Asian stocks rallied on Friday, buoyed by positive news on US inflation and ever-growing hopes that China will emerge from its Covid nightmare and recover strongly in the months ahead.

China’s benchmark index closed at its highest in four months and Hong Kong’s main index saw a fourth consecutive weekly gain as traders’ optimism over a post-Covid bounceback in the world’s No2 economy gathered pace.

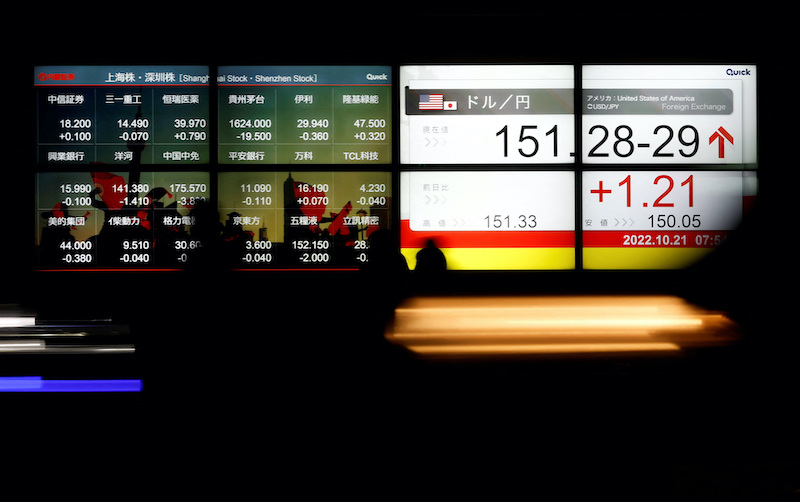

The outlier was Japan where a surging yen, which touched its strongest level against the dollar since May 31, and disappointing results from Uniqlo owner Fast Retailing dragged on the Nikkei.

Also on AF: China Acquires Minority ‘Golden’ Stakes in Two Alibaba Units

Tokyo’s main share average fell more than 1%, its first losing session in six, with more than two-thirds of the decline coming from Fast Retailing, which plunged 7.95% shaving 217.36 points off the Nikkei.

Japanese equities also came under pressure from the yen’s rise to a seven-month high, as traders bet the Bank of Japan could tweak policy further at a meeting next week, less than a month after a surprise widening of the 10-year Japanese government bond yield’s allowable range.

The Nikkei share average dropped 1.25%, or 330.30 points, to close at 26,119.52, while the broader Topix was down 0.27%, or 5.10 points, to 1,903.08.

The Nikkei managed to hold on for a weekly gain of 0.56%, having fallen for four straight weeks previously.

China’s benchmark index was lifted as foreign investors continued to buy Chinese shares for an eighth session on optimism that the world’s second-biggest economy was set for a robust recovery in a post-pandemic era.

China’s blue-chip CSI 300 Index ended 1.4% higher, touching its highest level since September 13, and the Shanghai Composite Index advanced too.

“There is mounting evidence that much of China’s population has already been infected and that disruption is already fading rapidly,” said Julian Evans-Pritchard, senior China economist at Capital Economics in a note.

“Coupled with a wider shift towards more pro-growth policies, this points at a reopening rebound starting this quarter and a stronger 2023 as a whole.”

China Exports Shrink

Meanwhile, China’s exports shrank sharply in December as global demand cooled, and the weakness is expected to continue well into the new year as the global economy teeters on the brink of recession.

The Shanghai Composite Index rose 1.01%, or 31.85 points, to 3,195.31, while the Shenzhen Composite Index on China’s second exchange edged up 0.90%, or 18.38 points, to 2,067.15.

The Hang Seng Index gained 1.04%, or 224.56 points, to 21,738.66.

Indian stocks advanced with Mumbai’s signature Nifty 50 index up 0.55%, or 98.40 points, at 17,956.60.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.8% to hit a new seven-month high and was headed for a third consecutive week of gains.

US Futures Weak

US stock futures were a tad weaker, taking a breather after the Nasdaq hit a one-month high overnight. European stock futures were also dull, with the Eurostoxx 50 futures down 0.05%, German DAX futures down 0.04% and FTSE futures up 0.02%.

Market sentiment was dominated by overnight US December inflation data that landed more or less on consensus expectations. The annual pace of headline consumer price rises slowed to 6.5% in December from 7.1% in November.

Investors responded by down-shifting expectations for US interest rates. A Federal Reserve hike of 25 basis points rather than 50 next month is now nearly universally expected, and futures markets have priced in several rate cuts this year.

The dollar slipped broadly, US treasuries rallied and assets seen as risky, such as stocks and cryptocurrencies, rose.

The US dollar dropped 0.9% to a nine-month low of $1.0868 per euro and the risk-sensitive Australian dollar rose to a roughly five-month high at $0.6983. Bitcoin surged 5% to break above $19,000.

Oil extended gains overnight, helped by optimism about China’s reopening, and Brent crude futures were broadly steady at $83.82 in Asia morning trade.

Key figures

Tokyo – Nikkei 225 < DOWN 1.25% at 26,119.52 (close)

Hong Kong – Hang Seng Index > UP 1.04% at 21,738.66 (close)

Shanghai – Composite > UP 1.01% at 3,195.31 (close)

London – FTSE 100 > UP 0.48% at 7,831.24 (0940 GMT)

New York – Dow > UP 0.64% at 34,189.97 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Yen Soars to 7-Month High, Markets Cheer US Inflation Decline

WHO Warns of China Lunar Holiday Covid Explosion

China Asks Banks to Release More Yuan Loans Abroad