China has made it harder for its exporters of rare earth magnets to get licenses with tighter scrutiny and longer wait times to process applications, sources have told Reuters.

Delays on export license applications began in September, even before Beijing’s move last week to expand controls over the critical minerals used in magnets, they said.

Since September obtaining an export license has been harder, two sources with knowledge of the matter told Reuters. Applications are now being returned more often with requests for extra information, they added.

Also on AF: China Hits US Ships With Extra Port Fees as Trade Tensions Rise

Approvals are taking longer, although generally still within the commerce ministry’s 45 business day deadline, said one source. The scrutiny is now similar to that in April, when China first instituted the license regime for rare earth exports in a retaliatory move against the US’ tariffs onslaught.

Data released on Monday showed China’s rare earth exports dropped by 31% in September. It’s unclear how much of that decline was driven by magnets because the data does not distinguish between products.

“It’s not surprising to see lower exports in September as getting a new license became increasingly difficult last month,” one of the sources told Reuters.

Rush of enquiries

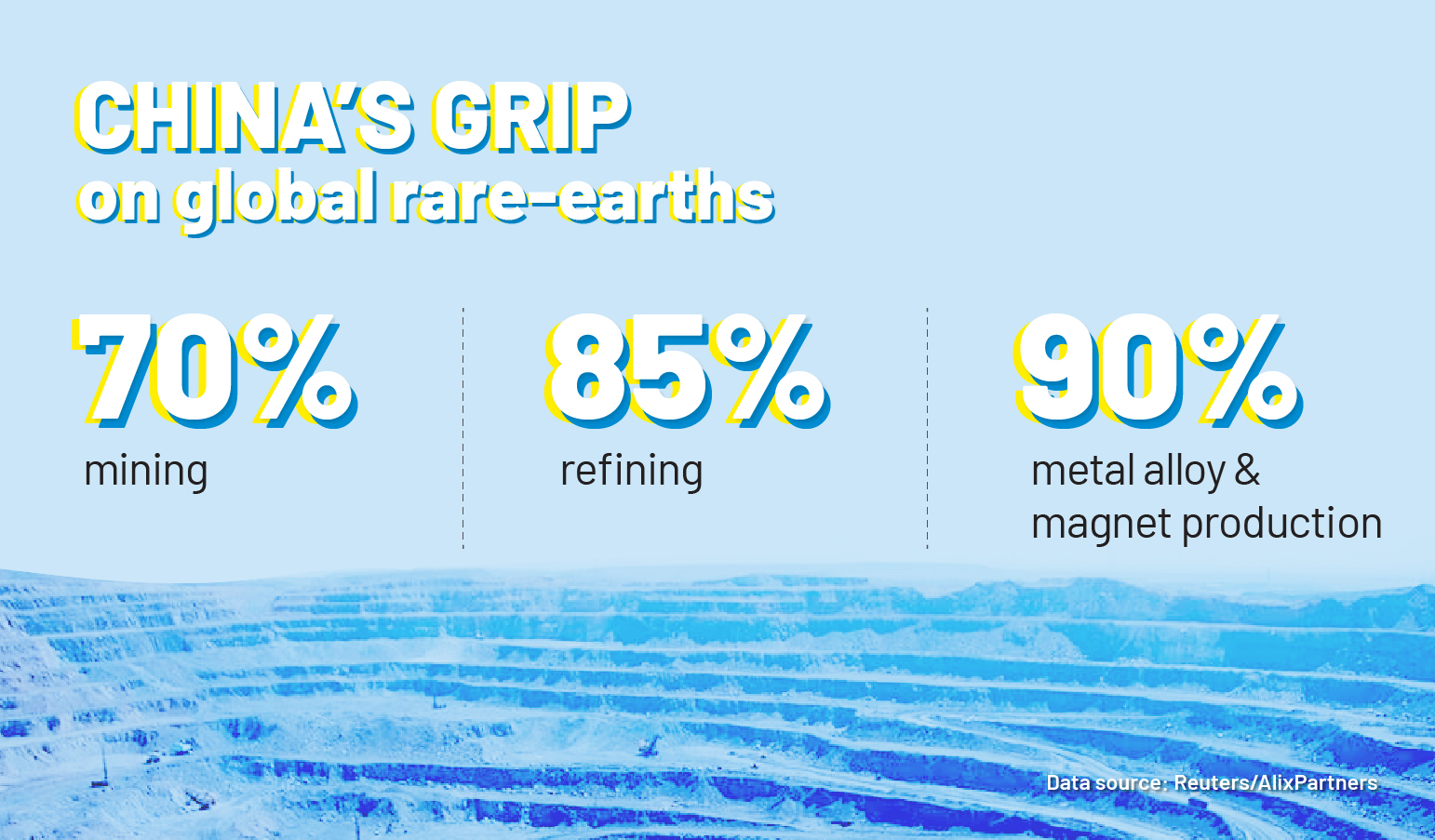

China is the world’s top supplier of rare earths, a group of 17 elements vital in products ranging from electric vehicles and wind turbines to military radars, and tightly controls the export of many types through its licensing system.

Magnets made of rare earths are essential to military and commercial technology.

The lengthier reviews magnet makers face raise questions about whether China is looking to throttle back magnet shipments, contrary to its commitment to speed up exports in a trade truce with the US in May.

Its unexpected move last week to tighten its existing curbs sparked anger in the US with President Donald Trump promising more tariffs and retaliatory export bans, although he later struck a more conciliatory tone.

There’s been a rush of inquiries since the announcement from foreign clients trying to get orders shipped before the new rules take effect on November 8, according to both sources.

Adam Dunnett, Secretary-General of the EU Chamber of Commerce in China, said the number one concern for members was still the bottleneck of rare earth product applications waiting for approval.

The chamber had seen both approvals and delays for its members over the past several weeks, he added.

“We can’t say that we’ve seen a decrease in the level of anxiety or concern,” he said. “Some companies have had their wait extended further without any response as to why that is the case.”

- Reuters with additional editing by Vishakha Saxena

Also read:

Asian Stocks In A Tizzy As Trump Plays Hot And Cold On China

China Stocks Drop Off 10-Year High; HK Down Amid Trade Tension

China Steps up Checks on Nvidia AI Chips at Major Ports, FT Says

US Keen to Control More Ports, Cut China’s ‘Maritime Advantage’

China Sets up Tracking System to Trace Its Rare Earth Magnets

China Stops Most Antimony Exports But Rare Earth Sales to US Soar

China Did Not Agree to Military Use of Rare Earths, US Says

China Export Curbs on Rare Earth Magnets: a Trade War Weapon

Lessons From Japan on Tackling China’s Rare Earth Dominance