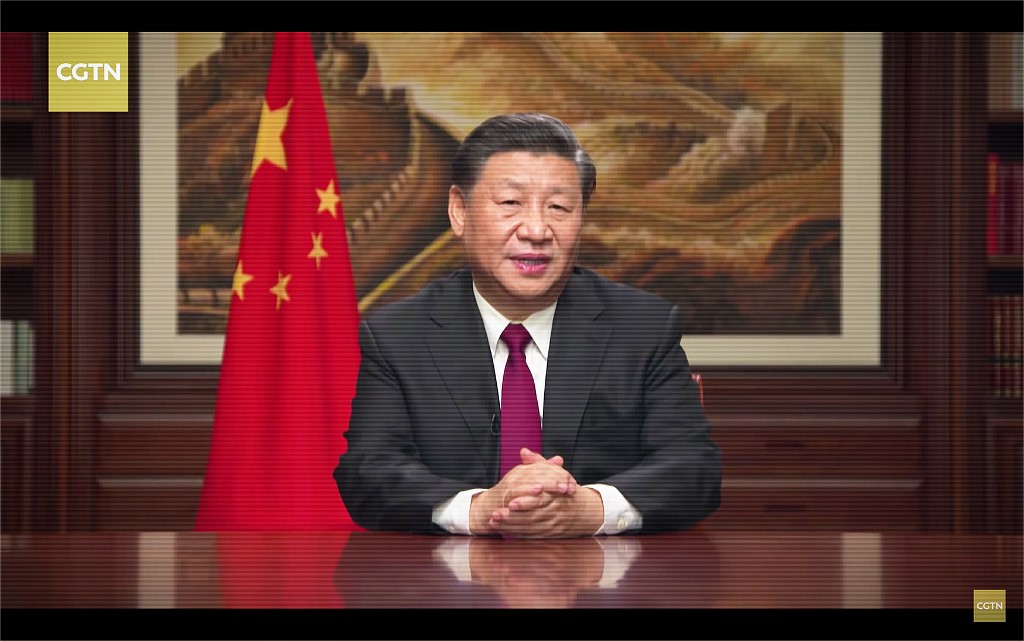

(ATF) CCTV News – China’s top state mouthpiece – announced yesterday that President and party General Secretary Xi Jinping chaired the 13th meeting of the Central Shenzhen Reform Commission, reviewing and approving a reform plan by the Growth Enterprise Market (GEM) stock board, which is like China’s equivalent of Nasdaq.

Xi approved the “GEM Reform and Pilot Registration System Overall Implementation Plan”, and officially launched the Shenzhen Stock Exchange and reform of the GEM registration system.

CCTV said: “This is a sign that reform of the registration system continues to be explored from the ‘test field’ to the ‘deep water area’ following the successful pilot registration system of the Science and Technology Board at the Shanghai Stock Exchange last year.”

China’s new Securities Law was formally implemented on March 1 this year, in a move to clear up regulations on registration reform and associated support measures.

So, what has changed in the registration reform? And how will it affect the development of China’s capital market?

On April 27, the 13th meeting of the Central Committee for Comprehensive Deepening Reform reviewed and approved the Overall Implementation Plan for GEM Reform and Pilot Registration System. That night, the China Securities Regulatory Commission or CSRC, and the Shenzhen Stock Exchange, issued a series of supporting rules such as “Administrative Measures on the Initial Public Offering of Stocks on the Growth Enterprise Market aka GEM (Trial)” and solicited opinions from the public.

The CSRC said that reform of the Shenzhen Stock Exchange Pilot Registration System would focus on solving two problems: one is to expand the pilot registration system based on the Science and Technology Board and accumulate experience for such a registration system in the stock sector.

For the past 30 years, the Securities Regulatory Commission had a department to supervise stock issuance, and it implemented a strict approval system for companies that applied to list on China’s capital market. It then transitioned to an approval system, which meant that the companies to be listed had to do more than just achieve higher profits.

The Growth Enterprise Market, born in Shenzhen, is at the forefront of China’s reform and opening up. It has become an important force supporting innovation, entrepreneurship and economic transformation since the market opened in October 2009.

According to the Shenzhen Stock Exchange, there are currently about 50 million GEM accounts. As of the close of business on April 27, 2020, there were six companies on the GEM with a market value of more than 100 billion yuan, and 25 companies with a market value of between 30 billion and 100 billion yuan. Today, a new round of registration reforms that has added inclusiveness will allowed many innovative companies with the capacity to grow to see new opportunities, CCTV said.

CSRC crackdown on fraud

The Regulatory Commission has cracked down on financial fraud by listed companies since 2019. Major cases include some related to illegal disclosure of information and the CSRC has investigated 22 listed companies for fraud. It handed out 296 administrative penalties throughout the year, imposing fines of 4.183 billion yuan on 66 people.

Moves to curb the violation of laws and regulations by listed companies is seen as an important way to ensure the securities market enjoys healthy growth. These moves are also considered to be vital for the promotion of the registration system.

Changes made to the Securities Law in March were the fourth amendments to the law since it was promulgated and implemented in 1998. As well as implementing a comprehensive registration system for the issuance of securities, the updated law has greatly increased the penalties for violations.

Listed companies that violate information disclosure provisions could face a penalty from 600,000 yuan to 10 million yuan, and that applies to sponsors, intermediaries such as accounting firms, and law firms – all would have to bear joint liability, and the penalty would be increased from the original maximum penalty of five times their business income to 10 times.

After implementation of the new law, listed companies involved in fraud face the threat of criminal penalties as well as administrative punishment, plus huge claims from investors.

Also read: China to deepen reform of GEM board