Global financial conditions are at their tightest since early 2016, driven by soaring energy prices, sliding stocks and market turmoil stemming from Russia’s invasion of Ukraine.

Financial conditions reflect the availability of funding in an economy and, because they strongly correlate with future growth, are watched closely by central bankers. How loose or tight they are dictates spending, saving and investment plans of businesses and households.

Goldman Sachs, which uses metrics such as exchange rates, equity swings and borrowing costs to compile the most widely used financial conditions indexes, has in the past shown a 100-basis-point tightening in conditions crimps growth by one percentage point in the coming year, with an equivalent loosening giving a corresponding boost.

Also on AF: Contracts Shield Asia’s EV Battery Makers From Nickel Surge

The current bout of tightening is an unwelcome development for a world economy that, despite historically loose monetary conditions in developed markets, is already threatened by the knock-on effect of oil prices at over $120 a barrel and supply chain setbacks caused by sanctions on Russia and the Covid-19 pandemic.

Goldman Sachs’ global financial conditions index (FCI) stood at 100.7 points at Tuesday’s close, a level last reached in February 2016 that is 70 basis points (bps) tighter than the index’s long-run average of 100 points and 110 bps tighter than prior to Russia’s invasion.

The rise has been led by the Russian FCI, which soared to 123 from around 98 at the start of February, the tightest on record in data going back to 2007, driven by the rouble losing a third of its value and a doubling of interest rates.

If current dynamics push inflation steadily higher, and “if the central banks take their mandates seriously, you will see a further [tightening] in financial conditions,” said Rene Albrecht, strategist at DZ Bank.

“Economic dynamics will slow down further, inflation will be high nonetheless and you will see second-round effects and then you get a stagflation scenario,” he added, referring to a combination of rising inflation and slower economic growth.

The war in Ukraine has taken an emerging markets FCI to its tightest since 2009.

“Commodity price pressures will likely lead to currency depreciation and heightened inflation, through imported inflation, in some emerging market countries, which will tighten financial conditions and weaken growth,” ratings agency Moody’s said in a recent report.

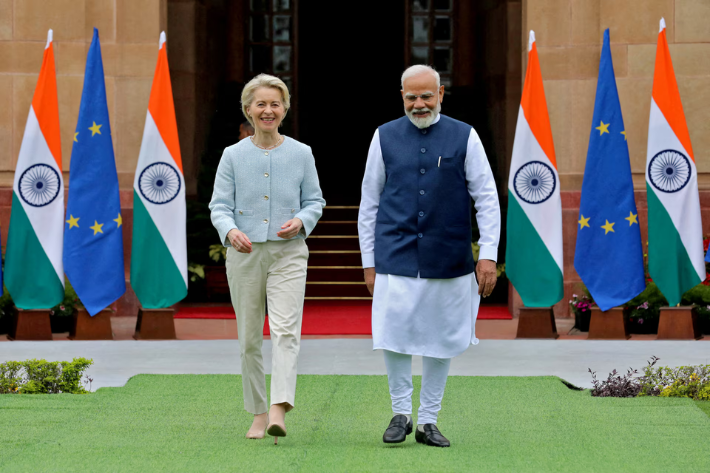

“The magnitude of the effects on individual countries will depend on whether they are net commodity importers or exporters,” Moody’s said, expecting importers such as China, Turkey, Korea, Japan, India and Indonesia to take the biggest hit.

Euro zone moves are sizeable too. Conditions in the bloc, heavily reliant on Russian energy, are at the tightest since November 2020.

They have moved 60 bps tighter since the start of February, driven also by the European Central Bank (ECB) opening the door to interest rate hikes this year. The ECB is expected to make as few policy commitments as possible at a meeting on Thursday as it waits to see how events in Ukraine play out.

Should it proceed with unwinding bond purchases followed by rate hikes, as expected before the invasion, financial conditions could tighten to levels seen at the height of the pandemic or even the bloc’s sovereign debt crisis a decade ago, Viraj Patel, global macro strategist at Vanda Research, said.

US conditions have tightened to a lesser extent.

The indicators Goldman uses to calculate its indexes signal no relief.

Safe-haven flows are boosting the dollar, which is near two-year highs, world stocks have fallen over 12% this year and US investment-grade corporate bond risk premia have widened 50 bps year-to-date as investors assess the hit to companies’ profits.

- Reuters with additional editing by Sean O’Meara

Read more:

China Factory Prices Ease in February, All Eyes on Commodities

Asia Stocks Halt Slide But US-Russia Oil Ban Impact Weighs