(ATF) Returns on China’s non-soverign bonds rose for a third day, with Corporates leading the charge after the Ministry of Finance demanded the acceleration of bond sales to fund coronavirus-recovery projects.

Energy bonds and highway construction-linked debt gained on bets the 1.5 trillion yuan of outstanding special-purpose bonds will raise money for local infrastructure projects. Local Government debt declined after the ministry warned that the raised cash must not be absorbed into the coffers of struggling municipalities.

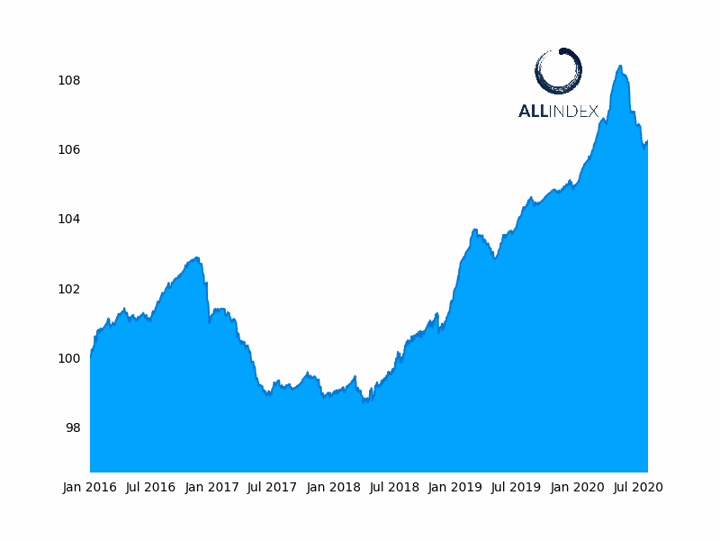

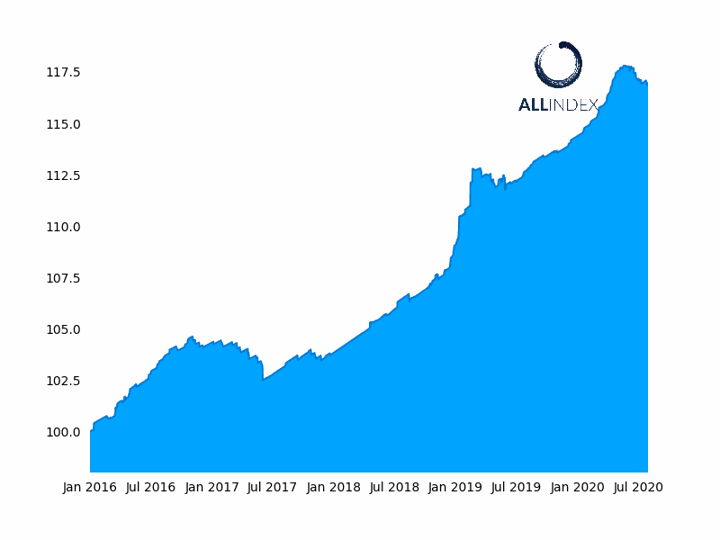

The ATF China Bond 50 Index climbed 0.02%

The benchmark ATF China Bond 50 Index climbed 0.2% on Thursday, the smallest advance in three weeks. Of the ALLINDEX sub-measures, Corporates climbed 0.05%, their biggest advance since July 6; Enterprises were flat; Financials fell 0.06%; and Local Governments slid 0.02%.

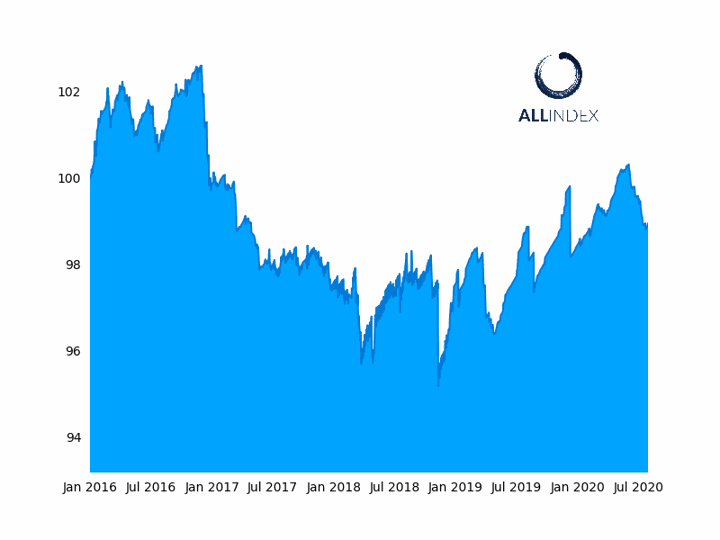

The ALLINDEX Corporates Index added 0.05%

Corporate bonds are recovering from a two-month selloff sparked by the coronavirus downturn, which decimated the economy and was especially brutal on private and state-owned businesses. Money printing by the People’s Bank of China to stimulate spending sent interest rates to record lows, encouraging yield-hungry investors to seek higher returns in riskier corporate and municipal debt.

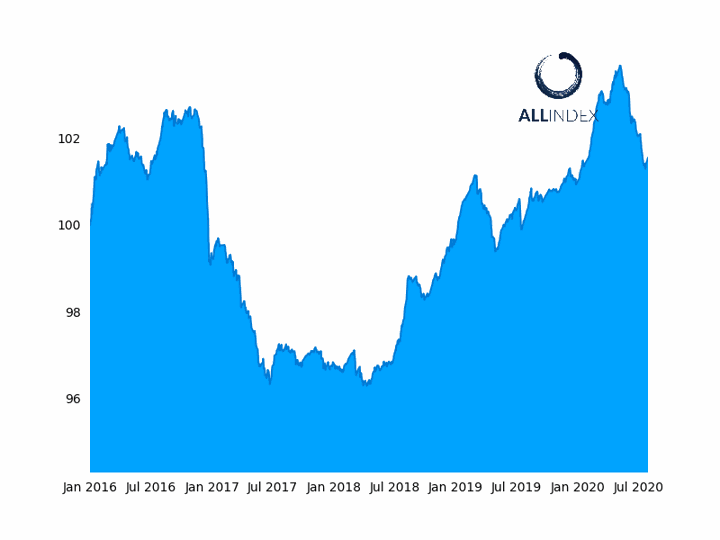

The ALLINDEX Enterprise Index advanced 0.01%

Corporates climbed after the MoF demanded local authorities complete a 3.75 trillion yuan special-bond issuance programme to fund specific recovery projects.

Bonds of Henan Province Tolling Highways added 1.23 on the gauge and Jizhong Energy Group climbed 0.02 on bets the funds will benefit key infrastructure developers.

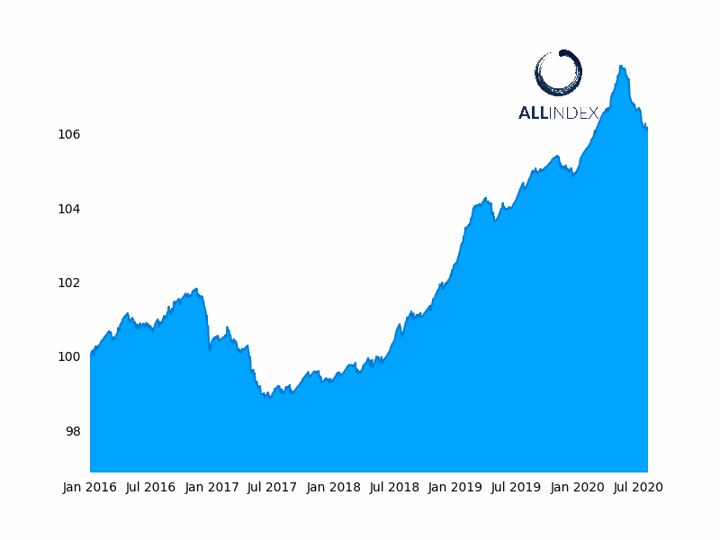

The ALLINDEX Financials Index fell 0.06%

Banks were mixed with larger companies declining after lenders were urged to abandon the SWIFT international payments system as US sanctions loomed. Bonds of Bank of Communications dropped 0.06 and those of China Merchants Bank lost 0.11.

The ALLINDEX Local Government Index dropped 0.02%

The Bank of China’s investment banking unit said the nation’s banks should prepare for potential US sanctions by increasing use of its own financial messaging network for cross-border transactions in the mainland, Hong Kong and Macau.