(ATF) Hong Kong: Investors were on edge as rising coronavirus infections across the US and Europe began to weigh on optimism over a vaccine.

Markets were also awaiting the next phase of the US post-election drama with President Donald Trump yet to formally concede defeat.

There is growing hope a vaccine will rein in the coronavirus pandemic, which has already claimed 1.3 million lives and infected over 52 million people globally, and restart economies.

The Asia Eight: Daily must-reads from world’s most dynamic region

“The nascent global economic recovery is under threat from rising COVID-19 cases in the US and Europe,” said Moody’s analysts in a note published on Thursday.

“The recovery path is beset by uncertainty and will remain highly dependent on: the development and distribution of a vaccine; effective pandemic management; and, government policy support.

“Overall, sustained economic improvement is not possible in countries where new waves of the virus continue to cause disruption.”

Australia’s S&P ASX 200 fell 0.49% and Hong Kong’s Hang Seng index inched down 0.22% but Japan’s Nikkei 225 index added 0.68% amid expectations of more financial support after a policymaker said the Bank of Japan’s monetary policy can play a bigger role in the economic recovery.

Accommodative policy

“I believe that it remains necessary in the COVID-19 era to maintain an accommodative monetary policy stance while carefully monitoring economic developments,” said central bank board member Seiji Adachi.

Markets are heading lower as vaccine optimism, which had driven a rally across the first part of the week, fizzles and the covid trade is back in play.

“Rising covid cases and tighter and more widespread lockdown restrictions are prompting a risk-off trade sending riskier assets such as stocks lower, while safe havens such as the US dollar and gold are back in favour,” said Fiona Cincotta, analyst at Gain Capital.

There is also scepticism about a smooth transition of power in the United States and the impact on China from the US policies in Trump’s final days at the White House.

“The risk of Trump escalating tensions with China before Biden’s inauguration in January is non-negligible,” said Standard Chartered Bank analysts in a note.

US Treasuries were firm ahead of a key speech by Federal Reserve Chairman Jerome Powell with the 10-year yield edging down 3 basis points to 0.94%. Gold has caught he safety bid and jumped 0.3% to $1,871 per ounce.

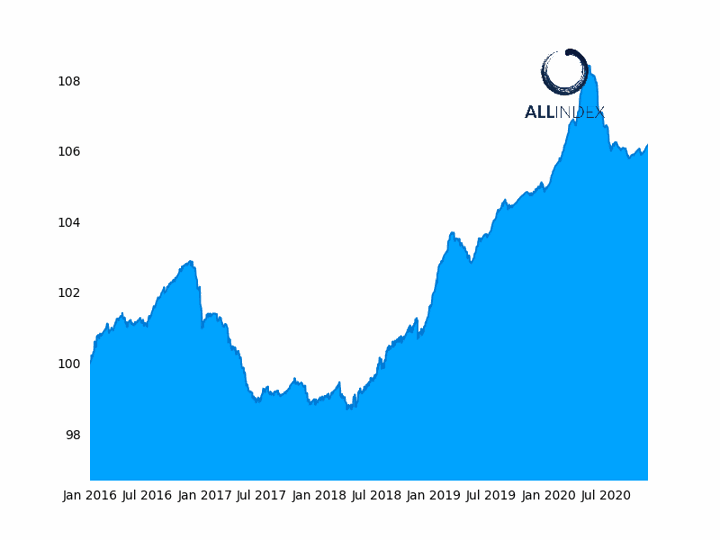

ATF China Bond 50 Index

The ATF CB50 climbed 0.01% to 106.17

Also on Asia Times Financial

- Indian watchdog probes Google again

- China’s latest Hong Kong clampdown condemned in US

- US Treasury seeks ‘resolution’ with ByteDance on security concerns

- Asian pharma joins Covid treatment crusade

- China ignites electric car production, sales

- Huawei now US’ Room 101

- China’s SMIC facing delays on some US-made supplies

Asia Stocks

- Japan’s Nikkei 225 index added 0.68%

- Australia’s S&P ASX 200 fell 0.49%

- Hong Kong’s Hang Seng index inched down 0.22%

- China’s CSI300 edged up 0.07%

- ·The MSCI Asia Pacific index inched down 0.05%.

Stock of the day

Chinese gaming and social media giant Tencent Holdings rose as much as 6.3% after reporting an 89% rise in quarterly profit which beat forecasts.