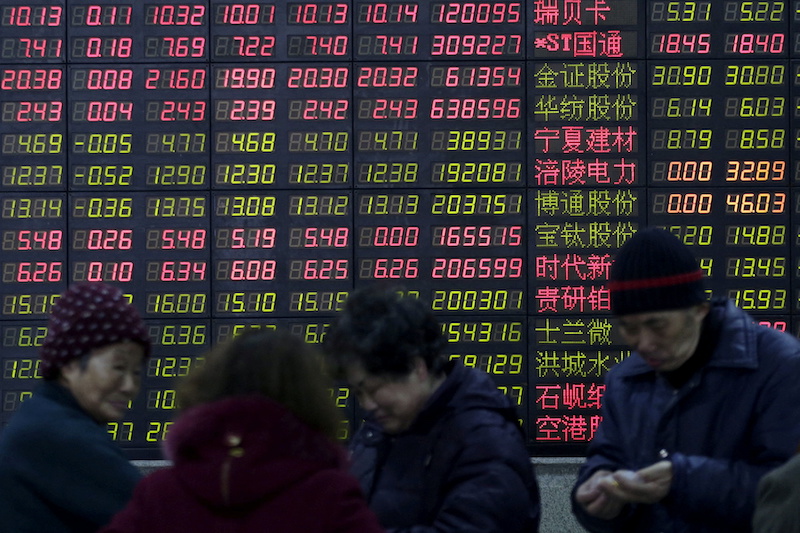

Asian shares slipped on Tuesday as the harsh reality of China’s post-Covid recovery prospects hit home with investors.

Indexes across the region had been buoyed by China’s abrupt reopening after nearly three years of economically painful restrictions, betting on a forceful bounceback for the world’s No2 economy.

However, traders were less optimistic about the pace of recovery after crunching the numbers and taking into account the gloomy global picture – and more rate hikes to come from the US Federal Reserve.

Also on AF: China Hits Back at Japan, South Korea over Covid Curbs

The outlier was Japan where the Nikkei index closed at its highest in two weeks, as technology stocks jumped, but the gains were capped by caution ahead of next week’s meeting by the Bank of Japan.

Japan’s central bank last month surprisingly widened the trading band for the benchmark 10-year government bonds to 0.5% from 0.25%, sending yields across the curve higher.

The Nikkei share average edged up 0.78%, or 201.71 points, to close at 26,175.56, its highest since December 28, while the broader Topix was up 0.27%, or 5.12 points, to 1,880.88.

But China stocks snapped a six-session winning streak, as some investors cashed in on doubts over the sustainability of the rebound driven by the country’s abrupt dropping of its zero-Covid policy.

Strategists at BlackRock, the world’s largest asset manager, on Tuesday said they expected the Chinese economy to grow by 6% this year, which should cushion the global slowdown as recession hits developed-market economies. But any bounce may be fleeting.

“We don’t expect the level of economic activity in China to return to its pre-Covid trend, even as domestic activity restarts. We see growth falling back once the restart runs its course,” Wei Li, who is global chief investment strategist for the BlackRock Investment Institute, wrote in a note.

The Hang Seng Index lost 0.27%, or 56.88 points, to close at 21,331.46.

The Shanghai Composite Index slipped 0.21%, or 6.58 points, to 3,169.51, while the Shenzhen Composite Index on China’s second exchange edged up 0.29%, or 5.96 points, to 2,060.44.

Nasdaq Retreats Overnight

Elsewhere across the region, shares fell following hawkish comments from two US Federal Reserve officials overnight, with investors turning cautious ahead of key inflation data due this week.

Indian stocks dropped with Mumbai’s signature Nifty 50 index down 0.98%, or 176.80 points, at 17,924.40.

The Nasdaq Composite ended well off the day’s highs overnight even as the Dow ended lower and the S&P 500 index closed nearly flat.

There had been a sense of optimism that inflation had peaked, especially in the United States, and that the Fed would not have to raise rates as much as many had feared.

However, with consumer price pressures still well above the central bank’s target of 2%, two Fed officials on Monday issued a stark reminder that interest rates will have to keep rising, no matter what investors have priced in.

“The market is trying to get one step ahead of the Fed but it’s not actually listening to what it’s saying. And the Fed is being quite clear with its message – that rates are going to push higher and they’re going to stay higher for longer,” CityIndex strategist Fiona Cincotta said.

Consumer price data, which is due on Thursday, is expected to show headline inflation slowed to 6.5% in December from 7.1% in November.

Oil Under Pressure

In Europe, equities opened in the red, with the STOXX 600, which on Monday hit its highest in eight months, down 0.7%. London’s FTSE 100 lost 0.3%, while Frankfurt’s DAX fell 0.5%.

US stock index futures eased 0.1%, indicating Wall Street could open a touch lower.

The dollar carved out gains against the Australian dollar, which is highly sensitive to the Chinese economy and has gained 3.5% in the last three weeks alone, based on the optimism around reopening.

Oil was under pressure from concern that China resuming more normal activity may not translate into a boom in demand.

“The social vitality of major Chinese cities is rapidly recovering, and the restart of China’s demand is worth looking forward to. However, considering that the recovery of consumption is still at the expected stage, the oil price will most likely remain low and range-bound,” analysts from Haitong Futures said.

Brent crude futures were last down 0.6% at $79.16 a barrel. The oil price is about 2.3% below where it was a year ago and 45% below the highs around $139 after Russia invaded Ukraine last February.

Key figures

Tokyo – Nikkei 225 > UP 0.78% at 26,175.56 (close)

Hong Kong – Hang Seng Index < DOWN 0.27% at 21,331.46 (close)

Shanghai – Composite < DOWN 0.21% at 3,169.51 (close)

London – FTSE 100 < DOWN 0.18% at 7,711.24 (0940 GMT)

New York – Dow < DOWN 0.34% at 33,517.65 (Monday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Berkshire Hathaway Continues BYD Sale Offloading 1.1m Shares

China Property Firms Hope to Build on 33% Financing Jump