, the maturity most sensitive to Fed rate expectations, dropped by nearly 20 basis points, the most in one day since June.

Traders in futures contracts tied to the Fed’s benchmark rate show investors now expect the blistering pace of policy tightening to slow next month – and for the Fed to stop its rate hikes sooner than expected.

After raising rates more sharply this year than at any time since the 1980s, including four straight 75-basis-point rate hikes that brought the policy rate to a 3.75%-4% range as of last week, the Fed is now seen shifting to a half-point rate hike next month and quarter-point hikes after that.

Rate futures contracts are now pricing in a top policy rate in the 4.75%-5% range next March – lower than the 5%-plus range seen before the report – and interest-rate cuts in the second half of the year.

Fed policymakers took some relief from the data but, in an era when their initially sanguine view of inflation left them playing catch-up, also said the fight with rising prices is far from over.

‘Long Way to Go’

“This morning’s CPI data were a welcome relief, but there is still a long way to go,” new Dallas Fed President Lorie Logan said. “While I believe it may soon be appropriate to slow the pace of rate increases so we can better assess how financial and economic conditions are evolving, I also believe a slower pace should not be taken to represent easier policy.”

Fed officials have said they want convincing evidence that inflation is in decline before altering their approach, and still believe returning inflation to their 2% target will require keeping rates at a “restrictive” level for a potentially extended period of time.

Continued high inflation for services, possibly reflecting labor markets that remain tight for those more labour-intensive businesses, could prevent any quick resolution of the overall inflation problem.

But the central bank at its last meeting also indicated it could take a step back from delivering interest rate hikes in such large chunks in favor of a more tempered approach as the economy adjusts to the “lagged” impact of monetary policy.

“The hikes in interest rates are beginning to bite into the economy and lower inflation as consumers become more frugal,” Peter Cardillo, chief market economist at Spartan Capital Securities, said.

Speaking after the report, Philadelphia Fed president Patrick Harker indicated his support for slowing rate hikes and then stopping, perhaps even earlier than markets now expect.

“I am in the camp of wanting to get to what would clearly be a restrictive stance (with the policy rate) somewhere north of 4-ish, you know, 4.5%, and then I would be okay with taking a brief pause, seeing how things are moving,” he said.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

US Fed Move to Raise Interest Rates Ripples Across Asia

Chinese Yuan Close to 15-Year Low After Fed Rate Hike

US Crackdown on China ‘Slave Labour’ Blocks Solar Projects