(ATF) Coinbase will make stock market history on Wednesday as the first company specialising in cryptocurrencies to launch an initial public offering (IPO).

The company, with a valuation of as much as $100 billion, will begin trading on the Nasdaq under the ticker symbol COIN in a direct listing rather than a traditional IPO.

While much speculation has swirled about Coinbase’s final valuation, investors were heartened by preliminary figures showing net revenue at $1.8 billion, which is almost twice as much as Euronext revenue in all of 2020.

Coinbase anticipates net income to grow to $730-800 million in 2021 from $31.9 million a year ago.

“The strong figures will likely drive huge demand for shares in Coinbase at the IPO, ” Steen Jakobsen, chief investment officer at Saxo Bank in Copenhagen, said.

Coinbase is the first company devoted entirely to cryptocurrency to enter a US stock exchange. Estimates vary depending on the method of calculation, but its capitalisation is expected to range from $70 to $100 billion, the largest IPO for a US company since Facebook in 2012.

TEST FOR CRYPTO SECTOR

Much is at stake for the cryptocurrency sector. “A disappointing IPO or excessive concerns over enhanced regulatory oversight could weigh on bitcoin and the other altcoins,” said Edward Moya, senior market analyst for the Americas at the foreign exchange brokerage OANDA in New York.

The company chose a direct listing, which does not allow it to raise new funds but does offer current shareholders – founders, employees and historical investors – the opportunity to sell stocks on the market.

Spotify, Slack, Palantir and Roblox had also used this method for their Wall Street debuts.

Nearly 115 million Coinbase shares will be put on the market. Their reference price will be announced on Tuesday evening.

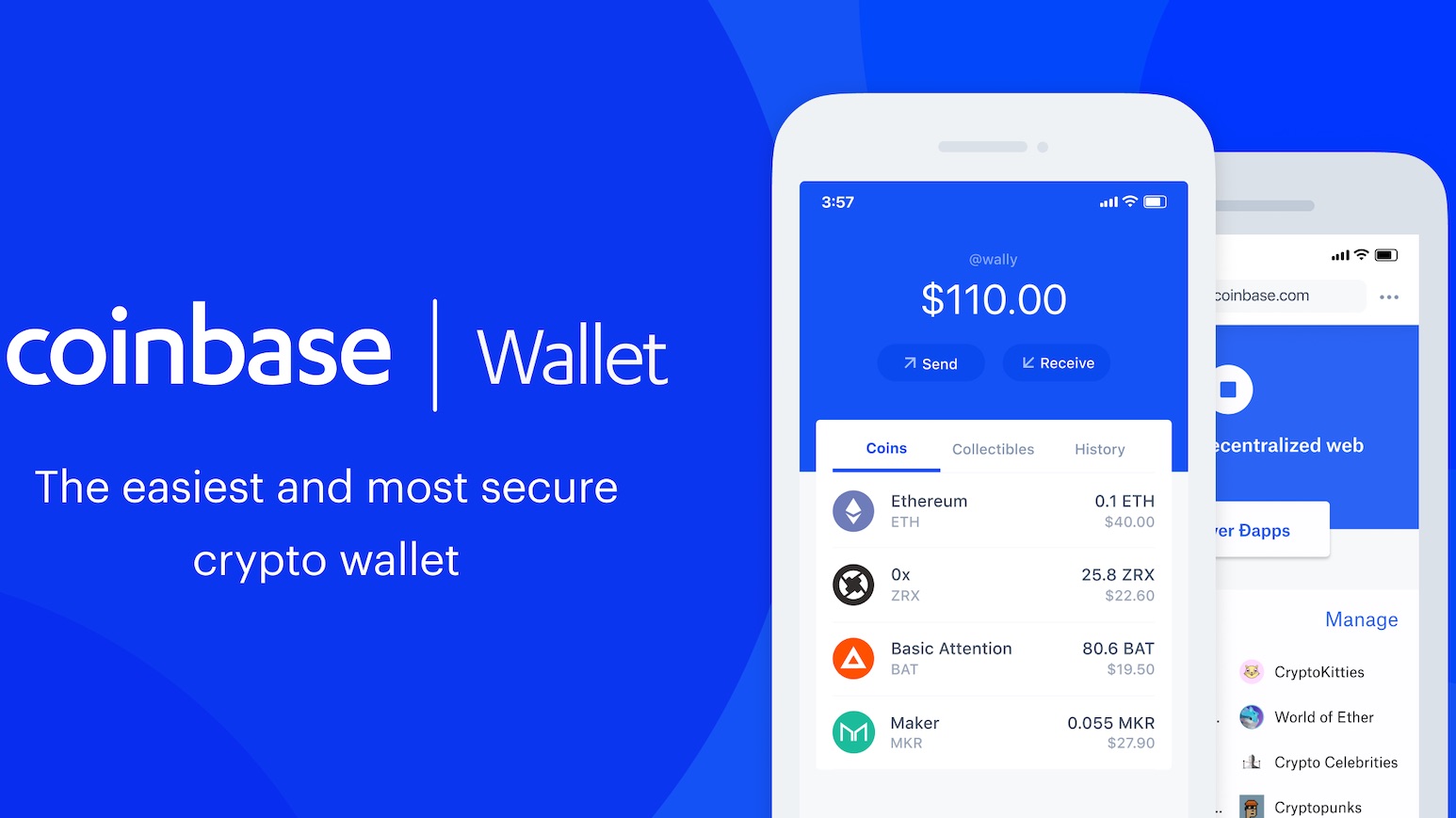

Founded in 2012 in San Francisco by Brian Armstrong and Fred Ehrsam, the platform allows users to buy and sell about 50 cryptocurrencies.

Coinbase claims 56 million total users and 6 million people making transactions each month, according to estimates from its first-quarter results, released in early April.

With reporting by Agence France-Presse