China’s Commerce Ministry expanded its restrictions on exports of rare earths on Thursday – in a bid to tighten export curbs on overseas defence suppliers and users of computer chips.

The move follows sweeping controls announced by Beijing in April that caused shortages around the world before a series of deals with Europe and the US eased the supply crunch.

It came two days after US lawmakers called for broader bans on the export of chipmaking equipment to China.

ALSO SEE: AI Data Centres Spark Fears on Memory Storage Devices – TH

The controls are a major bargaining chip for China in its trade talks with the United States, and the tightening comes weeks ahead of a face-to-face meeting between Presidents Donald Trump and Xi Jinping in South Korea.

“From a geostrategic perspective, this helps with increasing leverage for Beijing ahead of the anticipated Trump-Xi summit in (South) Korea later this month,” Tim Zhang, founder of Singapore-based Edge Research, said.

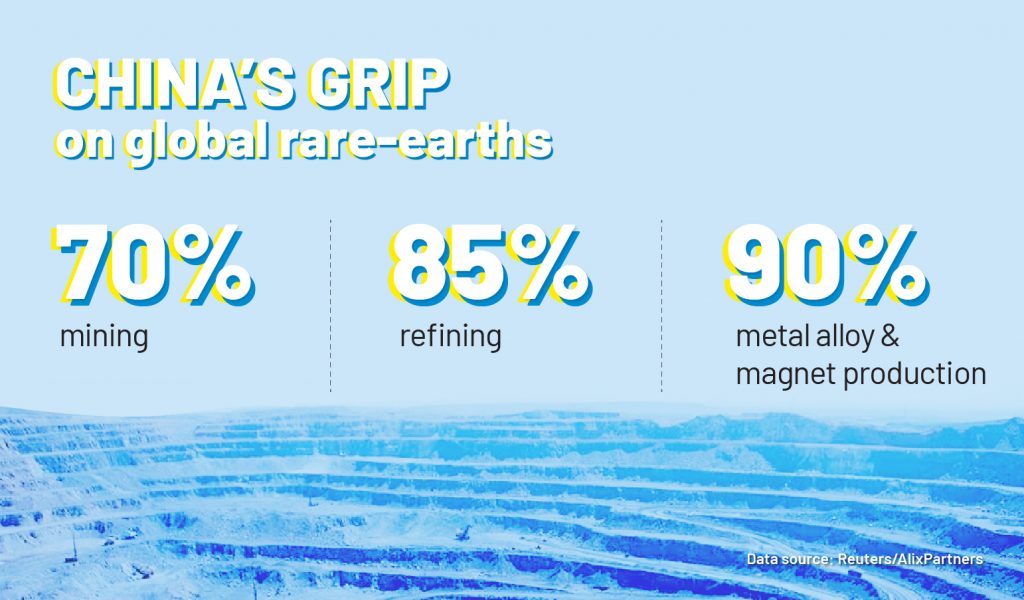

China produces over 90% of the world’s processed rare earths and rare earth magnets. The 17 rare earth elements are vital materials in products ranging from electric vehicles to aircraft engines and military radars.

China is also widening its export controls to foreign companies that use Chinese rare earth equipment or material, the Ministry of Commerce said in its statement. The changes are similar to US rules that restrict exports of semiconductor-related products.

Restrictions on exporting the technology to make rare earth magnets will also be expanded to more types of magnets, and China will limit some components and assemblies that contain restricted magnets, China’s Ministry of Commerce said in a statement.

China is the world leader in rare earth technology, and equipment to recycle rare earths will now require a licence to export, adding it to the long list of restricted processing technology.

The new extraterritorial rules will start on December 1, while the remainder commence immediately.

Shares of Chinese rare earth companies China Northern Rare Earth Group and Shenghe Resources surged by 8.3% and 6.3%, respectively, as of 0719 GMT.

Curbs linked to advanced chips

The Ministry of Commerce’s announcement clarified for the first time some of the targets of China’s restrictions. Overseas defence users will not be granted licences, the ministry said, while applications related to advanced semiconductors will only be approved on a case-by-case basis.

The new rules apply to 14-nanometre chips or more advanced chips, memory chips with 256 layers or more, and equipment used in production of such chips, as well as to related research and development. These advanced chips are used in a wide range of products from smartphones to AI chipsets that require powerful computing performance.

The rules will also apply to research and development of artificial intelligence with potential military applications.

South Korea, home to major memory chipmakers Samsung Electronics and SK Hynix, is assessing the details of the new restrictions and would continue discussions with China to minimise their impact, its industry ministry said in a statement to Reuters.

Samsung declined to comment. SK Hynix and Taiwan’s TSMC did not immediately respond to questions.

Shares in TSMC finished up 1.8% on Thursday, as the company reported forecast-beating third-quarter revenue. South Korea’s financial markets are closed on Thursday for a public holiday.

China’s rare earth shipments have been growing steadily over the past few months as Beijing grants more export licences, although some users still complain they are struggling to get them.

In a nod to concerns about access, the Ministry of Commerce said the scope of items in its latest round of restrictions was limited and “a variety of licensing facilitation measures will be adopted.”

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China Stops Most Antimony Exports But Rare Earth Sales to US Soar

China Did Not Agree to Military Use of Rare Earths, US Says

Trade Deal Signed, But China Still Slow to Release Rare Earths

Korea’s Hyundai Has Rare Earths Stockpile That Can Last A Year

Carmakers Stressed by China’s Curbs on Critical Mineral Exports

China Plays Rare Earths Card in EV Tariff Negotiations With EU

China Export Curbs on Rare Earth Magnets: a Trade War Weapon

Lessons From Japan on Tackling China’s Rare Earth Dominance

China Sets up Tracking System to Trace Its Rare Earth Magnets

China’s Critical Minerals Blockade Risks Global Chip Shortage

China’s Gallium Curbs a Headache for EV Carmakers

Western Firms Struggling to Break China’s Grip on Rare Earths