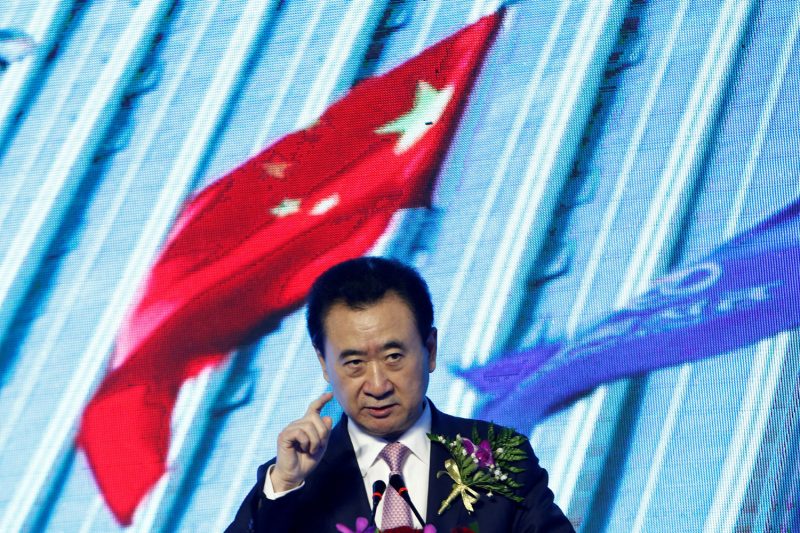

(ATF) Wanda Group has completed the sale of the Vista Tower project in Chicago in a deal previously disclosed to be $270 million. This marks the end of an ambitious international hotel chain plan by Chinese billionaire Wang Jianlin as the group trims its multi-billion-dollar debt.

Hong Kong-listed Wanda Hotel Development Company, a subsidiary of Wang’s conglomerate Wanda Group, announced it closed the disposal of a 90% stake in the condominium and hotel project to Magellan Parcel, a Chicago-based development group. Magellan already owned the other 10% of the project.

According to the company’s earlier announcement in July, the deal is worth $270 million and gives Wanda a gain of about $12.1 million.

Wanda had planned to bring an ultra-luxury hotel to the 101-storey super-tall skyscraper, which broke ground in 2016. The tower will be renamed The St. Regis Chicago as Magellan brings aboard a new luxury hotel brand and one of Chicago’s best-known restaurant operators, Alinea Group, to Chicago’s third-tallest skyscraper, which was designed by Jeanne Gang, according to the Chicago Tribune.

“Major changes to Magellan’s project come at a pivotal time in the commercial real estate industry, which is struggling to overcome the coronavirus pandemic. Hotels have been hit particularly hard by Covid-19,” the newspaper said in a report.

But Magellan executives told the paper that they are optimistic about the project with the positive news about vaccines. The first residents are expected to move in by December and the hotel is scheduled to open in the third quarter of next year.

The sale is expected to slightly reduce Wanda Group’s massive outstanding debts, which totalled about $2.9 billion at the end of March.

Massive sell-off

The Vista Tower project was Wanda Group’s third five-star hotel project outside China after those in London and Madrid.

Wanda Group, which once aspired to rival Walt Disney in entertainment, carried out a debt-fuelled shopping spree between 2012 and 2016 when it snapped up European football clubs, properties in Beverly Hills and Hollywood studios.

After Beijing placed curbs on Chinese conglomerates’ overseas investment in real estate, hotels, movie studios, and sport clubs, Wang said openly that he would focus his investment within mainland China.

In 2018, Wang sold three overseas projects within a month, which were One Nine Elms in London for £59 million ($82 million), and two projects in Australia for A$1.13 billion ($913 million).

Wanda Group’s businesses such as cinemas and theme parks have been particularly challenged this year by the coronavirus pandemic.

In March, Wanda Sports Group agreed to sell its Ironman triathlon business for $730 million in cash. Wanda Group has also disposed of stakes in Spanish soccer club Atletico Madrid and reduced its holdings in AMC Entertainment Holdings, the biggest cinema chain in the United States.

Wang fell to 30th position on Forbes’ China Rich List released earlier this month, a drop from 14th last year, with a net worth of $14.4 billion as at November 30.

ALSO SEE:

Chinese provinces to give away billions to boost spending