(ATF) Hong Kong: Asian markets rallied Wednesday on the heady cocktail of more coronavirus vaccines, US stimulus and hopes of a dovish Federal Reserve.

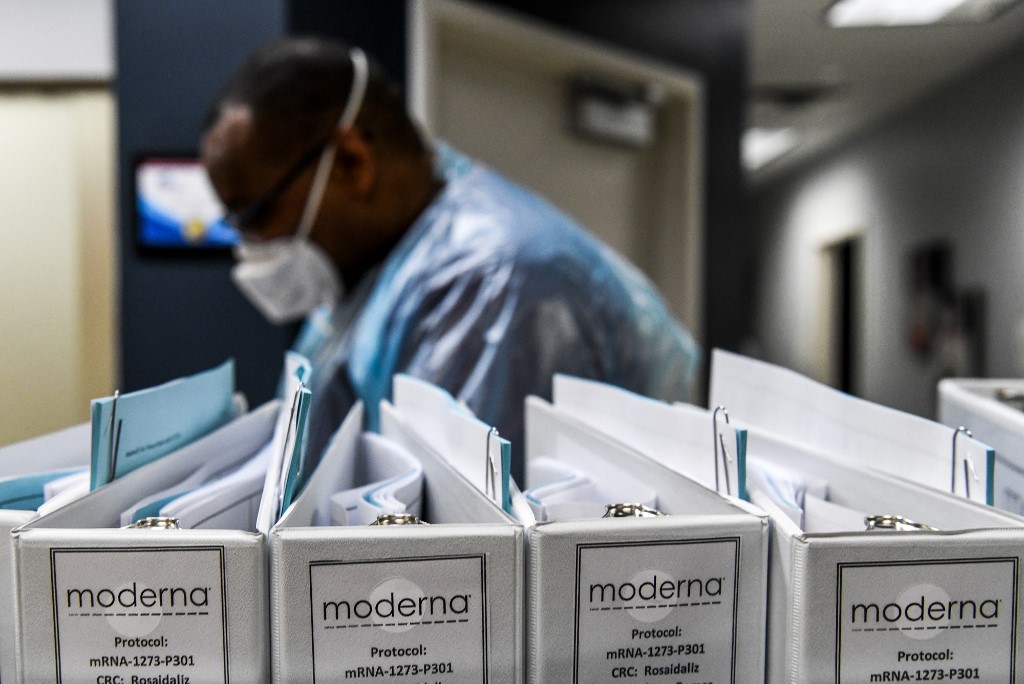

Moderna Inc’s COVID-19 vaccine could receive regulatory authorisation later this week while the FDA also gave emergency authorisation for the first Covid-19 test that can be fully taken at home.

“The two-dose vaccination regimen was highly effective in preventing PCR-confirmed Covid-19 occurring at least 14 days after receipt of the second dose,” according to documents related to Moderna’s vaccine candidate, released by the FDA.

Regular tests could also inform people when to stay home and encourage them to wear a mask and keeping away from others.

Investor sentiment was also stoked by hopes the US Federal Reserve will ease monetary policy later in the day by increasing the duration of its Treasury portfolio.

“It may also increase asset purchases or otherwise signal its willingness to support the economy and asset markets, but these may be explicitly temporary or tied to economic outcomes,” said Steve Englander and ohn Davies, Standard Chartered Bank economists in a note.

Japan’s Nikkei 225 index edged up 0.26%, Australia’s S&P ASX 200 jumped 0.72%, Hong Kong’s Hang Seng index added 0.97%, and China’s CSI300 inched up 0.18% under-performing the region after hMSCI Inc. joined other index providers in removing Chinese firms from some of its global indexes. MSCI moves followed on the heels of similar actions from S&P Dow Jones Indices and FTSE Russell after US restrictions on owning the companies.

Regionally, the MSCI Asia Pacific index advanced 0.83%.

Investor’s risk appetite was also whetted by reports the US lawmakers were on the verge of breaking the months-long stimulus stalemate.

The expectations of a dovish Fed and a breakthrough in the stimulus deadlock pushed the dollar down to new 2-1/2 year lows as it fell to 0.3% to 90.21 against a basket of currencies. Gold caught the safe haven bid rising 0.4% to $1,860 per ounce.

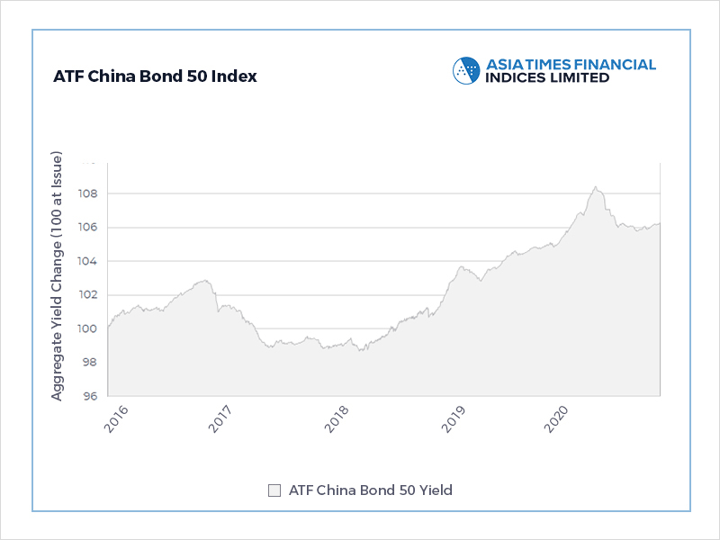

ATF China Bond 50 Index

Asia Stocks

· Japan’s Nikkei 225 index edged up 0.26%

· Australia’s S&P ASX 200 jumped 0.72%

· Hong Kong’s Hang Seng index added 0.97%

· China’s CSI300 inched up 0.18%

· The MSCI Asia Pacific index advanced 0.83%.

Stock of the day

Chinese chipmaker SMIC fell as much as 9.6% after co-CEO Liang Mong Song’s decision to resign. “As SMIC’s recent technology progress was directly attributable to Liang, we think his departure will trigger a negative market response,” Bernstein analyst Mark Li. “Foundry is a “team sport” and a collaborative team sharing a common goal is key. Being a national champion with huge governmental investments, SMIC inevitably has some considerations that professional managers may not share. Building a team that collaborates together toward a common goal is essential, but is something that money alone can’t buy.”