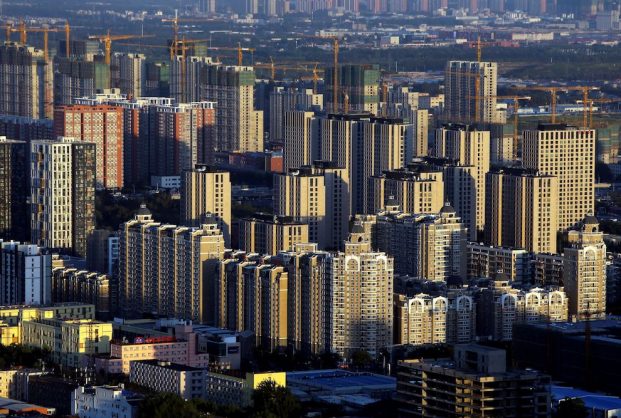

China property investments fell 4% from a year earlier in January-May, official data showed on Wednesday, as the sector continued to deteriorate.

The China property investments figure followed a 2.7% year-on-year decline in the first four months.

Real estate sales by floor area fell 23.6% year-on-year in the first five months, extending the 20.9% decline in January-April, according to data from the National Bureau of Statistics (NBS).

New construction starts measured by floor area plunged 30.6% in January-May from a year earlier, after a 26.3% fall in January-April.

Funds raised by China real estate developers slumped 25.8% year-on-year in the first five months, compared with a 23.6% fall in the first four months.

Adrian Cheng, co-head of China property at Fitch Ratings, said the agency maintains a “deteriorating” sector outlook for China property developers.

“The operating environment for Chinese developers will remain challenging in the second half of 2022,” he said.

The sector faces a $22 billion in offshore bonds maturities in the second half of this year.

“This still presents significant liquidity pressure for developers. Other funding channels, such as bank financings and pre-sales proceeds, have not seen significant improvements,” Cheng said.

- Reuters, with additional editing by George Russell

READ MORE:

Chinese Developer Seazen to Test Offshore Market With Green Bond

China Developer Greenland Seen Deferring $488m Bond Debt

China to Launch First Residential Property REITs Soon