Electric vehicle sales in the world’s largest automobile market started off slowly in the first two months of the year, fuelling fears of a global slowdown in demand.

Sales of battery-powered EVs in China rose 18.2% in January-February, versus 20.8% for all of 2023, data from the China Passenger Car Association showed on Friday.

The slowdown has fuelled intensifying competition in China’s EV market, led by a fresh round of deep cuts by Tesla-beating carmaker BYD.

Also on AF: EU Says China EVs Funded by Subsidies, Plans Retroactive Tariffs

BYD this year has lowered prices more than rivals and across a wider number of models. It has cut prices of the 13 models that made up 93% of its total 2023 China sales by 17% on average, Reuters calculations showed.

Cuts include nearly 12% for its best-selling Yuan Plus crossover – or the Atto 3 overseas – and 5% for its lowest-priced EV Seagull.

A dozen automakers have joined the price war, including Geely Auto, GAC Aion, Leapmotor and Xpeng, with discounts mostly ranging from 9% to 17%.

The price cuts came as BYD’s NEV market share fell to 30.7% in February, its lowest since June 2022, Reuters calculations showed.

BYD is the world’s biggest EV seller having unseated US rival Tesla, even if most of its sales are in China.

It exported 19% of its cars overseas in February, its highest ratio ever. It sold 8% of all outbound cars in 2023.

China’s car exports soar

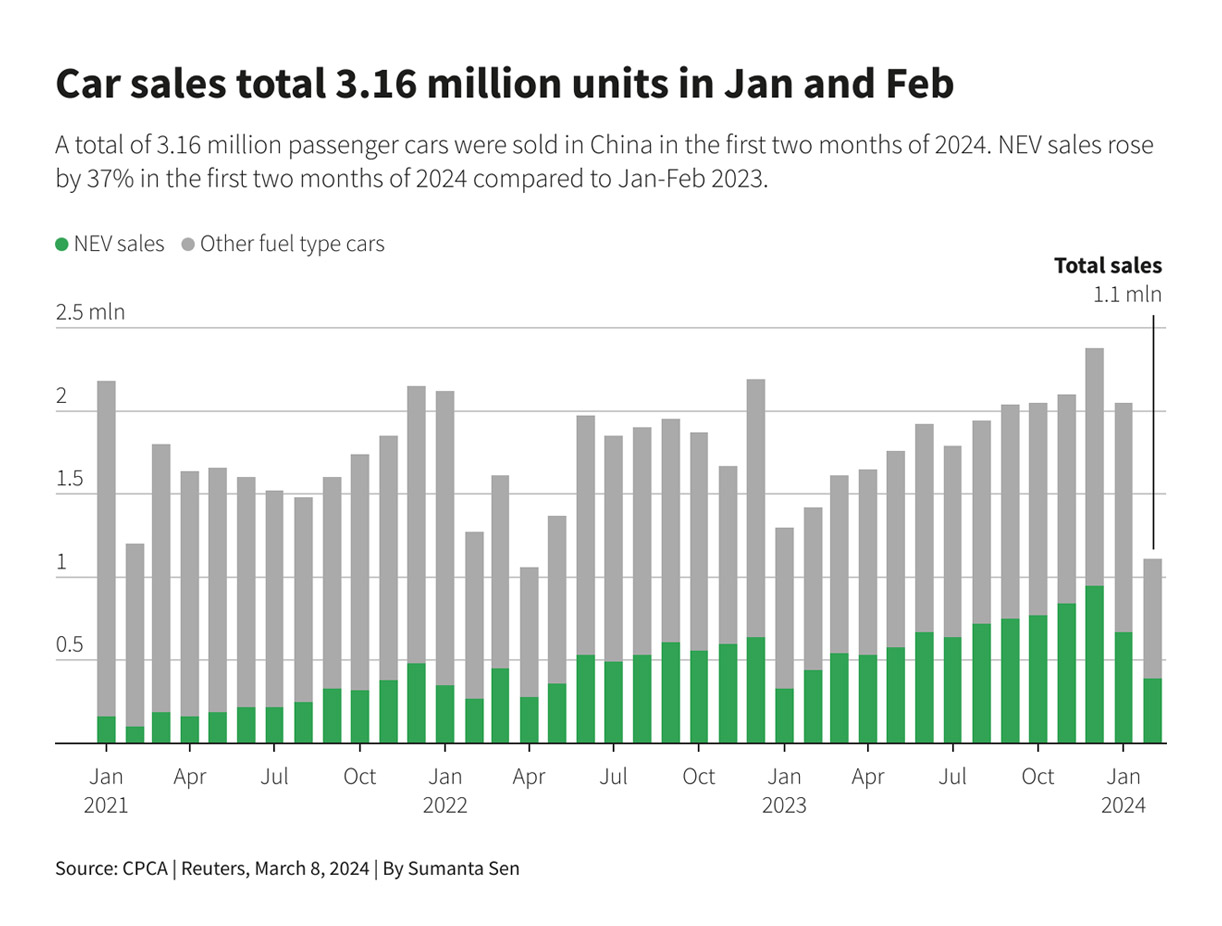

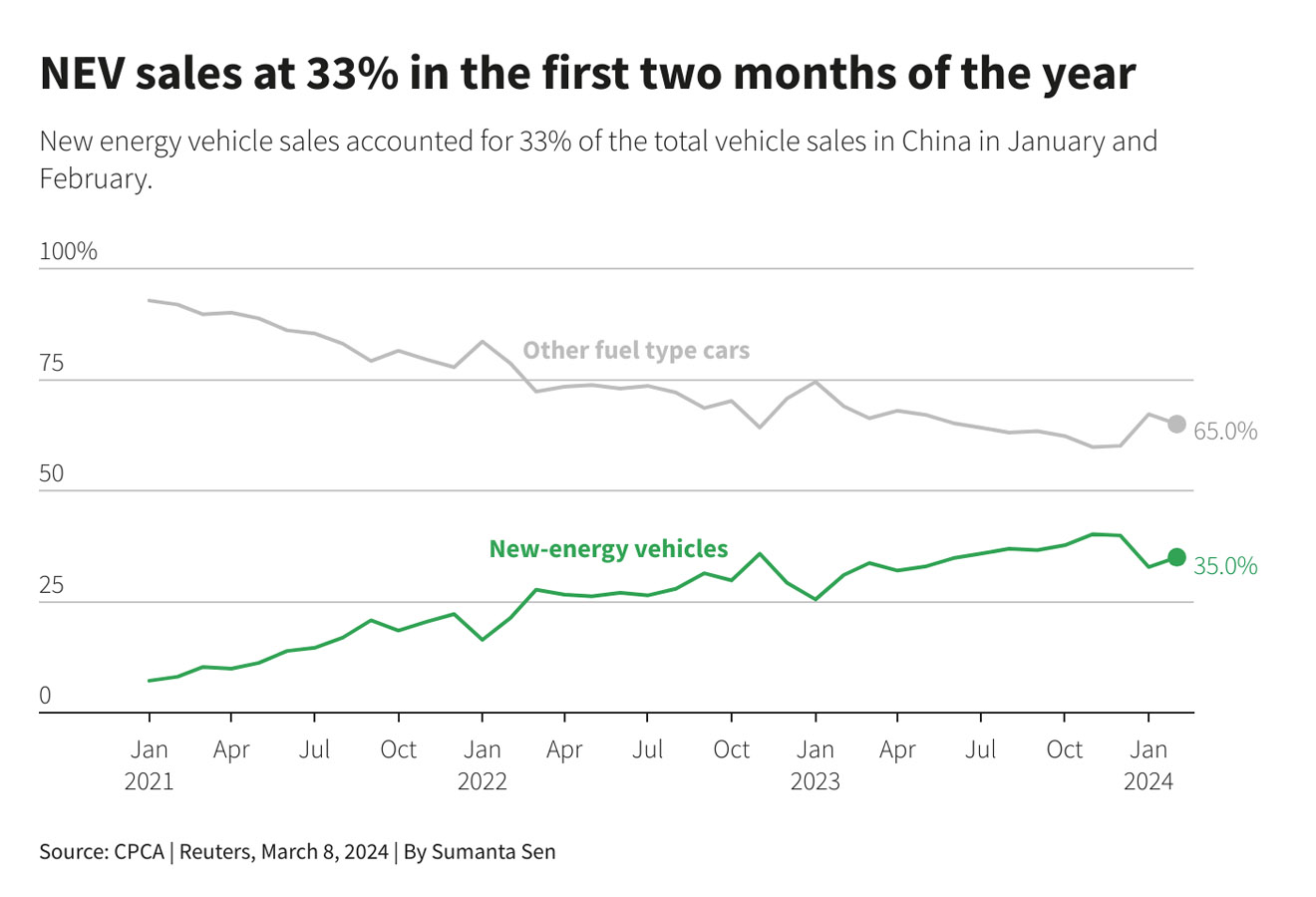

Meanwhile, new energy vehicles (NEVs) accounted for 33.5% of total car sales in China for the January-February period, grabbing market share from petrol-powered cars of which sales rose 7.8%.

NEV sales were 28.3% of the total in the same period a year earlier.

Some EVs are priced on a par with petrol-powered cars, pressuring sales of the latter, Cui Dongshu, secretary general of the association, told reporters on Friday.

Together with plug-in hybrids, NEV sales jumped 37.5% in the two-month period, versus 36.2% for 2023. The result outpaced the overall passenger vehicle market’s 16.3% growth as widespread discounts fuelled demand.

Association data also showed China’s February car exports rose 18% to 298,000 passenger cars, with NEVs accounting for 26.4% of the total.

Last year, China overtook Japan for the first time to become the world’s largest auto exporter.

Exports have become a growth engine for Chinese carmakers struggling with weakening domestic demand. They have been selling new EV models in droves to markets such as Australia where they do not face trade barriers and where sales have surged due to subsidies and tax benefits as well as high fuel prices.

However, in some markets, China’s rising auto export prowess has caused friction. European authorities have launched an investigation into whether Chinese EV makers unfairly benefit from state subsidies, while the US has begun a probe into whether Chinese-made vehicles could be used to spy on Americans.

- Reuters, with additional editing by Vishakha Saxena

Also read:

Biden Orders Probe Into Data Security Risks From Chinese EVs

Raimondo Says Chinese EVs Are a National Security Risk For US, EU

China EV Firms Can Destroy Rivals Without Trade Barriers: Musk

US Auto Sector ‘Faces Extinction’ From Chinese Mexico Imports

China Vows to Help EV Makers Expand Overseas, Fight Sanction

BYD’s First Vehicle Charter Sets Sail Loaded With 5,000 EVs

Chinese Outbound EV Investment ‘Hit Record High in 2023’