Alibaba among stocks that have failed to regain momentum after Chinese authorities began pursuing tech and other companies over anti-competitive practices

(AF) The shares of China’s biggest US-listed companies may be poised for deep declines following the weekend crackdown on Didi Chuxing, if recent performance is any indication.

All but one of the 12 largest Chinese companies by market capitalisation traded on American exchanges fell in pre-market trade Tuesday after authorities forced Didi Chuxin to remove its app from users’ devices pending a data-violation investigation. US markets were closed on Monday for a public holiday.

The ride-hailing app, which raised $4.4 billion in an IPO last week, complied with the order immediately. Similar demands were subsequently placed on commercial vehicle-rental app Full Trucking and recruitment platform Boss Zhipin.

They are the latest targets of a Chinese government clamp on data retention by tech firms, who are conduits for huge amounts of the personal information about their millions of users.

Didi’s US-listed shares fell as much as 25% in pre-market trade, shedding $19 billion in value. Those of Alibaba were about 2% lower and Li Auto slumped 6%.

The omens aren’t good for the stocks.

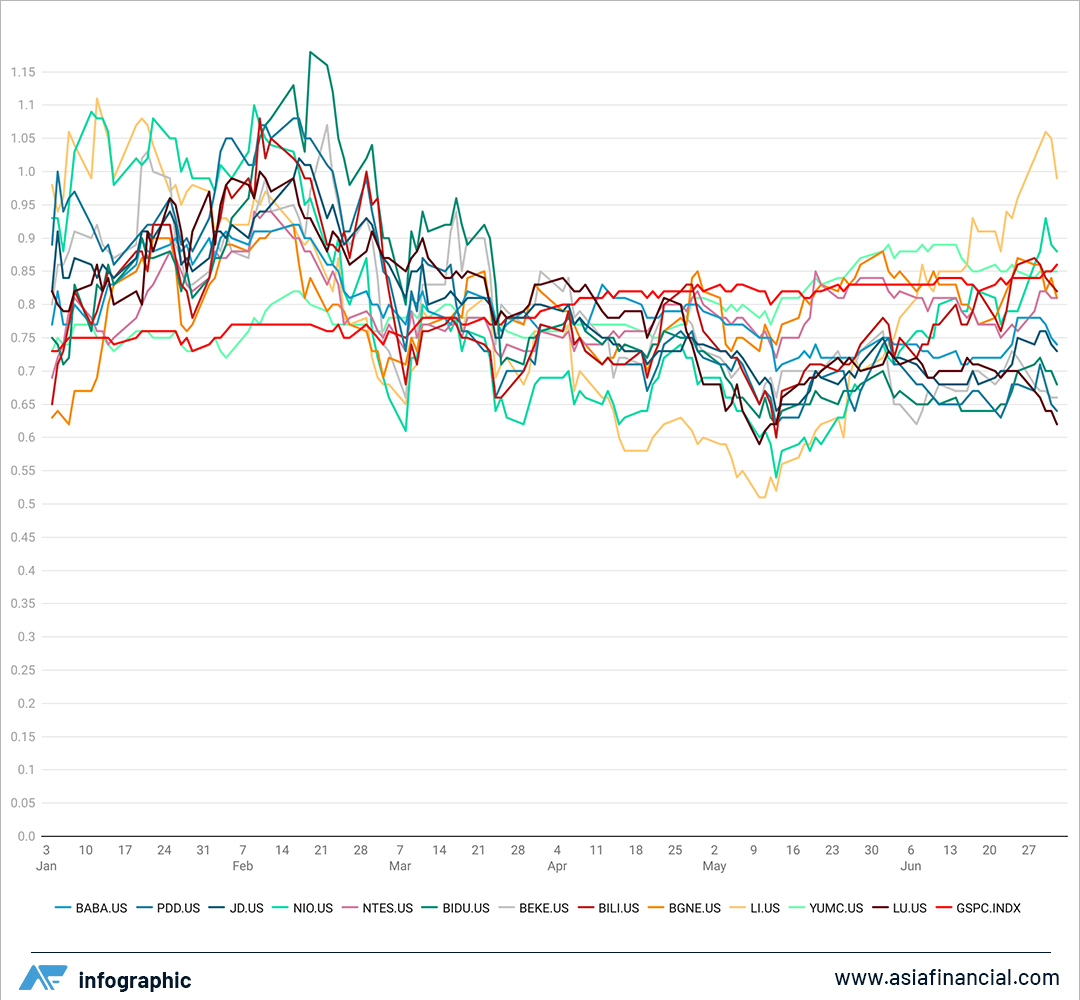

Shares in the companies dropped after a similar spate of government crackdowns late last year heralded a redrawing of anti-monopoly legislation and the issuance of fines against the likes of Baidu, Tencent and Suning. Only half of them have made up those losses since.

The 12, in order of market cap, are: Alibaba (BABA), Pinduoduo (PDD), JD.com (JD), Nio (NIO), Netease (NTES), Baidu (BIDU), KE Holdings (BEKE), Bilibili (BILI), Beigene (BGNE), Li Auto (LI), Lufax (LU) Yum China Holdings (YUMC).

Among the biggest losers, electric vehicle maker Nio fell 36% between mid-February and mid-March, the period over which China began signalling its new antitrust law and when it began investigations of tech companies. Li Auto fell almost 30%, Beigene 21% and Netease 18%.

By the end of June, only Netease, Bilibili, Li and Yum China had made year-to-date advances.

Additionally, over the same period the stocks begun underperforming the S&P 500, which has gained about 17% this year.

The weekend’s developments have spurred speculation that Chinese firms looking to list may find it difficult to gain a place on a US board and may instead seek a flotation in Hong Kong.

“The key question is will US or international investors maintain their appetite for China stocks listing in New York and also Hong Kong – does the regulatory intervention cause hesitation from investors,” said Duncan Clark, founder and chairman of BDA China, a Beijing-based investment consultancy.