The ATF indices continued their fall on Tuesday, with only the ATF ALLINDEX Local Governments again holding steady and closing at 116.96. The China Bond 50 index, the flagship index, and the ATF ALLINDEX Financial gauge dropped 0.06%, while the ATF ALLINDEX Corporates and Enterprises retreated 0.12% and 0.10%, respectively.

Financials led losses in the China Bond 50 index, with the biggest drops seen in the bonds of China Citic Bank (-0.42%), China Zheshang Bank (-0.36%), Hua Xia Bank (-0.91%) and Bank of Hangzhou (-0.58%). These names also dragged down the ATF ALLINDEX Financial.

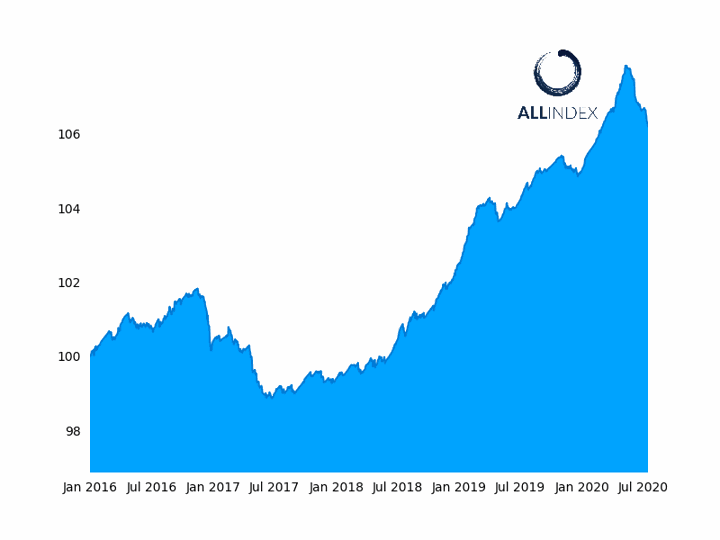

The ALLINDEX Corporates Index fell 0.12%.

Within the ATF ALLINDEX Enterprise, the largest losses were in the industrial sector, with drops in the bonds of Chengdu Rail Transit Group (-1.58%), Qingdao City Construction (-0.96%), and Zhuhai Da Heng Qin (-0.19%). China State Construction Engineering fell a further 0.15%, continuing Monday’s fall.

Zijin Mining Group, in the materials sector, weighed further on the index, losing 1.61%.

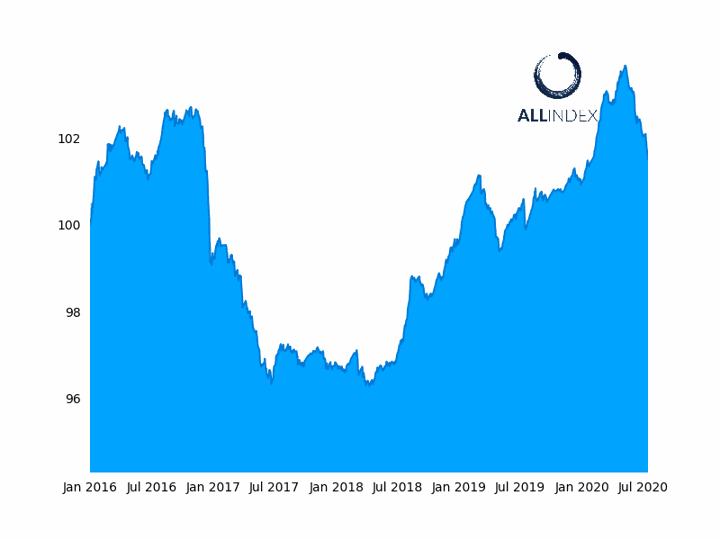

The ALLINDEX Enterprise Index declined 0.10%.

Industrial names were also a big drag on the ATF ALLINDEX Corporates. Hubei Science and Technology retreated 1.56%, Suquian City Construction dropped 0.73%, while Qingdao extended yesterday’s losses and fell a further 0.47%. Hebei Iron and Steel, in the materials sector, fell 1.02% and also weighed heavily on the index.

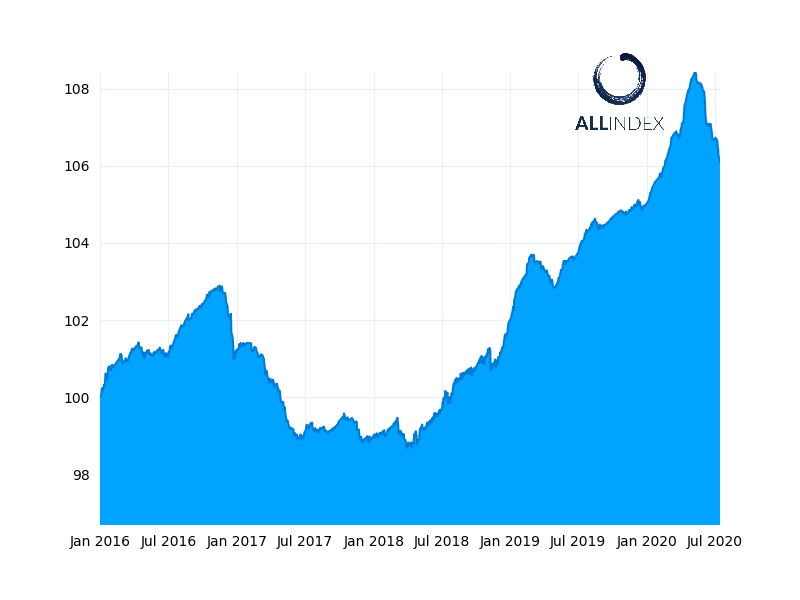

The ALLINDEX Financials Index dropped 0.06%.

On Tuesday, China posted a remarkable uptick in its export and import figures, signalling both strong domestic demand and a recovery in external demand as lockdowns eased abroad.

June exports expanded 0.5% year-on-year, in contrast to a 3.3% drop in May, and a consensus of a 1.5% contraction. Meanwhile, June imports rose even faster, increasing 2.7% year-on-year, versus a 16.7% contraction in the previous month and a market consensus of a 10% drop.

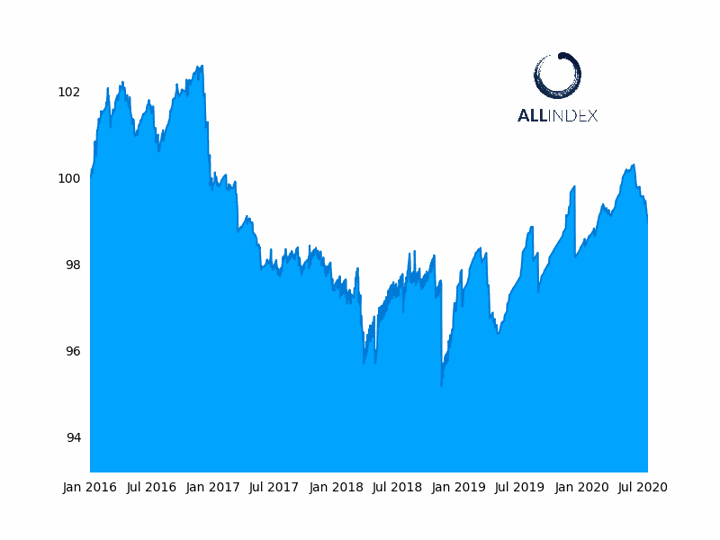

The ALLINDEX Local Governments Index was unchanged.

As a result of the stronger expansion in imports, the country’s trade surplus shrank to $46.4bn in June from $49.6 in the same month last year. In May 2020, the balance stood at $62.9bn.

On Thursday, Beijing will release its hotly anticipated year-on-year GDP growth for Q2.