US private equity firm TPG, one of the earliest such investors in China, has submitted paperwork for an initial public offering, according to a regulatory filing on Thursday, as it seeks to better compete with its publicly traded peers.

Fort Worth, Texas-headquartered TPG, which did not reveal the number of shares it plans to sell or the indicative price range, is known for its leveraged buyouts.

TPG, which has invested across sectors from retail to healthcare, has around $109 billion in assets under management. Its portfolio includes Airbnb, Burger King, Uber Technologies and Spotify Technology.

The asset manager could be valued at about $10 billion, The Wall Street Journal reported in June. Its net income attributable to TPG’s controlling interests was $1.7 billion for the nine months ended September, its filing showed.

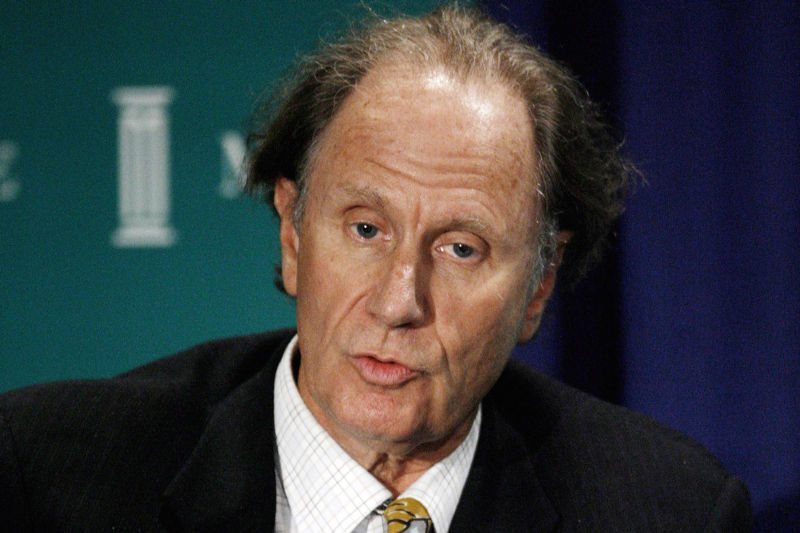

Founded in 1992 by David Bonderman and Jim Coulter, TPG was launched as Texas Pacific Group in Mill Valley, California. Its first major investment was in the then-bankrupt Continental Airlines in 1993.

Joint Venture in China

It was among the first private equity firms to invest in China. In 2010, it earmarked $1.5 billion for Chinese investments. Its most recent China deal was in October, when it led a consortium to invest $45 million in casual sportswear maker China Vogue.

In 2019 TPG and CICC Capital, the private equity arm of China International Capital Corporation, signed an agreement to jointly establish a platform to target investment opportunities both in China and overseas that benefit from key trends in the Chinese economy.

Chang Sun, chairman of TPG China, was the founder of Black Soil Group, an agriculture investment holding company. From 1995 to 2015, Chang was a partner at Warburg Pincus Asia and served as the firm’s Asia Pacific chair.

TPG’s move to go public coincides with record-breaking levels of IPOs and dealmaking as well as impressive stock market rallies of its listed rivals.

Shares of rivals Apollo Global Management, KKR & Co, Carlyle Group and Blackstone have risen between 43% and 94% so far this year.

- Reuters, with George Russell

READ MORE

Private Equity Firms Revise China Strategy as Regulatory Crackdown Widens

US Equity Firm Blackstone Axes $3bn Soho China Takeover Plan

US Says China Private Equity’s Magnachip Purchase Is Security Risk