Global semiconductor stocks have taken a knock after US-China tensions were ramped up by US House of Representatives Speaker Nancy Pelosi’s expected visit to Taiwan.

China views the planned visit by Pelosi, second in the line of succession to the US presidency and a long-time critic of China, as sending an encouraging signal to the pro-independence camp in Taiwan and has repeatedly warned against it.

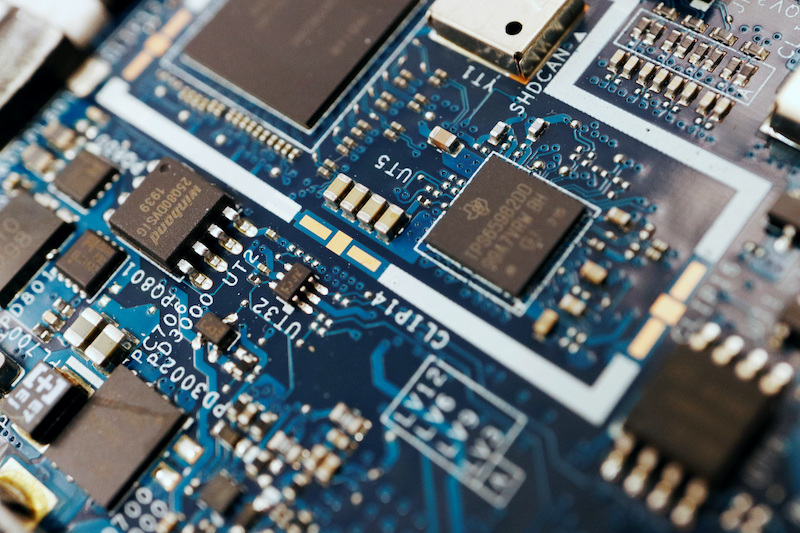

Taiwan is home to the world’s biggest manufacturer of semiconductors on contract, Taiwan Semiconductor Manufacturing Co Ltd (TSMC). Shares of the company closed down 2.4%, while peer United Microelectronics Corp (UMC) fell 3%.

Read more: Asia Shares Tumble as Pelosi Taiwan Visit Shocks Markets

Taiwanese stocks dropped 1.6%, marking their biggest percentage decline in three weeks, while stocks in China posted their biggest fall in more than two months as mounting tensions unsettled Asian financial markets.

“The outlook for trade in Asia is likely to weigh on semiconductors, given how much of the world’s global production comes from Taiwan,” said Michael Hewson, chief markets analyst at CMC Markets UK.

Semiconductor stocks globally felt the heat. Germany’s Infineon declined 2.3%, while Dutch firms ASML, ASMI and BESI fell between 3% and 4%. US chip stocks such as Nvidia Corp, Intel Corp, Qualcomm and Micron Technology Inc dipped more than 1% each in trading before the bell.

“This market reaction is expected following the strong performance of equity markets in July,” said Andrea Cicione, head of strategy at TS Lombard in London.

“The longer term impact is unlikely to be significant unless the situation escalates, which wouldn’t be my expectation right now.”

Pelosi was set to visit the island on Tuesday, three sources said, as several Chinese warplanes flew close to the median line dividing the Taiwan Strait, a source told Reuters.

- Reuters with additional editing by Sean O’Meara

Read more:

US Senate Passes Semiconductors Subsidy Legislation

US Set to Limit Export of Chipmaking Gear to China Firms