(ATF) – SAIC Motor reports 1Q drop in auto sales: Shanghai-based Chinese automaker SAIC Motor Corporation saw auto sales plunge 56% year on year to 679,028 units in the first quarter, the company said in a statement filed to the Shanghai Stock Exchange on Monday.

Its three joint ventures – SAIC Volkswagen, SAIC-GM and Shanghai General Motors Wuling – all reported falling sales, down 61%, 58% and 62%, respectively.

Car production also lost steam, with a total of 657,000 made, 42% lower than a year ago.

Auto production and sales in China stood at 3.47 million units and 3.67 million units in the quarter, down 45% and 42%, respectively, according to data from the China Association of Automobile Manufacturers.

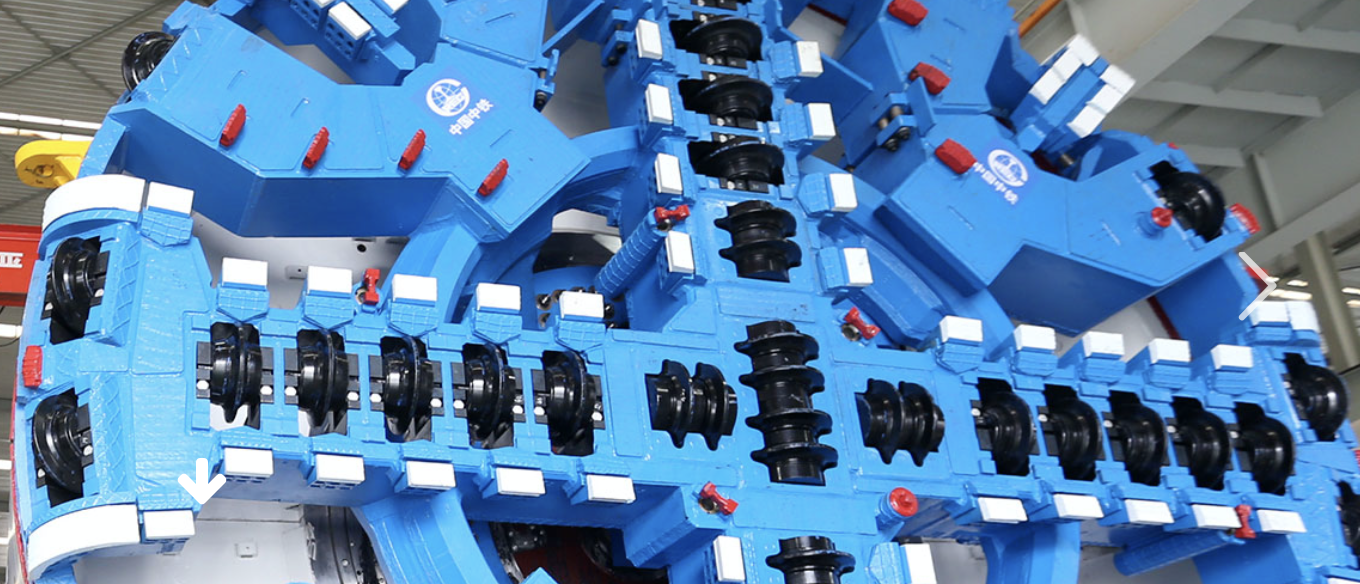

World’s largest rectangular shield tunnelling machine rolls off production line: China Railway Engineering Equipment Group Co (CREG) said Sunday it had produced the world’s largest rectangular shield tunneling machine.

The shield tunneling machine, which rolled off the production line Friday at the corporation’s Shanghai plant, is 14.8m wide and 9.5m high. It will be used to carry out tunneling for an expressway project in the city of Jiaxing, in east China’s Zhejiang Province, according to a CREG source based in Zhengzhou, Henan Province.

CREG has been the dominant tunneling machine manufacturer in China since 2012, and was the biggest in the world in 2017 and 2018. The company has exported its products to 20 countries and regions including Italy, Denmark, Singapore, Australia and Algeria.

China Everbright Bank defers loan payments for small businesses: China Everbright Bank, a joint-stock lender, ramped up its credit support for small and micro enterprises amid the coronavirus outbreak.

The bank said on Sunday that from January 25 to the end of March, it had deferred more than 1.6 billion yuan ($229 million) in payments of small business loans.

For virus-stricken micro-, small- and medium-sized firms, loan principal repayments that have matured since January 25 can be deferred provisionally as well as their interest payments between January 25 and June 30.

Meanwhile, further deferred payment arrangements can be provided for eligible micro-, small- and medium-sized enterprises that were hit hard by the outbreak.

The bank pledged to issue more preferential policies to develop inclusive finance, aid these firms resuming work and production, and better serve the real economy.