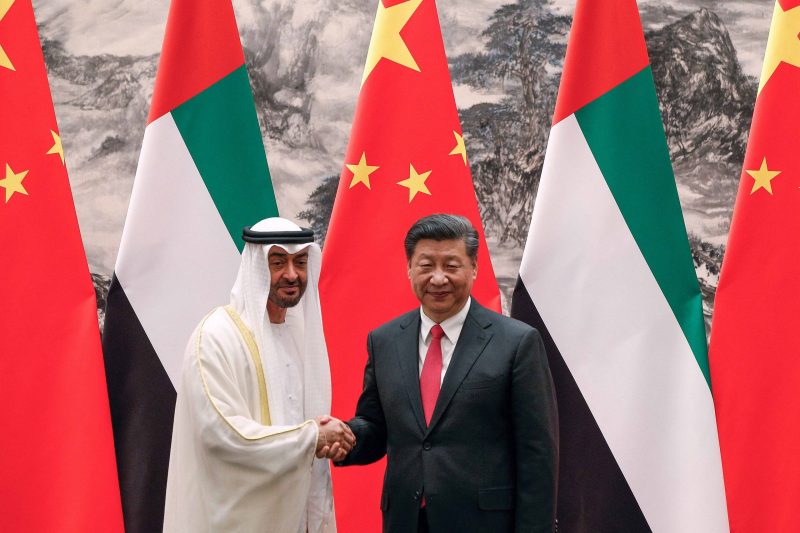

The decline of US investment in China has forced managers of local funds to seek alternate sources of capital from the Middle East and other regions.

Geopolitical tensions and bilateral rivalry is reconfiguring investment flows, as China’s focus on security has led to American firms divesting and eyeing business in more ‘friendly shores’ seen as having less risk, such as India and Southeast Asia.

Seven China equity funds, including hedge funds and mutual funds, running more than $500 billion in combined assets, have said they visited the Middle East this year to raise money, three of them for the first time.

Investors in the Middle East are also keen to allocate more resources to China as they can benefit from lower valuations and the effects of government stimulus to support the recovery.

ALSO SEE: China Plans 50% Jump in Computing Power by 2025 Amid AI Rush

The search for new capital could affect Asia’s hedge fund scene, where China firms account for more than half the market. Brokers and ancillary firms could change their focus to provide for Middle East-related services.

“In the past perhaps the holy grail of capital raising was the US,” Effie Vasilopoulos, co-Leader of law firm Sidley Austin’s Asia-Pacific investment funds group, said.

“But if the US investor leaves, there is a real focus on replacing that with other capital that is de-risked to this US-Sino tension. So that dynamic is leading many of our clients to the Middle East.”

More positive sentiment from Mideast investors

Managers of four of the seven funds visiting the Middle East spoke on condition of anonymity, as they have not yet drawn new investment.

But the warm reception has managers sensing a deeper shift.

“Sentiment (towards China) is most positive among Middle East investors relative to other investor groups,” said Steven Luk, CEO of FountainCap Research & Investment, one of the seven funds who visited the Middle East this year.

“Some sovereign wealth funds are overweighting China,” he said. “They talk more about how to play China instead of ‘why China’.”

The long-only equity manager, which has been investing in China since 2015, nearly doubled its asset size to $2.1 billion since the end of last year, which it attributed to inflows predominantly from Europe but also from the Middle East.

As a next step, the firm wants to build relationships in Australia for capital raising.

Many advisers have followed to expand their presence in the Gulf too, said Erin Wu, head of investor relations at OP Investment Management, a Hong Kong-based hedge fund platform.

‘New volatile environment’

It was unclear whether military conflict in the Middle East would hasten moves among the region’s investors to allocate beyond the US, but opinions on whether China’s underperforming markets present value have been split for months.

Big US investors such Texas Teachers’ Pension and California State Teachers’ Retirement System, for example, have cut exposure to China equities in the past year.

However, sovereign funds in the Middle East have been large buyers.

MSCI’s China index is down 11% this year, against a 8% gain for world stocks.

“It’s a ‘politico-investment’ strategic decision,” Wong Kok Hoi, CIO at Singapore-based APS Asset Management, said.

“On the one hand, China is cheap and on the other hand, they believe they need to diversify away from their US-centric investments.”

APS attracted fresh capital from Middle Eastern and African investors this year.

Wong said it might be too early to predict how fund flows will be affected in coming months from the Middle East conflict, but the long-term strategy of Mideast investors to increase their exposure to non-dollar assets should not change much.

“If anything, the pace may even pick up in this new volatile environment as the oil-producing countries, benefitting from higher oil prices, will have more revenue to invest.”

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Economic Risks Mount for Asia as Israel Declares War on Hamas

World Bank Says Asia Faces Worst Outlook in 50 Years – FT

China-Western Tensions Reshaping Global Business

Saudi Arabia Emerging as Hot New Market For Chinese Investors

China, Saudi Arabia Pledge Closer Energy Cooperation