China’s trade of critical minerals and rare earths remained mixed in June with a near-collapse in exports of antimony and germanium despite a significant revival in shipments of rare earth magnets to the United States.

Exports of antimony and germanium in June were down 88% and 95%, respectively, versus January, according to customs data published on Sunday.

The two critical minerals are used in weapons, telecommunications and solar cells and, as with rare earths, China is by far the largest miner and or refiner for both elements.

Also on AF: China Softens Tone on US Ties Amid Potential Thaw In Chip War

The drop in their exports — down to some of the lowest levels on record — follows a well-publicised crackdown by China’s top spy agency on their smuggling and transshipment.

China added antimony and germanium to an export control list in 2023 and 2024, respectively, making it mandatory for their exports to apply for licences from the commerce ministry. The clampdown drove up price of both the minerals, with antimony nearly quadrupling since May last year.

Meanwhile, in December, Beijing outright banned exports of antimony and germanium to the US as part of retaliation for Washington’s chip restrictions.

But China’s spy agency said last week it had detected attempts to bypass controls via trans-shipment, where cargoes move through a third country before going on to their final destination.

That was after Reuters reported that unusually large quantities of antimony were being exported to the US from Thailand and Mexico in what appeared to be trans-shipment conducted by at least one Chinese company.

China’s exports of antimony to Thailand have collapsed by 90% after hitting a record in April. There have been no exports to Mexico since April.

Jump in rare earth magnet exports to US

While antimony and germanium exports plunged last month, rare earth export volumes rebounded sharply thanks to a deal struck between Washington and Beijing.

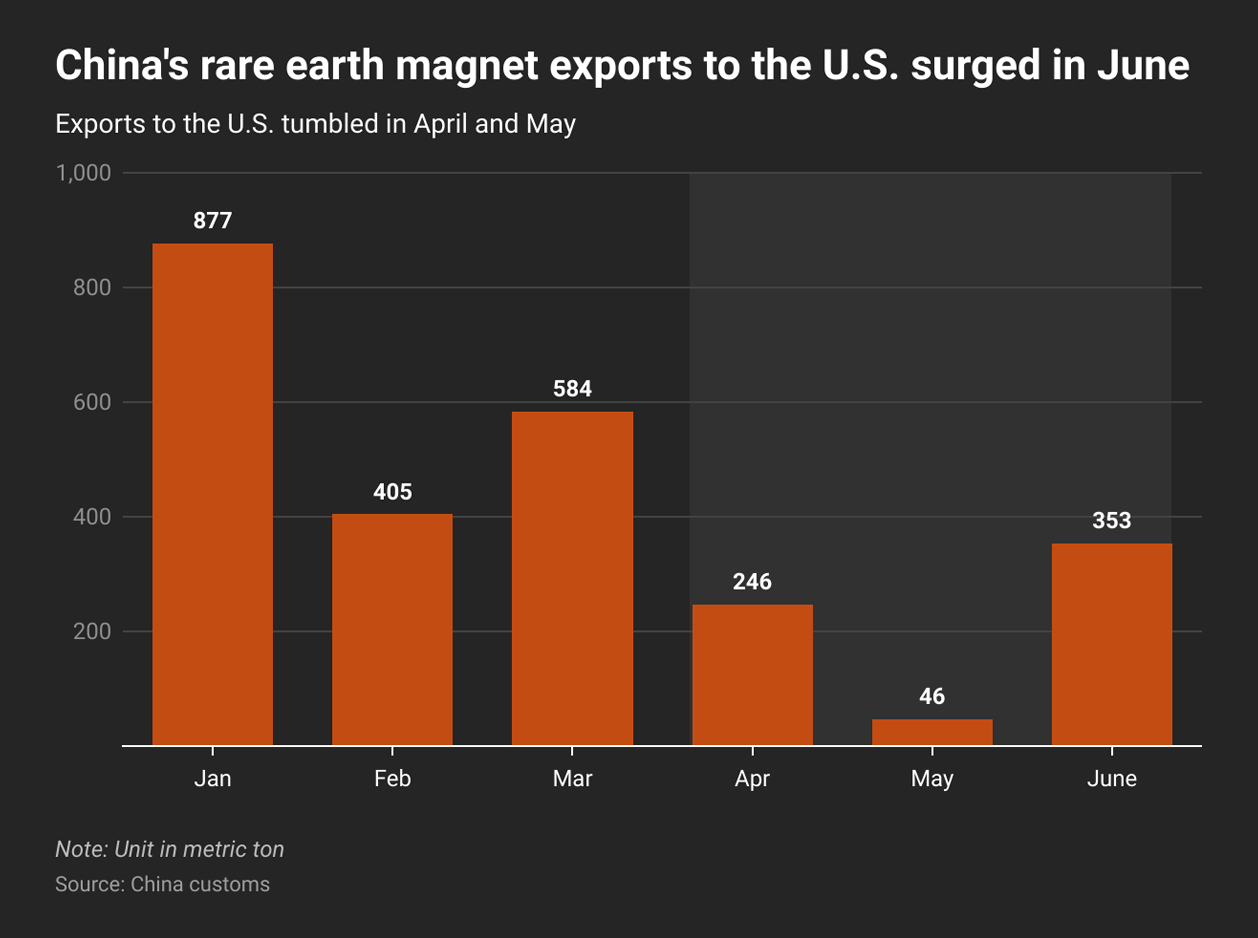

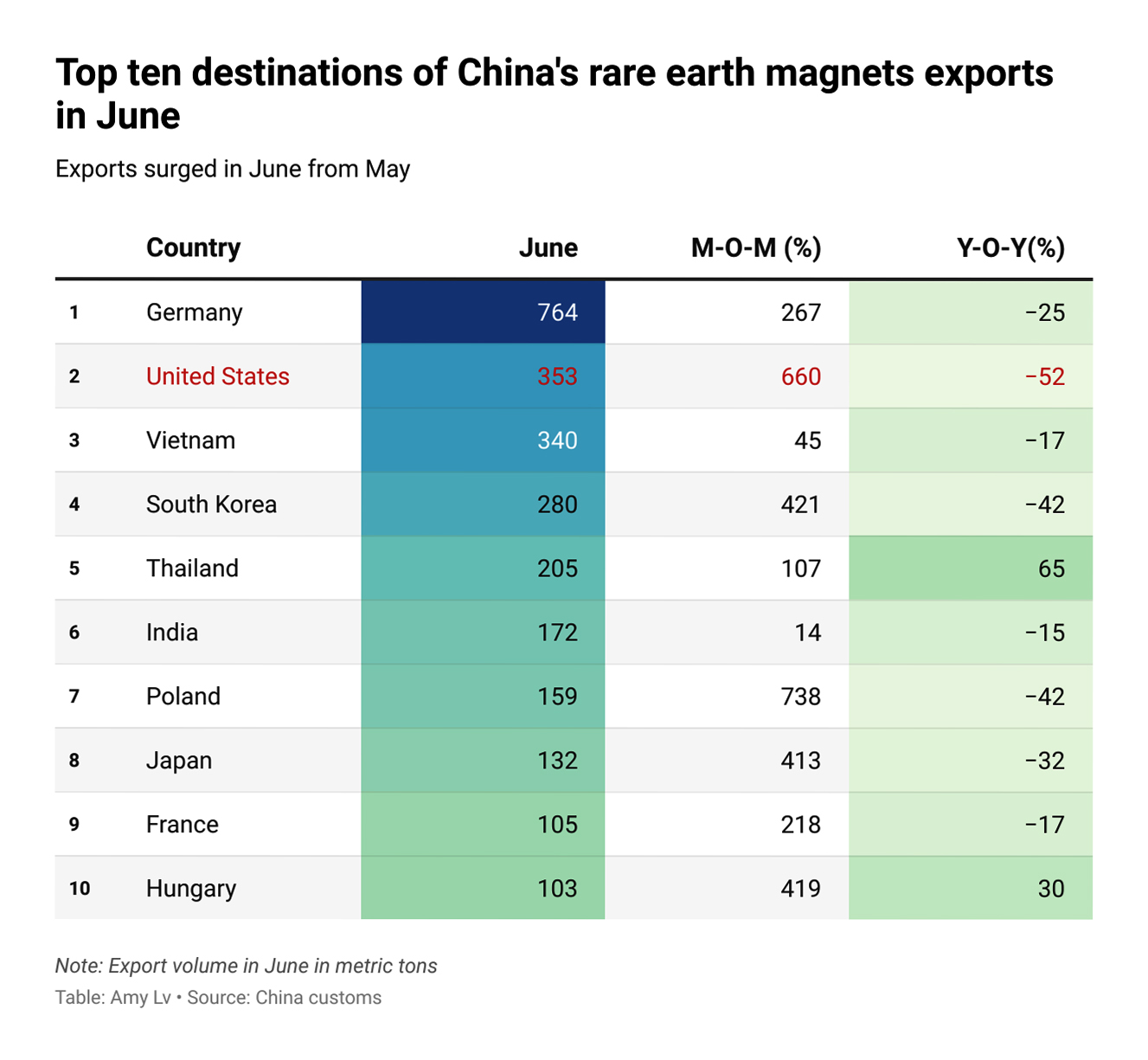

China’s exports of rare earth magnets to the US in June soared to more than seven times their May level. Outbound shipments to the US from the world’s largest producer of rare earth magnets surged to 353 metric tons in June, up 660% from May, data from the General Administration of Customs showed on Sunday.

China added rare earths and magnets made using them were added to the same control list as antimony and germanium in April in retaliation for US tariffs. That led to a sharp collapse in their export volumes exacerbated by the lengthy time required to secure export licences.

But envoys from the two rivalling economies reached an agreement in June to resolve the rare earth issue. Chipmaker Nvidia plans to resume sales of its H20 artificial intelligence chips to China as part of the agreement.

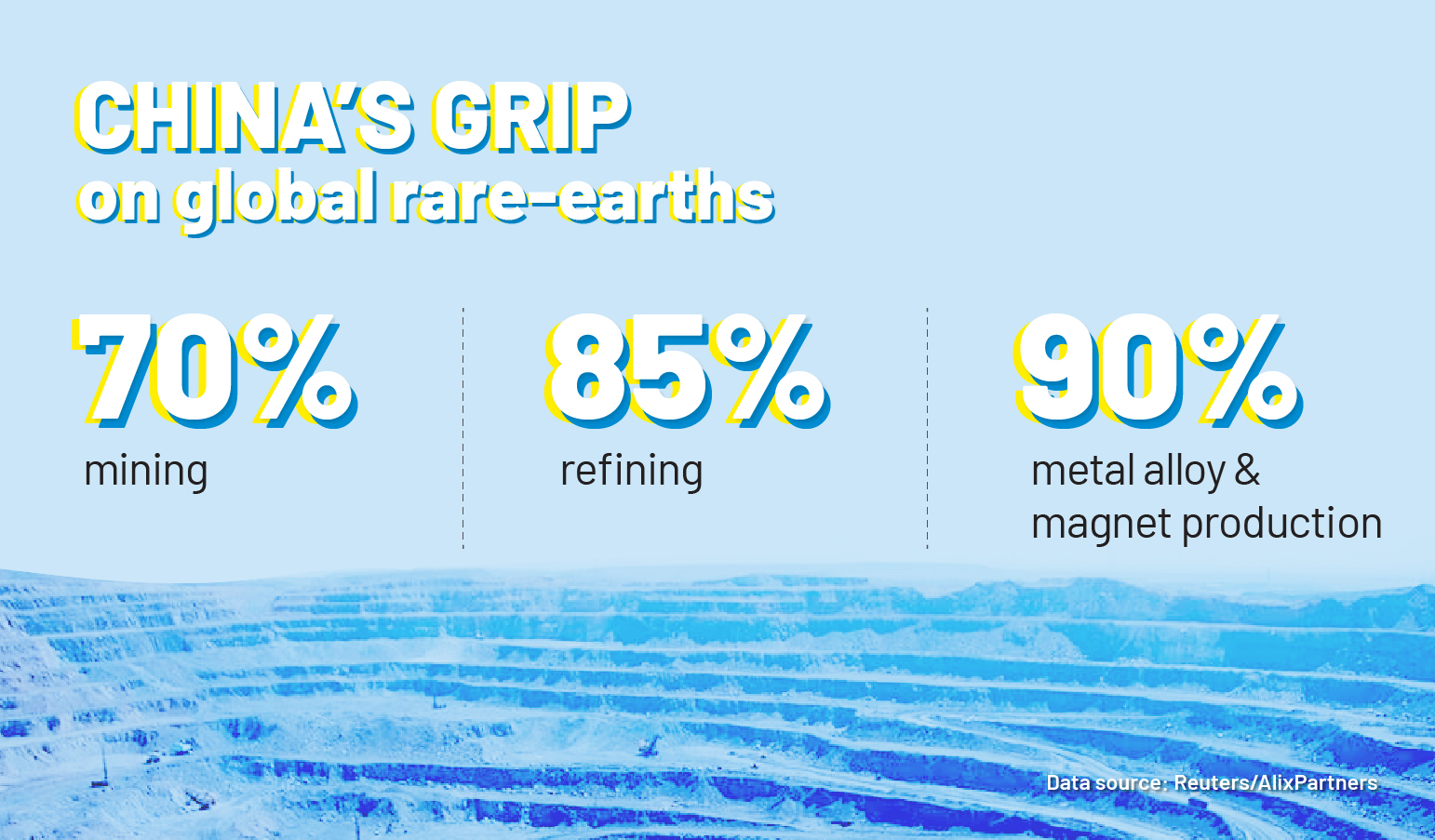

China provides more than 90% of the global supply of rare earth magnets.

In total, China exported 3,188 tons of rare earth permanent magnets globally last month, up 157.5% from 1,238 tons in May, although the June volume was still 38.1% lower than the corresponding month in 2024.

Shipments of magnets are likely to recover further in July as more exporters obtained licences in June, analysts said.

During the first half of 2025, exports of rare earth magnets fell 18.9% on the year to 22,319 tons.

- Reuters, with additional editing by Vishakha Saxena

Also read:

‘National Emergency’: China’s Antimony Blockade Hits Battery Firms

China Did Not Agree to Military Use of Rare Earths, US Says

Trade Deal Signed, But China Still Slow to Release Rare Earths

Korea’s Hyundai Has Rare Earths Stockpile That Can Last A Year

Carmakers Stressed by China’s Curbs on Critical Mineral Exports

China Plays Rare Earths Card in EV Tariff Negotiations With EU

China Export Curbs on Rare Earth Magnets: a Trade War Weapon

China’s Rare Earths 1, Donald Trump 0

Lessons From Japan on Tackling China’s Rare Earth Dominance

China Sets up Tracking System to Trace Its Rare Earth Magnets

China’s Critical Minerals Blockade Risks Global Chip Shortage

China’s Gallium Curbs a Headache for EV Carmakers

Western Firms Struggling to Break China’s Grip on Rare Earths