Chinese entrepreneurs and investors are increasingly eyeing Saudi Arabia for expansion and fundraising opportunities amid the recent warming of ties between Beijing and Riyadh.

About 2,000 investors from Greater China are heading to Saudi Arabia this week to attend a business conference which will see a confluence of business and government leaders.

“From the perspective of both capital and new market, the Middle East, Saudi Arabia are really good new choices for Chinese companies and investors,” Henry Zhang, president of Hong Kong-based private equity firm Hermitage Capital, said.

Also on AF: Chinese Energy Storage, Battery Firms Plan $1bn Vietnam Plants

Zhang is traveling to Riyadh to participate in the 10th Arab-China Business Conference along with a number of portfolio companies.

Attending the conference for the first time, Zhang hopes the trip will help his investees explore the local market and help himself understand the real demands of Middle Eastern investors for Chinese funds.

“Since late last year, a large number of Chinese funds have rushed to the Middle East looking for new investors. In light of this, what we have to think about is what the potential investors want and how we can differentiate ourselves.”

The gathering between the world’s second-largest economy and Gulf energy giants comes as economic slowdown and geopolitical tensions have made fundraising and expansion challenging for many Chinese funds and companies.

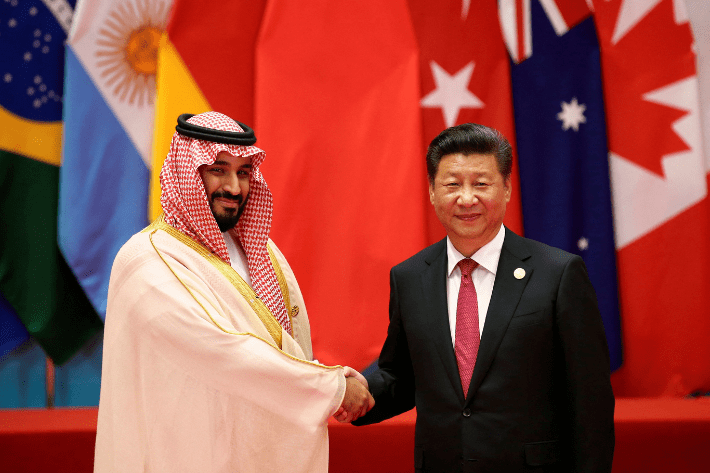

It also follows Chinese President Xi Jinping’s ‘epoch-making’ visit to the Gulf state, which Beijing described as the biggest diplomatic initiative in the Arab world.

Interest from hi-tech Chinese industries

Set to be held on Sunday and Monday, the conference will take place two days after US Secretary of State Antony Blinken’s Saudi Arabia visit.

Washington is working to mend frayed ties with its closest ally in the Middle East and deepening cooperation between Riyadh and Beijing in security and sensitive high-tech has been a major US concern.

The Riyadh conference will see participation from Chinese entrepreneurs representing a range of industries, including renewable energy, artificial intelligence, biotech, finance and tourism.

The delegation from Greater China will be one of the region’s biggest-yet to Saudi Arabia, according to one person with direct knowledge of the matter.

China is Saudi Arabia’s top trading partner globally with bilateral trade worth $87.3 billion in 2021. While economic ties remain anchored by energy interests, bilateral relations have expanded under the latter’s infrastructure and technology push.

Unprecedented Chinese interest

The attitude of Chinese enterprises towards expanding in the Gulf state has also undergone “tremendous changes”, according to Edison Gao, China-based group vice president of Saudi conglomerate Ajlan & Brothers.

“I’ve never seen Chinese companies being so interested in and committed to the Saudi market,” said Gao, who joined Ajlan in 2017 and has since been helping attract Chinese firms to expand locally.

“Previously, I had to actively pitch Chinese companies to consider Saudi Arabia as their destination of outbound investment and overseas expansion. But it’s the other way around recently, I’ve received many business proposals from them.”

Robert Mogielnicki, senior resident scholar at the Arab Gulf States Institute in Washington, said one key reason for Saudi-Chinese linkages strengthening is that the Arab country is looking for major growth areas via international partnerships.

“The calculation here is that there’s much to gain from more cooperation with China,” he said.

“Chinese technology firms have read the writing on the wall and see the Saudi Vision 2030 transformation agenda as an invitation for longer-term commercial engagement with Saudi customers.”

Vision 2030 lists Saudi Arabia’s new economic agenda, as the world’s top crude exporter and largest Arab economy aims to cut oil dependence and modernise the country with new industries.

- Reuters, with additional editing by Vishakha Saxena

Also read:

Beijing Tight-Lipped on Blinken’s Plan to Visit China This Month

Saudi Arabia Inks Deal With Huawei During Xi Visit Despite US Fears

China, Saudi Arabia Pledge Closer Energy Cooperation

China Envoys ‘Grab’ Billions in Unprecedented Push for Deals