China’s rapid shift to electric vehicles (EVs) has hammered Japanese carmakers, which have seen sales of their cars, still largely powered by gasoline (petrol), plunge.

Industry data shows that sales of Japanese cars were down 32% year-on-year in the first quarter in China, more than double the overall market slump.

Other automakers like Volkswagen have also been caught out by the sharp shift in China, but Japanese automakers stand out because of their limited showing in the fast-growing electric and plug-in hybrid sales categories.

Production and margins will come under pressure in China as automakers cut output and prices of gasoline-powered cars to keep inventories in check, analysts say, in a worrying sign of the competition Japanese automakers could increasingly face outside their home market.

ALSO SEE:

Mintz Executive Caught in China’s Growing Web of Exit Bans

Mitsubishi sales down by half

Mitsubishi Motors Corp, said last week it had suspended production of its Outlander SUV in China for three months and would take a charge of $77 million for slowing sales at its joint venture with state-owned GAC Group.

Mitsubishi, like some other Japanese automakers, does not break out China sales figures. But industry data analysed by Reuters showed its first-quarter sales in China fell by 58% from a year earlier.

“Especially Japanese automakers face a little bit more inventory of new cars,” in China, Yasushi Matsui, chief financial officer at parts supplier Denso Corp, said last week. “They are making adjustments.”

In another shift, Nissan’s Sylphy, a sedan that had been China’s top-selling vehicle for three years, was edged out last year by the BYD Song, a plug-in hybrid made by BYD, China’s top automaker.

In emailed comments, Nissan said it had sold over 5 million Sylphys in China over the years, adding that an electric-drive hybrid version was eligible for incentives in Guangzhou.

The company said it was working with other cities on similar support. The e-Power electric-drive hybrid version of the sedan would be central to Nissan’s brand transformation in China, it said.

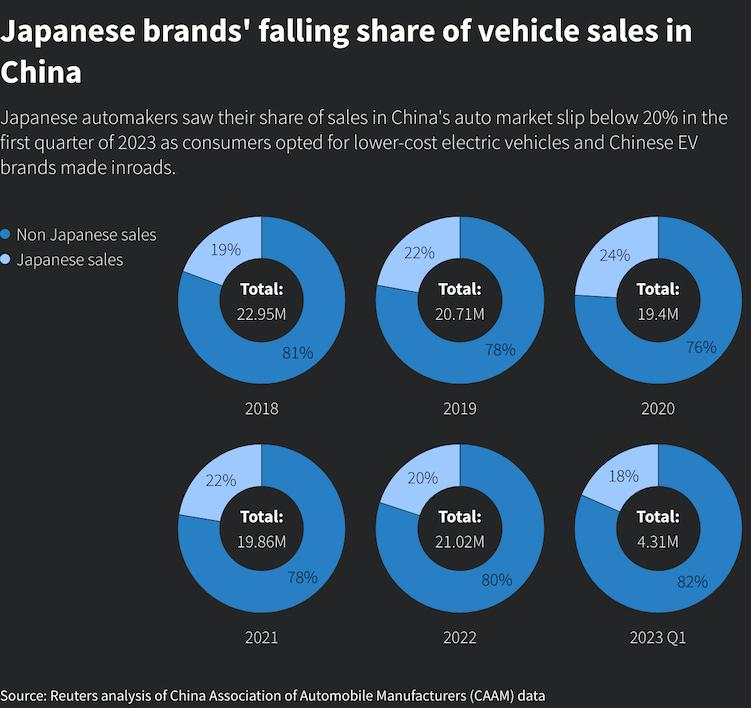

Japan car sales drop to 18.5% in Q1

Toyota Motor Corp has said its go-slow approach to all-electric cars protects consumer choice, but analysts say the strategy is costing sales in China.

“Japan is the biggest loser of the price war so far,” said Bill Russo, founder and CEO of Automobility, a Shanghai-based consultancy.

“As EVs get more affordable, they become more attractive to the core buyers who have been resisting so far, the buyers of foreign brands. So, you can see the writing is on the wall.”

Japan’s share of car sales in China slumped to 18.5% in the first quarter, down from 24% in 2020, industry data from the China Association of Automobile Manufacturers showed.

Toyota and its luxury brand Lexus posted a 14.5% drop in first-quarter sales, company data showed.

“We need to increase our speed and efforts to firmly meet the customer expectations in the Chinese market,” Toyota CEO Koji Sato said in an interview last month.

Nissan Motor posted a 45.8% drop in China sales and Mazda Motor Corp sales were down 66.5% in the first quarter. Honda Motor had a 38.2% drop, industry data showed.

Honda CEO Toshihiro Mibe acknowledged the automaker lagged Chinese rivals in some software technologies.

China’s automakers are “further ahead of us than we expected,” Mibe told reporters at a presentation in Tokyo focused on Honda’s efforts in autonomous driving and services like gaming.

Japanese automakers built their reputation on factors like durability, but the shift in China shows the draw of lower-priced electric cars and new offerings based on software, said Masatoshi Nishimoto, principal research analyst at S&P Global Mobility in Tokyo.

“Japanese automakers could face a similar struggle in the United States as in China,” he said.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China’s EV Stars Leaving Global Auto Rivals in Their Wake

China EV Leader BYD Posts Five-Fold Quarterly Profit Leap

Nissan Targets 80% Electric China Model Range by 2030

Toyota Planning 10 Battery EV Models as New CEO Takes Control

Europe Beats China for World’s Top EV Growth Markets