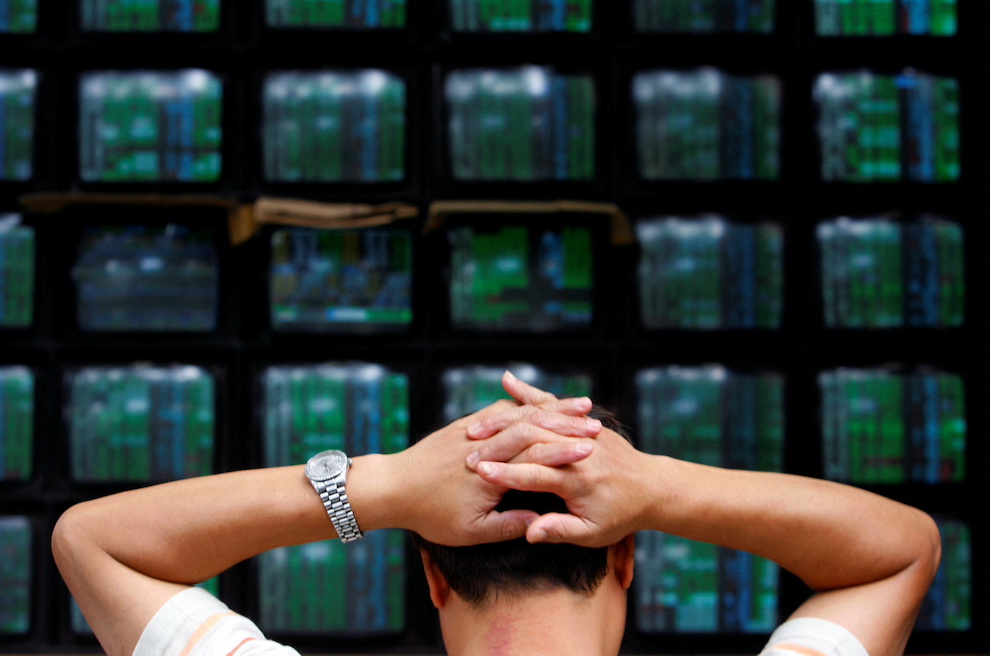

Asian stocks were on the front foot on Friday, despite what has been a turbulent week politically in the region, with investors buoyed by good earnings reports and signs of more government support for China’s struggling economy.

China’s bluechip stock index posted its biggest jump in more than five weeks, led by information technology companies, after US legislation to help its chip firms compete with Chinese rivals stoked expectations of more domestic support.

Meanwhile, Japan’s Nikkei benchmark index surged above the 28,000 psychological barrier for the first time in nearly two months, helped by upbeat corporate earnings reports.

Also on AF: Asia’s Harsh Weather Threatens Rice Price Hike

The Nikkei share average hit 28,190.04, its highest since June 9, before closing up 0.9% at 28,175. The index extended gains to a third day and rose 0.9% for the week. The broader Topix index gained 0.85%.

Sentiment was also lifted by a rally in Taiwanese stocks, with the TAIEX index climbing 2.3%, and gains in US stock futures.

China’s blue-chip CSI300 index rose 1.4% to end at 4,156.91, its biggest jump since June 30, while the Shanghai Composite Index gained 1.2% to 3,227.03, its best performance since July 18.

The Hang Seng index rose 0.14% to 20,204.40, while the China Enterprises Index gained 0.4% to 6,905.17. For the week, the CSI300 index edged down 0.3%, while the Hang Seng Index was up 0.2%.

China’s CSI Information Technology index jumped 4.3%. The semiconductor sub-index soared nearly 7% and more than 14% for the week, its best weekly performance in two years.

The US Senate last week passed sweeping legislation to subsidise the domestic semiconductor industry, hoping to boost its firms as they compete with China.

“The Act’s introduction will largely intensify chip competition around the globe and is expected to stimulate the development of China’s semiconductor industry,” Guorong Securities said in a note.

Tech companies listed in Hong Kong edged up 0.8%, with Alibaba down 2.2% as the e-commerce giant reported flat quarterly revenue growth for the first time.

Seoul, Taipei Stocks Rally

Elsewhere across the region, equities were largely mixed, with shares in South Korea and Taiwan advancing 0.3%-2%, while Malaysia fell 0.5%.

Indian stocks gained ground with Mumbai’s signature Nifty 50 index up 0.1%, or 14.35 points, at 17,396.35.

Globally, European equities slipped slightly on Friday but were still set for a weekly gain, while traders waited for US jobs data due later in the session to give clues as to the health of the world’s largest economy.

The MSCI world equity index, which tracks shares in 47 countries, was up 0.2% and on track for a weekly gain of 0.7% – marking its third consecutive week of gains.

Central banks around the world have been raising interest rates in an attempt to limit surging inflation, but European stocks have recovered to near two-month highs this week.

But other asset classes are reflecting a slowdown. The closely watched part of the US Treasury yield curve measuring the gap between yields on two- and 10-year Treasury notes reached 39.2 basis points on Thursday, the deepest inversion since 2000.

An inverted yield curve is often seen as an indicator of a future recession.

Australian Dollar Slips

Oil rose, recovering after the previous session saw prices hit their lowest levels since February. Concerns about supply shortages were enough to cancel out fears of weakening fuel demand.

Investors will look to US jobs data to see if the US Federal Reserve’s aggressive pace of rate hikes is starting to cause economic growth to slow.

The data is expected to show that non-farm payrolls increased by 250,000 jobs last month, after rising by 372,000 in June.

“Until now, markets have been responding to stronger economic data as good news. But at some point, they will maybe question whether the Fed’s tightening is having the desired effect if the economy remains strong,” wrote ING economists in a note to clients.

The US dollar index was up around 0.2% and the euro was down 0.2% at $1.02265. The Australian dollar, which is seen as a liquid proxy for risk appetite, was down 0.1% at $0.6958.

Key figures

Tokyo – Nikkei 225 > UP 0.9% at 28,175.87 (close)

Hong Kong – Hang Seng Index > UP 0.14% at 20,201.94 (close)

Shanghai – Composite > UP 1.2% at 3,227.03 (close)

New York – Dow < DOWN 0.3% at 32,726.82 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

As Hong Kong IPOs Flop, Outlook For Second Half Dims

India Shares, Rupee up After RBI’s 50bps Rate Hike

Dollar Edges up After Fall Thursday Ahead of Key Jobs Data