In less than a year and a half, liquefied natural gas (LNG) prices have lurched from record lows to record highs, with the market first reeling from the impact of the pandemic and now unable to keep up with a global recovery in demand.

Demand jumped on economic growth plus a cold northern hemisphere winter followed by a hot summer, while supplies have been stymied by production problems. Recent power curbs and outages across China due to coal shortages have only exacerbated competition between Asia and Europe in securing sources of energy.

Asian LNG prices surged to a record high this week on sustained demand from China amid a power crunch and high gas prices in Europe as the winter season begins.

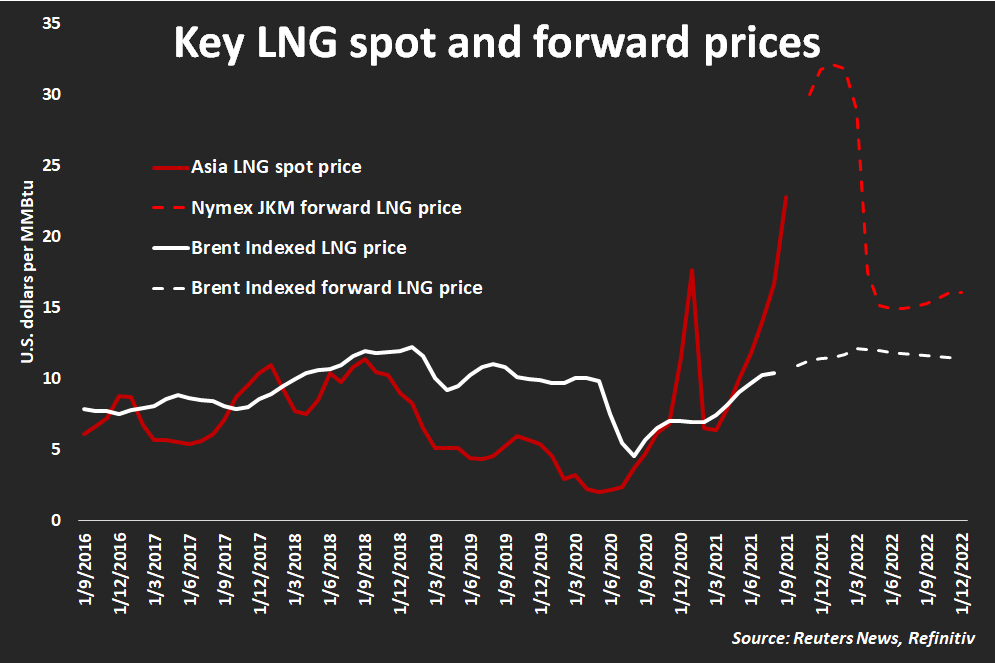

The average LNG price for November delivery into Northeast Asia was estimated at about $32 per metric million British thermal units (mmBtu), up nearly 20% from the previous week, industry sources said. And price agency S&P Global Platts said on Thursday its Japan-Korea-Marker (JKM), which is widely used as a benchmark for spot LNG contracts, rose to $34.47 per mmBtu.

CHINESE BUYERS, RECORD RATES

Chinese buyers are seeking more cargoes despite record prices, bidding above market rates as the winter season starts with the country’s gas inventory not full, trade sources said.

Unipec, the trading arm of Chinese oil and gas group Sinopec, is likely to have bought more than the 11 cargoes it sought last week for winter, while China National Offshore Oil Corp (CNOOC) and PetroChina are also seeking cargoes for winter.

Sinopec said on Thursday it planned to import 13.3 billion cubic metres (bcm) of LNG this winter – about 9% higher than imports last winter – to operate its existing terminals at full capacity, and accelerate adding gas storage by the end of October.

It has also secured approval for a third major gas-receiving terminal, to be built in Longkou in eastern China’s Shandong province and handle about 6 million tonnes of LNG a year.

Meanwhile, demand was strong from Argentina, with energy company Integracion Energetica Argentina (IEASA) seeking four partial LNG cargoes for delivery in the fourth quarter, an industry source said.

Some supply deals were also done this week with Pertamina selling two LNG cargoes from Bontang for mid-October and November, while Australia’s AP LNG plant sold a cargo for November at a discount to North Asian price quotes, traders said.

Taiwan’s CPC Corp is also likely to have bought cargoes for winter, one trader said, though the exact volumes could not be confirmed.

HOW BAD IS THE SUPPLY-DEMAND MISMATCH?

Gas inventories remain critically tight in Europe and Asia which together account for 94% of global LNG imports and over a third of global gas consumption.

Most major LNG producers are operating at or close to full capacity and have allocated the vast majority of their shipments to specific customers, leaving little prospect of a short-term fix.

According to the International Gas Union, only 8.9 million tonnes per annum (mtpa) of a total 139.1 mtpa of planned new liquefaction capacity is expected to come online in 2021.

Some of that additional capacity has been delayed by Covid-19 movement restrictions that have stopped or dragged out construction and maintenance work at several key sites including in Indonesia and Russia over the past year.

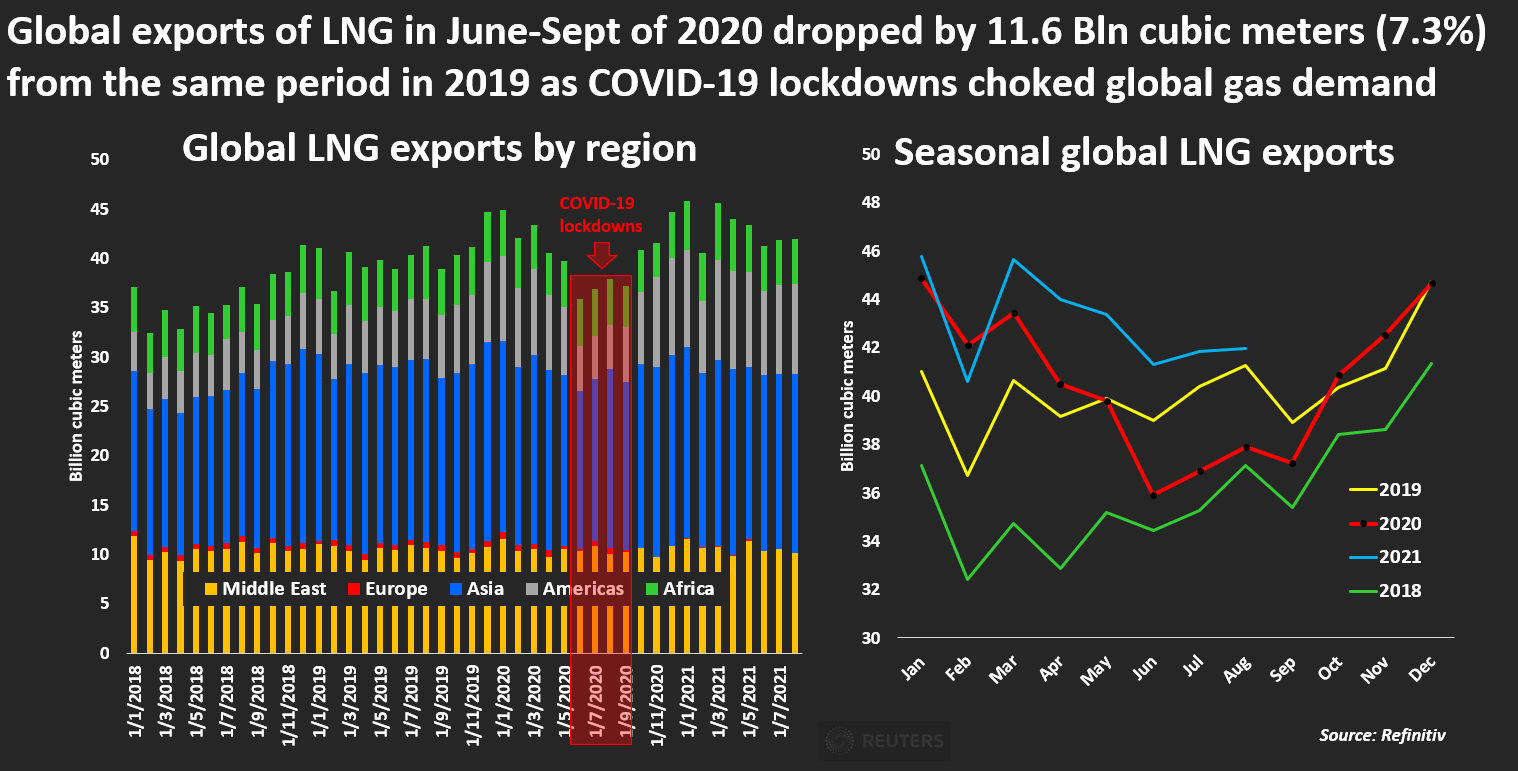

So far this year, 288.1 million tonnes of LNG has loaded for exports globally, just 7% growth over the same period last year, Refinitiv data shows.

WHAT ARE THE RISKS AHEAD?

Buyers may struggle to buy enough gas for restocking and use. Less wind in Europe lately has boosted gas usage by power stations there, while in China power is being rationed to industry and some residential users, triggering a jump in LNG imports.

Current long-range forecasts call for a mild winter in much of Asia this year, but the market fears a repeat of the 2020/21 cold snap could lead to a buying binge similar to the one in January that fired up prices.

“At the extreme, it would not be a surprise if some gas or LNG cargoes could even change hands in the $100/MMBtu range, or ~$580/bbl in oil-equivalent terms, based on observing how prices have spiked in the US gas market, for example, over the past ten years,” Citi said in a note to clients last week.

HOW DID WE GET HERE?

Spot LNG fell to a record low of $1.85/mmBtu in May 2020, when coronavirus containment measures snuffed out power demand just as new supplies from major producers including Qatar, Australia and the United States flowed onto the market.

LNG producers slashed production, reducing shipments through the 2020 summer which have had a lasting impact on global gas inventories. The 2020/21 winter freeze then caught many power providers short, sparking a surge in spot demand and tightening gas stockpiles further just as logistics constraints slowed delivery times.

Those factors and high shipping rates sent LNG spot prices rocketing to a record $32.50 per mmBtu in mid-January, though prices returned below $10 by the end of the month.

Prices have since bounced back. European buyers struggled to rebuild stocks, with a hot summer boosting air conditioner use just as high carbon prices forced power generators to cut coal use and burn more gas. Gas field maintenance in Norway and lower volumes from Russia also cut supplies.

Higher purchases by Asia on growth in Chinese demand and stock rebuilding exacerbated Europe’s shortfall, resulting in Europe-bound shipments through August sliding 18% from the same period in 2020, Refinitiv data shows.

That left Europe’s gas inventories at 50-60% full by late summer, compared to 80% in the same period last year. The current re-stocking wave is now fuelling Europe’s surge in gas prices.

WILL SUPPLIES BE FORTHCOMING?

Apart from Covid-19-related project delays, the global energy sector pivot away from fossil fuels towards greener energy supplies has slowed investment in LNG infrastructure. That has hindered the ability of producers to quickly deliver more supply to market, said Charif Souki, co-founder of US natural gas company Tellurian.

“The world was kind of lulled to complacency because prices were low for five years so no one felt an urge to plan and everyone got very religious on environmental protection and it is wonderful – it should be – but we should look at what things actually work rather than simply what we hope for,” he added.

• Reuters with additional editing by Jim Pollard