Tesla chief Elon Musk warned on Wednesday that Chinese electric vehicle (EV) makers were extremely competitive and capable of destroying global rivals without protectionist measures in place.

“Our observation is generally that the Chinese car companies are the most competitive car companies in the world,” Nikkei Asia quoted Musk as saying at a post-earnings call with analysts.

China’s EV firms “will have significant success outside of China, depending on what kind of tariffs or trade barriers are established,” Musk added.

Also on AF: Foreign Auto Brands Account For 20% of China’s 2023 Exports

“If there are no trade barriers established, they will pretty much demolish most other car companies in the world,” he said.

“They’re extremely good.”

Musk’s comments came on the back of a year of ups and downs, in which the US carmaker made record vehicle deliveries but still lost its crown as the world’s biggest EV seller to China’s BYD.

A major driver of BYD’s sales win was its willingness to operate on thinner margins and move toe-to-toe with Tesla in implementing aggressive price cuts.

At the same time, China’s biggest EV maker also unveiled a luxury line — Yangwang — to compete with Tesla on its premium models.

The Wall Street Journal reported this week that one ‘supercar’ BYD released recently was capable of floating in water and rotating 360 degrees — all while resembling a Lamborghini.

Asked about Musk’s comments, the Chinese foreign ministry said at a regular briefing on Thursday that it advocated “maintaining a fair, just and open business environment”.

Challenges in the US

Musk made his comments in response to a question about a possible tie-up between Tesla and a Chinese EV firm.

Musk said there was “no obvious opportunity” to partner with Chinese rivals but Tesla was open to giving them access to its charging network and licensing other technologies such as self-driving.

A tie-up between Tesla and any Chinese firm would also be a hardsell in the US amid efforts by the Joe Biden administration to tackle competition from China.

Biden has said China was determined to dominate the EV market and that he “won’t let that happen”.

Former President Donald Trump, who is the frontrunner for the Republican nomination as the US presidential election picks up, is also likely to tamp down on China, if elected.

Trump has, on the campaign trail, called for a universal 10% tariff on all imports into the US and revoking China’s most-favoured-nation trading status.

Also on AF: Chinese EV ‘Invasion’ Forces Western Rivals to Slash Costs

China’s supply chain resilience

On Wednesday, Musk warned Tesla was reaching “the natural limit of cost down” with its existing line-up.

Tesla plans to start producing a cheaper, mass market compact crossover codenamed “Redwood” in the second half of 2025, to compete with inexpensive rivals like BYD.

But Chinese EV makers, adept at keeping costs in check with a stable supply chain, are moving fast. With rising competition and excess capacity in China, many are now working on rapidly expanding their foreign footprint after years of state subsidies helped boost domestic sales.

“The completeness and resilience of China’s multi-decade state-directed battery materials processing infrastructure build out is biting hard,” said Ross Gregory, a partner at Melbourne-based consultant New Electric Partners.

China’s SAIC Motor, for instance, has been placing orders for more vehicle vessels in its fleet to counter shipping costs as it looks to boost sales overseas.

Meanwhile, BYD’s first vehicle charter, loaded with 5,000 EVs, set sail for Europe this month.

View this post on Instagram

Multiple challenges ahead

Despite those efforts, brand awareness of Chinese car companies in the United States is extremely low and their reliability, durability and safety is middling, so they have a long way to go to win US market share, said Spencer Imel, a partner at consumer insights firm Lansgton.

“They enjoy high demand in China with innovation such as in-car technology and battery swapping,” Imel said. “That, we believe, will be an important ingredient and a differentiator in their future growth overseas.”

Chinese carmakers also face a similar set of challenges in the European market, where they have, so far, made a steady start.

But Europe has already taken a protectionist stance towards Chinese EV makers.

Last year, the EU launched an investigation into whether to impose punitive tariffs against cheaper Chinese EV imports that it says are benefitting from state subsidies.

EU inspectors are in China this month to visit the facilities of BYD, Geely and SAIC to conduct their probe.

Apart from those, a larger challenge facing Chinese carmakers would be a potential slowdown in EV demand, driven by toughening global economic conditions and the threat of persistent high interest rates amid wars and stubborn inflation.

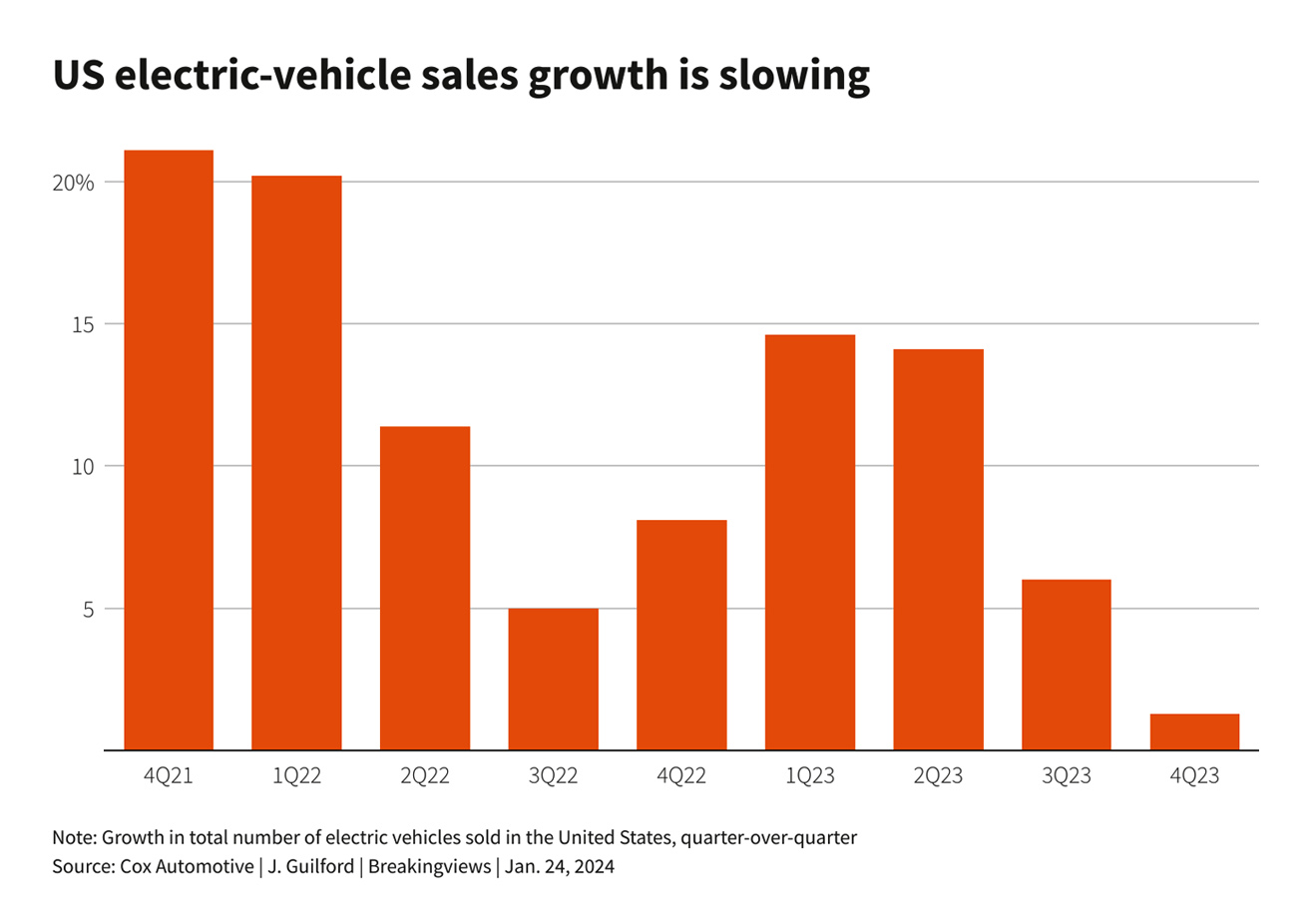

At the earnings call on Wednesday, Tesla warned of “notably lower” sales growth this year.

The warning led Chinese EV stocks including BYD, Nio, Li Auto and Xpeng to end the day lower, amid broader weakness in the Chinese market.

- Reuters, with additional reporting by Vishakha Saxena

Also read:

China’s BYD Posts Highest Ever Quarterly Profit With 82% Jump

BYD’s Thai Distributor to Triple EV Outlets as Sales Boom

Tesla Gains $31m Shanghai Land For New Megapack Battery Plant

Chinese Car Exports to EU Seen Hit by Red Sea Ship Attacks

Threat of More Rate Rises Slowing the Shift to Electric Vehicles

Japan to Shake Up Battery Supply Lines Over China Fears

Ford Halts Work on $3.5bn CATL-Backed US Battery Plant

France Reworks Subsidy Criteria to Cut-Off Chinese EVs – Nikkei