Countries all around the world need to respond more vigorously to cybercrimes, because the threats they pose to all nations are growing, a senior UN official has warned.

Jeremy Douglas, the deputy director of operations at the UN Office of Drugs and Crime (UNODC), commented in a recent briefing that modern technology and the development of digital and cryptocurrencies had accelerated various types of organized crimes and that cybercrimes had become a global phenomenon.

Organized crime is now estimated to be equivalent to 15% of global GDP, and the range of cybercrimes “is potentially worth up to $8 trillion a year.” That figure, he said, includes money generated in illegal online marketplaces, through to illegal online gaming, money laundering from online casinos and scams and different forms of fraud, plus profits generated by “cyber threat actors” who use malware and other advanced techniques to steal financial information and demand ransoms from companies and government agencies.

ALSO SEE: Trump’s ‘Tariff on States Trading With Iran’ Could Kill China Truce

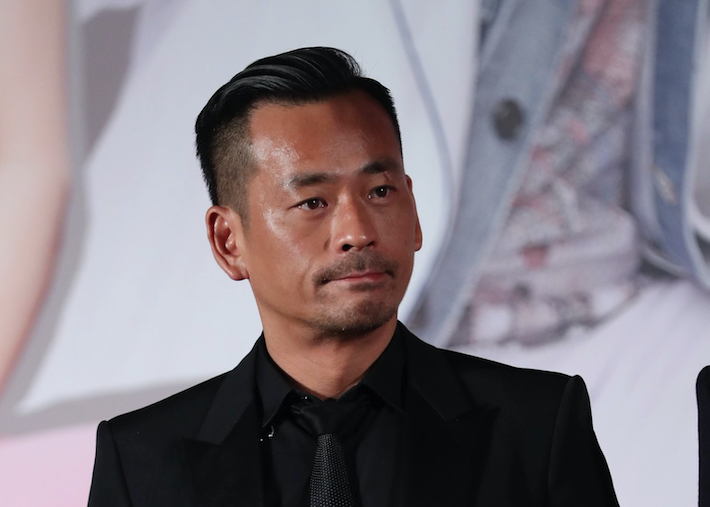

Douglas was one of several speakers at a forum at the Foreign Correspondents’ Club in Bangkok last week on scam centres in the Mekong region, a day after the ‘scam billionaire’ Chen Zhi was flown out of Cambodia back to China.

The UN official has deep knowledge of criminal activities in Southeast Asia, having been based in Bangkok for close to a decade before returning to UNODC’s head office in Vienna two years ago. He previously worked in the region managing strategies to counter organized crime, and synthetic drugs and precursor chemicals.

He said the ASEAN region was at the forefront of transnational cybercrime risks, because of the freedom criminal groups enjoy in autonomous armed group territories and Special Economic Zones in parts of Myanmar, Laos and Cambodia, as such areas often lacked functional governance.

‘Intelligent response needed’

For many years, police in Thailand and neighbouring countries focused on the regional drug crisis, and the production and trafficking of synthetic drugs such as methamphetamine, which began to replace ‘traditional’ illicit drugs such as heroin and opium, grown in Shan state in northeast Myanmar and adjacent areas, from about the late ’90s.

Online casinos run by Chinese crime groups in the Philippines and Cambodia became a concern about a decade ago, until the Covid-19 pandemic spurred another transformation: an epidemic of scamming and online fraud from casinos in parts of Myanmar (wracked by civil war for the past five years), plus Sihanoukville and border areas in Cambodia and northern Laos.

The drug economy centred in the Golden Triangle was lucrative over the past decade, thanks to a significant expansion of methamphetamine shipments across the Asia-Pacific and particularly to Australia and Japan, and returns from the narcotics trade have in some parts of the region financed the technology now being used by casinos and scammers, he said.

“The industrialisation of synthetic drugs provided the money for ‘underground’ banking networks connected to online casinos, which then morphed to scams during Covid, with crime networks further reinvesting their profits into casino ‘architecture,’ such as King’s Romans [in northern Laos] and mushrooming into what it is today.

“And now we see the environment changing with some of the same infrastructure used by cyber-threat actors pushing malware to infect computer systems and mobile devices to extract financial and other information. There was investment in technology, especially during and after Covid, and we’re now seeing additional investment to expand the types of crimes, to innovate and professionalise and expand scams.”

Douglas said the policy response to the scam centres and cybercrimes was fundamentally lacking in Southeast Asia. “It’s unfortunately working. At the same time, the drug problem is still growing – an increase in methamphetamine is again expected.

“The fact is that a significant shift in policy logic and response is needed in the region. Special economic zones need to be dealt with, they need to be governed. But more than anything an intelligent response is needed – not a reactive strategy. And we need an active public discussion on this.

“At the UN, we’ve shifted our response on this, to expand our approach and bring the system together to deal with this – to use the strengths of different parts of the UN system, for example, the IMF [International Monetary Fund], as a multilateral response is needed.”

Transnational crime groups operating or connected to scam centres in Southeast Asia have been on “scouting missions to Africa, Pakistan and the Caucasus in recent years,” looking for, and in some cases setting up, alternate sites where they can set up crime hubs.

“There is no getting around the fact that on certain issues you need a multilateral response, and there needs to be a big global response to this problem – it’s accelerating.”

ASEAN, he said, was starting to have a conversation on the scam crisis, but Douglas noted: “We had conversations with the region on drugs – but it didn’t work. And the scam crisis, it’s globalising,” he said.

A key reason for the booming ‘grey economy’ is the level of investment put into illegal banking systems. Douglas said Alvin Chau, a notorious Chinese casino boss in Macau, now serving a long sentence in jail, had invested $90-100 billion in Southeast Asia.

“Chau’s organization in some ways set the stage for what we are experiencing today. And Bangkok is the banking centre of the Mekong region. It’s definitely a pronounced issue here,” he said.

“This country [Thailand] has sadly been flooded with illegal drugs from the Triangle. There has to be a policy shift. We need to reshape the idea of consensus on how to respond.”

Victimisation, suicides

Bhanubatra Jittiang, a Thai academic on the ASEAN Intergovernmental Commission on Human Rights who spoke at the same event, said Southeast Asia was susceptible to organised crime because it had porous borders, and good connectivity with adjacent states to facilitate tourism.

Political crises and conflict had allowed criminal groups to infiltrate areas that had become lawless, while some of these areas also enjoyed digital advancement and had fintech options that groups were able to utilise.

Border areas had refugees from Myanmar’s civil war and people who needed to survive and were easily coerced into scamming when threatened with physical violence. But they endured humiliation and despair.

The scammers had created a global chain of victimisation, with multiple suicides by people who’d been trafficked or lost their savings. One of the big problems, he said, was “so many people are unaware of how serious the threat [of scamming] is. And state responses are so slow.”

John Wojcik, a former UNODC technical expert who is now a Senior Threat Researcher for Infoblox, a company that works to block technical infrastructure such as toxic websites set up by criminals, plus downloads of trojans and malware, said these “corrosive ecosystems are becoming far more aggressive.”

Money-laundering groups in the region that were sanctioned by the US were able to simply move to new websites, because they had technical service people who developed multiple domains that they could shift to.

“This is a problem that is not going away,” Wojcik said, adding that there was a heavy dependency on outsourcing for deep-fake services, chatbots in different languages, ransomware and phishing devices [that copy people’s emails and data].

“There is a wilful blindness about the grey tech in the business among service providers and these industries providing services to these scammers,” he said. “And there is reinvestment in R&D in the future of the business by definitely willing participants. But nobody is holding these service providers to account.”

- Jim Pollard

ALSO SEE:

‘Scam Billionaire’ Chen Zhi Arrested in Cambodia, Flown to China

States Seize $700m Prince Group Assets Amid Hunt for ‘Scam Billionaire’

US, UK Lauded for Scam Centre Sanctions, $15bn Bitcoin Seizure

US Targets Billion-Dollar Scam Networks in Myanmar, Cambodia

Cambodian Scam Centres Straining Ties With States Near And Far

US Sanctions Karen Warlord, Cambodia ‘Money Laundering Group’

Cyber Scam Hubs Spread From Asia Like a Global Cancer: UN

Thousands in Limbo as Thailand Fights Scam Hubs on Two Fronts

SE Asia Crime Networks Rely on Telegram, Crypto, UN Says

Weak ASEAN Nations ‘at Risk of Evolving Into Scamming States’

‘US to Sanction Prominent Cambodians Tied to Scam Centres’

N Korean Hackers Used Cambodian Firm to Launder Stolen Crypto

Cambo-Chinese Firm Tied to Crypto Scams, Money Laundering

Scamming Compounds in SE Asia Stole $64 Billion in 2023: Report

Macau Junket King Alvin Chau Gets 18 Years For Casino Crimes