Asia’s major markets regained lost ground on Wednesday and oil prices stabilised as investors reacted to less harsh sanctions on Moscow than had been feared after Russian troops moved into Ukraine.

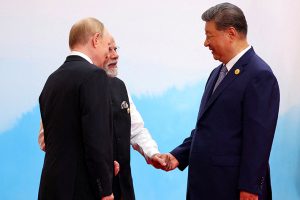

However, trading floors remain on edge after Russian President Vladimir Putin ordered his forces into Ukraine to secure the self-declared Donetsk and Lugansk rebel republics, with Western leaders warning that a war could break out imminently.

Global markets have been in turmoil since the invasion, with oil soaring towards the $100 mark – not seen since 2014 – and other commodities also hitting multi-year highs.

Wall Street, which was closed for a holiday on Monday, tanked in early trade but saw a noticeable bounce after US President Joe Biden unveiled a series of sanctions against Russia.

Also on AF: Meituan Shares Rise as State Media Play Down Delivery Fee Plan

The measures included moves against two Russian banks, cutting the country off from Western financing by targeting Moscow’s sovereign debt, and penalising oligarchs and their families who are part of Putin’s inner circle.

That came after a series of announcements in Europe with Germany halting certification of the lucrative Nord Stream 2 gas pipeline from Russia, while Britain targeted five banks and three billionaires.

Canada, Japan and Australia have since followed up with their own punishments.

But the sanctions were not as bad as feared – crucially not aiming at Russia’s crude exports – providing some much-needed breathing room for investors and halting the surge in oil prices that has seen both main contracts pile on more than 20% so far this year.

Brent, which touched $99.50 on Tuesday, and WTI were slightly lower in Asia.

However, Biden said the moves were only a “first tranche” in response to Putin “carving out a big chunk of Ukraine,” and more penalties could follow if he does not change course.

Traders Readying For Rate Hikes

On Wednesday, Hong Kong, Shanghai, Sydney, Seoul, Singapore, Bangkok, Wellington, Taipei and Jakarta were all in positive territory. Mumbai and Manila slipped. Tokyo was closed for a holiday.

The Hang Seng Index rose 0.60%, or 140.28 points, to 23,660.28. The Shanghai Composite Index climbed 0.93%, or 32.00 points to 3,489.15, while the Shenzhen Composite Index on China’s second exchange jumped 1.75%, or 40.28 points, to 2,337.58.

London, Paris and Frankfurt edged up at the open.

The crisis comes just as investors are preparing for a series of interest rate hikes by the US Federal Reserve as it tries to rein in 40-year-high inflation.

Commentators say that while a March hike is baked in, forecasts for further increases this year are being affected by events in Europe as officials try to assess the impact on the economy.

Key figures around 0820 GMT

Hong Kong > Hang Seng Index: UP 0.6% at 23,660.28 (close)

Shanghai > Composite: UP 0.9% at 3,489.15 (close)

London > FTSE 100: UP 0.1% at 7,504.48

Tokyo > Nikkei 225: Closed for a holiday

New York > Dow: DOWN 1.4% at 33,596.61 (Tuesday close)

- AFP with additional editing by Sean O’Meara