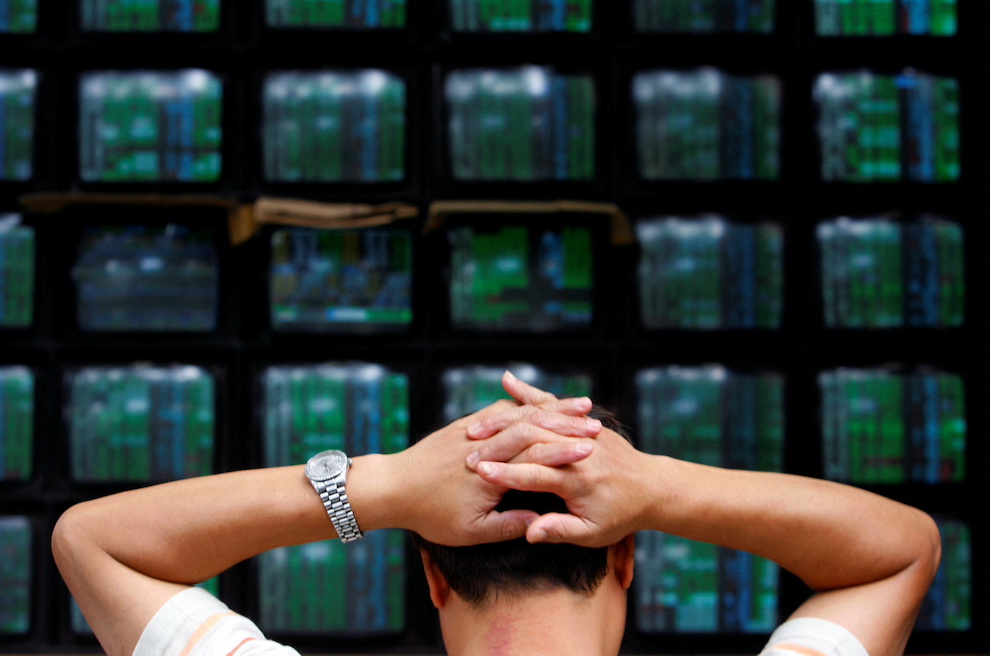

Asian markets were on the back foot on Thursday after a Wall Street slump sparked by worries over soaring global prices.

Wall Street suffered one of its worst days in two years after news of poor earnings reports from retailers rippled across trading floors.

Those shockwaves found their way to Asia where Hong Kong slumped with its tech giants leading the plunge after Tencent reported disappointing profits, fuelling fears of a grim earnings season as China’s economic outlook darkens.

Tencent dropped more than 8% in early trading before recovering some of its losses, a day after it posted its slowest revenue gain since going public in 2004. Alibaba fell by over 6% while Baidu and Xiaomi also suffered.

Also on AF: US Sues Casino Mogul Wynn, Says He’s China ‘Foreign Agent’

The Hang Seng index dipped 2.54%, or 523.68 points, to 20,120.60, while Tokyo closed down too.

The benchmark Nikkei 225 index dropped 1.89%, or 508.36 points, to 26,402.84, while the broader Topix index lost 1.31%, or 24.61 points, to end at 1,860.08.

Mainland China stocks found some gains though after Shanghai set out its latest plan for exiting its coronavirus lockdowns, with buying boosted by inflows from foreign investors.

The Shanghai Composite Index was up 0.36%, or 10.99 points, to 3,096.96, while the mainland’s second exchange, the Shenzhen Composite Index, rose 0.58%, or 11.17 points, to 1,952.71.

China’s blue-chip CSI300 index ended the day up 0.19% at 3,999.60, after dropping nearly 1.5% earlier.

Battery makers and automobile manufacturers led the gains, after data from the China Passenger Car Association showed a jump in retail sales in the first half of May.

Battery Makers Boosted

Companies involved in battery manufacturing, including LONGi Green Energy Technology Co Ltd and Contemporary Amperex Technology Co Ltd were among the most-traded A-shares through the Stock Connect programme on Thursday, Hong Kong exchange data showed.

Foreign investors were net buyers of A-shares, with Refinitiv data showing inflows of more than 8.5 billion yuan ($1.26 billion) through Stock Connect.

So far this year, the Shanghai stock index is down 14.9% and the CSI300 has fallen 19%, while China’s H-share index listed in Hong Kong is down 16.2%. Shanghai stocks have risen 1.64% this month.

Indian stocks followed Wall Street’s slump too with Mumbai’s signature Nifty 50 index down 2.73%, or 443.30 points, at 15,797.00.

And stocks in Sydney were down, as were those in Singapore, Seoul and Taipei. Jakarta and Shanghai eked out small gains.

Key figures at around 0820 GMT

Hong Kong – Hang Seng Index > DOWN 2.54% at 20,120.60 (close)

Shanghai – Composite > UP 0.36% at 3,096.96 (close)

Tokyo – Nikkei 225 > DOWN 1.89% at 26,402.84 (close)

London – FTSE 100 > DOWN 0.8% at 7,376.16

Brent North Sea crude > UP 0.58% at $109.74 per barrel

West Texas Intermediate > UP 0.05% at $109.65 per barrel

New York – Dow > DOWN 3.6% at 31,490.07 (Wednesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Tesla’s Removal From S&P ESG Index Sparks Elon Musk Fury

Japan Trade Balance Widens on Record April Imports Bill