Chinese officials confirmed on Thursday that the country had begun issuing some licences for exports of rare earths critical to global tech supply chains, in the first such indication from Beijing.

“China has been actively making use of general licences and other facilitation measures to promote compliant trade in dual-use items,” state news outlet Xinhua said on Thursday, quoting a Commerce Ministry weekly briefing.

“Dual-use items” refer to goods and services that have both civilian and military applications. Beijing has maintained that it will not approve licences for exports of rare earth elements and related technology for use in foreign military applications.

Also on AF: Chinese Firms Fare Worst As Study Finds AI Majors Fail Safety Test

“As long as export licence applications for rare earth-related items are for civilian use, the government has given timely approval,” Commerce Ministry spokesman He Yadong told reporters at a weekly briefing on Thursday.

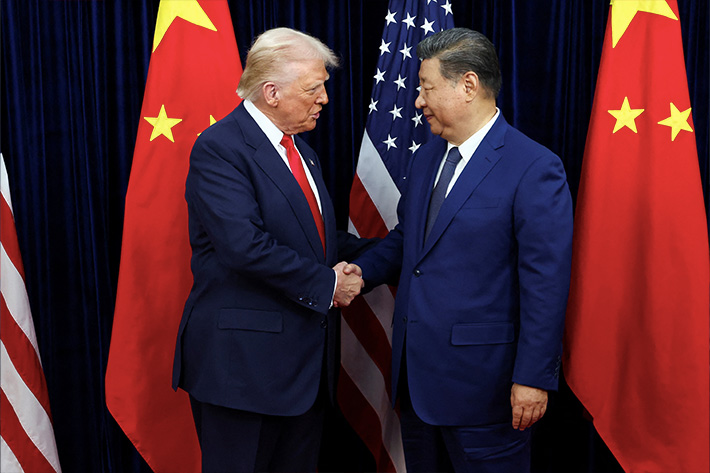

The statements from Chinese officials point to a key promised outcome from a meeting between US President Donald Trump and his counterpart Xi Jinping in October. The two met amid a heightened trade and technology war, part of which saw Beijing impose strict tit-for-tat export controls on the trade of rare earth elements and magnets.

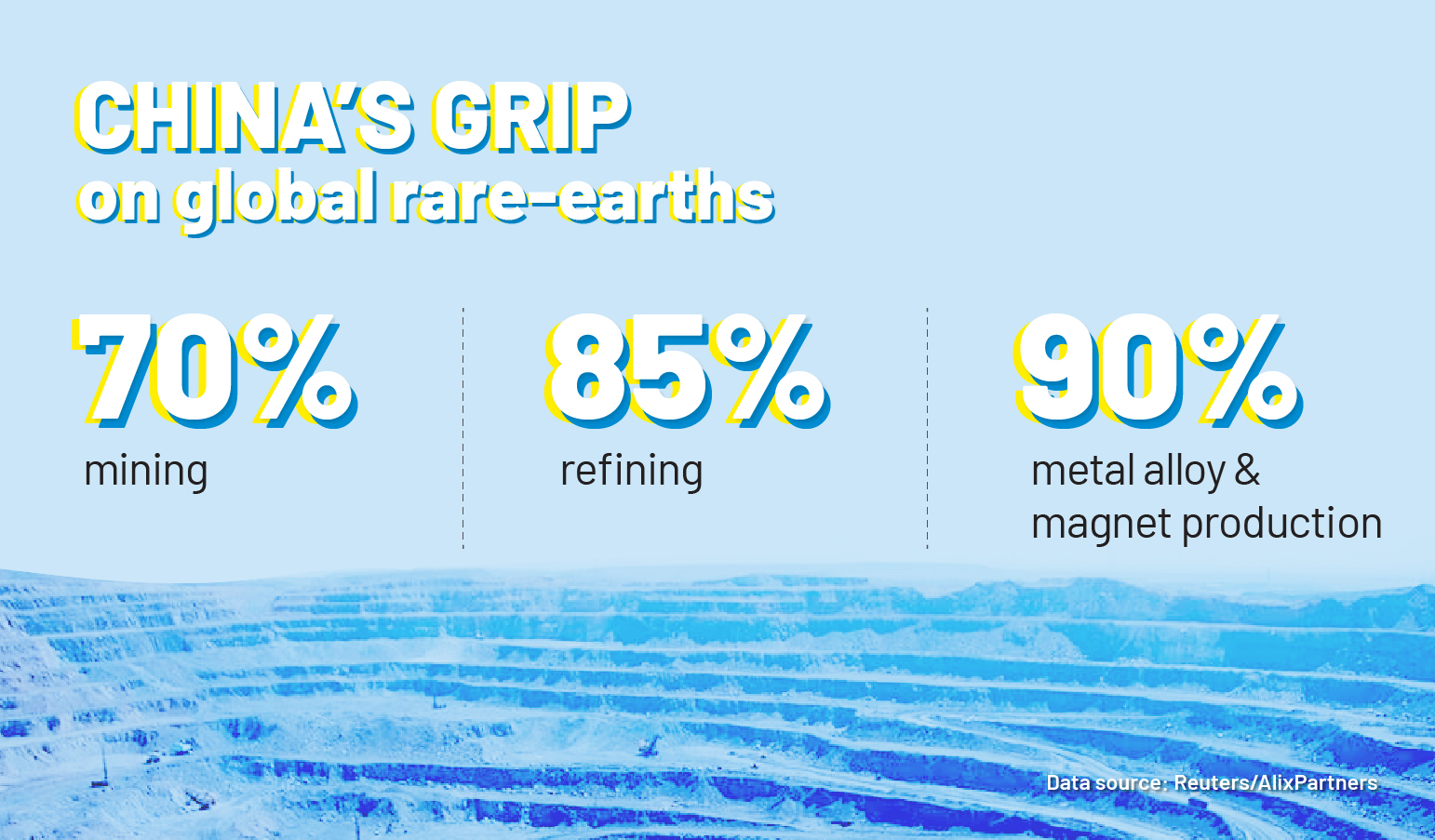

China controls 80-90% of rare earth exports and refining globally. In October, China dramatically expanded its rare earth export controls by adding five new elements and extra scrutiny for semiconductor users.

Those rules were an extension of steps it took in April, adding several rare earth elements and magnets to its export control list and introducing the dual-use licensing regime. Those rules caused a decline in exports of rare earth magnets in April and May, and forced some global automakers to cut or shut down some production facilities.

Reuters reported on Tuesday that at least three Chinese rare-earth magnet makers had secured licences enabling them to accelerate exports to some customers.

“The government is actively adapting,” Commerce Ministry spokesman He told reporters on Thursday, adding that authorities “were aligning themselves with general licence mechanisms”.

The new general licences are designed to allow more exports under year-long permits for individual customers, Reuters reported in early November.

But they will not replace the existing dual-use licensing regime and only large Chinese rare earth companies are currently eligible for them.

In November, the Wall Street Journal also reported that China was working on launching a “validated end-user” (VEU) framework similar to one used by the US to implement its chip controls. The VEU framework will vet companies applying for rare earth licences to ensure they have no ties to US defence contractors.

Rare earth diplomacy

Managing China’s rare earth blockade has been a key worry for the West, which relied overwhelmingly on Beijing’s supplies. Despite recent efforts by both the US and Europe to create alternate supply chains, experts say it will take them years to break their reliance on China.

That has led to European leaders increasingly voicing their concerns to Beijing. On Thursday, French President Emmanuel Macron raised European concerns on rare earth uncertainty with Chinese leader Xi Jinping during a state visit.

Beijing’s latest curbs have caused fresh panic in European car, clean energy and semiconductor sectors, all of which are heavily dependent on Chinese rare earth supplies.

“It is essential to create an environment of trust and to deal with every instability risk in supply chains,” Macron said.

Meanwhile, the US has also resorted to taking a less aggressive stance in its trade ties with China. Most recently, the White House has been considering allowing US chipmaker Nvidia to sell some of its more advanced semiconductors to China.

Separately, the Financial Times reported on Wednesday that the Trump administration had halted plans to impose sanctions on China’s Ministry of State Security over a massive cyber spying campaign that has targeted a host of US and global telecom companies. Washington wanted to avoid derailing the trade truce struck by Trump and Xi, the FT report said, citing US officials and others familiar with the situation.

The Trump administration will also not enact major new export controls against China, the report said.

- Vishakha Saxena, with Reuters

Also read:

China Launches First Lot of Simpler Rare Earth Export

China Holds ‘Heavy’ Cards in High Stakes Rare Earth Power Play

Yttrium is Latest Rare Earth Concern as Global Supplies Fall

Rare Earth And The US-China Powerplay

Trump Taps Southeast Asia For Rare Earths Amid China Uncertainty

Trump Cuts US Tariffs to 47%, Xi Vows to Ease Rare Earth Curbs

China Making Exports Of Rare Earth Magnets ‘Increasingly Difficult’

US May ‘Extend Tariff Truce’ If China Delays New Rare Earth Rule

China Did Not Agree to Military Use of Rare Earths, US Says

Carmakers Stressed by China’s Curbs on Critical Mineral Exports

China Export Curbs on Rare Earth Magnets: a Trade War Weapon

China Sets up Tracking System to Trace Its Rare Earth Magnets