(ATF) Japan’s Subaru said on January 14 it would cut output by “several thousand” vehicles this month in both the US and its home market as it becomes the latest carmaker to be squeezed by a shortage of semiconductors.

Subaru said it would reduce output at factories in Gunma, northwest of Tokyo, a company spokesman said, without specifying exact numbers. Subaru will also reduce output at its US plant in Lafayette, Indiana.

Global carmakers have been hit by a scramble for semiconductors as demand rebounds from the coronavirus crisis. Japan’s Nissan plans to reduce production of the Note, a hybrid electric car, at its Oppama Plant in Kanagawa prefecture, while Honda Motor Co said on January 8 that its domestic output could be affected by a shortage of chips.

The shortage of chips hitting Asian carmakers follows bottlenecks in Europe as companies competed for scarce supply of semiconductors used in smartphones, tablets and gaming devices as well as vehicles.

Volkswagen said in December that it would produce 100,000 fewer cars in the first quarter of the year at sites in Europe, North America and Asia, because parts makers such as Continental and Bosch have struggled to secure chip supplies. Bosch announced in 2017 it would build a huge semiconductor fabrication plant in Dresden, but it is not expected to go online until later this year.

Renault, Daimler and General Motors are also grappling with a chip shortage. Analysts said some carmakers could see production fall by 10-20% from February.

TECHNOLOGICAL ADVANCES

The rapid growth of technology has increased the automotive industry’s consumption of chips, which power everything from battery management to driver assistance systems and in-car entertainment.

“Semiconductors are in short supply globally at present,” Nomura automotive analyst Masataka Kunugimoto told Asia Times Financial. “Demand for automobiles and consumer electronics has been quick to recover and more semiconductors are needed than expected.”

The global electric-vehicle boom – as well as autonomous driving projects – has only served to exacerbate demand. “Automotive electrification, the growth of advanced driver-assistance systems and increases in 5G smartphones and game equipment have led to a rise in the number of semiconductors used per product,” Kunugimoto added.

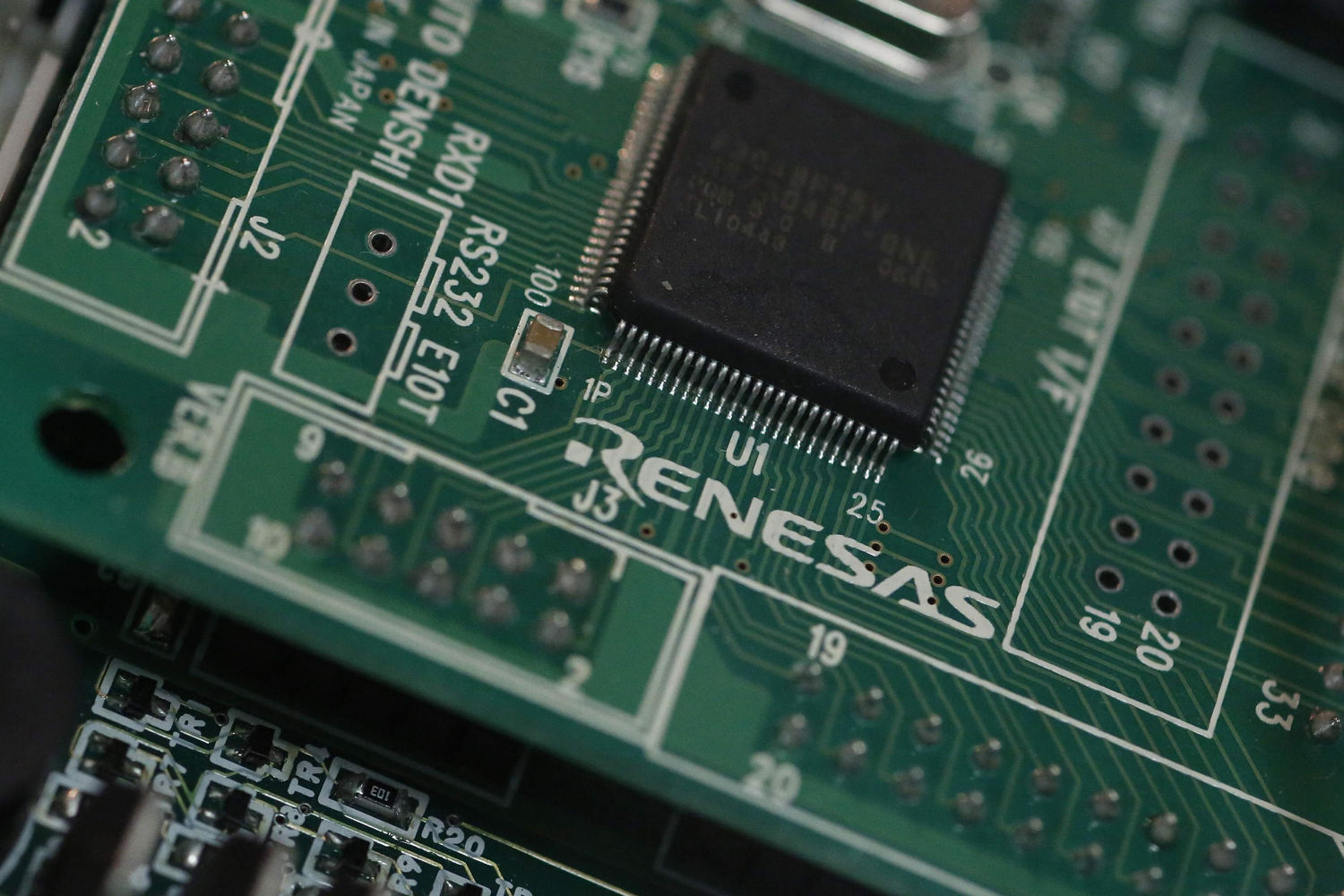

The world’s top five automotive semiconductor manufacturers are Germany’s Infineon Technologies, the Netherlands-based NXP, Japan’s Renesas, US-based Texas Instruments and Switzerland’s STMicroelectronics.

The global battle to source semiconductors is likely to hit automakers in China, which import 95% of chips for advanced sensors, in-vehicle networks, batteries, engines and electric control systems.

Prices are rising as a result of the scarcity. In December 2020, NXP told customers it would charge more for all products because of a “severe shortage” of chips. Infineon said it was ramping up output, as did Renesas.

With reporting by Reuters