Latest News: AF China Bond 50 Index

Beijing and Washington are painting a picture of bonhomie between the world's superpowers ahead of Trump's inauguration, but Chinese businesses remain cautious of a potential trade war

The incoming US president described his Chinese counterpart as a strong and powerful man, adding that they were both already communicating through aides

The US Commerce Department said it was concerned about ‘adversaries’ remotely accessing and manipulating drones

Nvidia has asked its big distributors, including Super Micro and Dell, to conduct spot checks of their customers in Southeast Asia

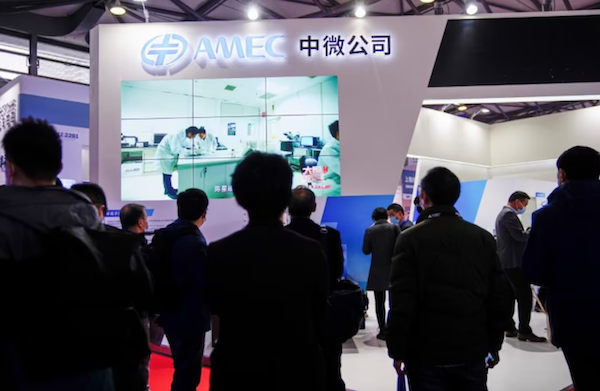

Shares of the company— Advanced Micro-Fabrication Equipment (AMEC) — jumped 4.35% after its removal from the list

Scrutiny on TP-Link comes at a time when American officials are investigating a sweeping ‘cyber-espionage’ campaign carried out by a Chinese hacking group dubbed Salt Typhoon

The short video app is believed to have played an important role in Trump’s victory, boosting his performance among young voters

Trump’s transition team is recommending to strengthen measures blocking cars, components and battery materials from China

Diplomatic precedent suggests that Chinese President Xi Jinping is unlikely to attend Trump's inauguration ceremony on January 20

"They can go find another sucker," Trump said in a social media post, responding to efforts by the BRICS group of countries to build a currency alternative to the dollar

But the world’s second-largest economy still needs to navigate major challenges to meet its overall climate goals — the biggest being a booming demand for power

Trump's tariff threats are rattling China's industrial complex, which sells goods worth more than $400 billion annually to the US

AF China Bond

- Popular