(ATF) China, a big raw materials consumer, hopes to position itself as a global commodities marketplace, with its launch of a new futures contract on the copper market available to foreign investors.

The Shanghai International Energy Exchange (INE), a division of the Shanghai Commodity Exchange, had previously offered copper contracts but exclusively for domestic trading.

“The launch of bonded copper futures is necessary for the continued growth of China’s copper industry,” INE has said.

China accounts for around half of global copper production but it faces an uphill struggle to win business for commodities as London has historically dominated exchanges, especially through the London Metal Exchange (LME), which was founded in 1877, which trades in non-ferrous metals such as copper, aluminium, lead and zinc.

LME is a subsidiary since 2012 of HKEX – owner of the Hong Kong stock exchange.

INE and its contracts are denominated in yuan, but analysts say the copper contract launch is another step towards freer convertibility of the Chinese currency.

Useful indicator

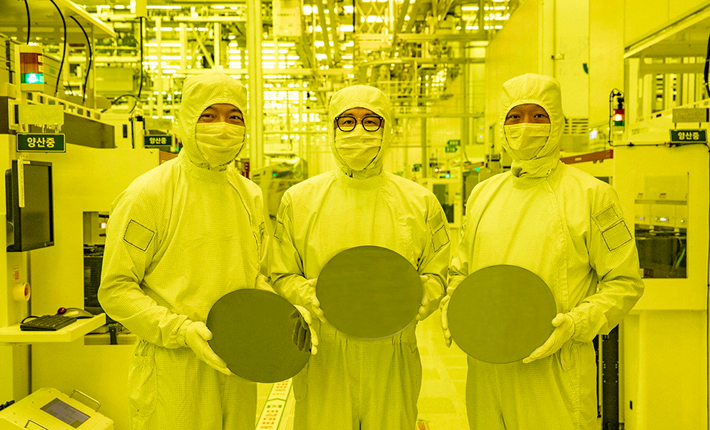

The price of copper is tracked particularly because it is often considered a good indicator of the health of the world economy. Copper is widely used across various industries, in particular in electrical circuits from real estate to vehicles and household appliances.

Copper, the world’s most important industrial metal, has rallied from its March lows, climbing more than 70% to a seven-year high above $7,900 a tonne. The metal has been in huge demand as it is vital to help build out green energy networks and electric vehicles.

“Copper has chosen to end the year on a high note,” said Yao Wenyu, senior commodities strategist at ING, a Dutch bank. “The funds community has been enthusiastic on copper, given the macro tailwinds and the long-term bull narrative rooted in copper’s increasing usage from electrification – tied to global decarbonisation and energy transition.”

Last week, China said it would accelerate the rollout of new commodity futures and options including natural gas, refined oil and peanuts as it sets out to develop its derivatives market amid increasing demand.

Fang Xinghai, vice chairman of the China Securities Regulatory Commission, told China Futures Association forum in Shenzhen that a planned expansion of China’s capital markets would require a more sophisticated financial derivatives market. “Currently, China’s financial futures and options market is at an early stage of development,” Fang said.

With reporting by AFP, Reuters