China Resources Land Ltd secured 23 billion yuan ($3.64 billion) in credit lines for real estate acquisitions on Wednesday, while two other state-owned developers completed bond sales worth 2.29 billion yuan for the same purpose.

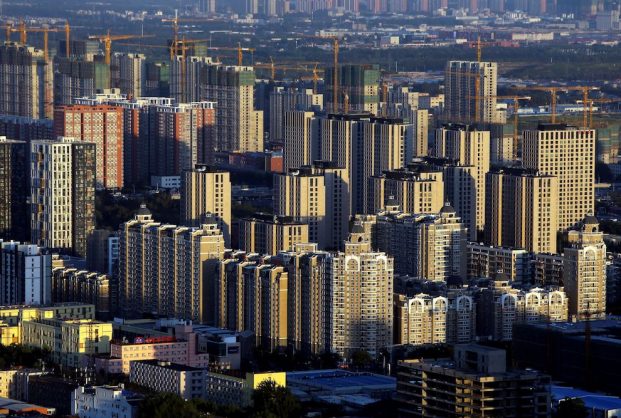

The fundraising rush comes as Beijing encourages state companies to acquire projects from cash-strapped developers to help ease severe liquidity stress on the sector that could threaten financial and social stability.

China Resources Land and a subsidiary entered into strategic cooperation with China Merchants Bank, which will fund the developer’s acquisition businesses, the company said in a statement.

C&D Real Estate Corp Ltd and China Merchants Shekou Industrial Zone Holdings Co said in separate statements that they raised 1 billion yuan, and 1.29 billion yuan, respectively, through bond sales to fund purchases of real estate projects.

A slew of Chinese developers, including China Evergrande Group and Kaisa Group have defaulted in recent months, as they struggle to repay debts after Beijing launched a deleveraging campaign for the bloated sector.

State-owned property firms are expected to acquire more assets from private developers, analysts said, as Beijing steps up efforts to stabilise and tighten control over a crisis-hit sector that accounts for a quarter of its economy.

Guizhou LGFVs get relief

Meanwhile, China will allow local government financing vehicles (LGFVs) in the southwestern province of Guizhou to delay debt payments and undergo debt restructuring, the cabinet said on Wednesday.

The move is part of a broader plan to spur growth in one of China’s poorest regions.

China’s local governments are struggling financially as tax and fee cuts by the central government and a downturn in the property market weigh on fiscal revenues. Governments in less-developed regions like Guizhou have been particularly hard-hit.

Analysts at S&P said in November that they expect fiscal balances for China’s local and regional governments to widen this year, owing to increasing economic headwinds and more counter-cyclical fiscal support.

“For qualified outstanding hidden debt oligations, China will allow local financing platforms to negotiate with financial institutions to appropriately extend repayment and undergo debt restructuring to maintain cashflow,” the State Council said in a document on its website.

In addition, the central government will increase the quota for local government debt issuance allocated to Guizhou.

Local government hidden debts, mainly LGFV debts including loans and bonds, reached 45.0 trillion yuan ($7.12 trillion) at the end of 2020 – equivalent to 44% of GDP and more than four times its end-2010 level, Nomura estimated last year.

China will also support state-owned companies in Guizhou to conduct strategic restructuring, as well as pushing for reforms in local energy and mining sectors, the State Council said.

The new document on Wednesday also outlined favourable policies to help Guizhou transition into a digital economy and develop its tourism industry.

• Reuters with additional editing by Jim Pollard

ALSO ON AF:

China’s State Property Firms Rescuing Indebted Developers

Evergrande Shares Jump on News China Official Will Join Board

China Dollar Property Bonds Show Deeper Distress: DBS Bank

China’s Next Debt Crisis Could Be Municipal Funding Vehicles

China Evergrande and Kaisa Declared in Default by Fitch