(ATF) China’s 4.9% YoY third quarter 2020 GDP growth was lower than my 5.5% forecast. But the new data (released last week) has not changed my forecast that China’s recovery is back on the track despite the growth-plunge in the first quarter.

Data since 2Q20 indicates continued and steady recovery, as I now expect full-year 2020 GDP growth at 2.2% YoY (versus 2.3% earlier) and 6.6% YoY in 2021 (same as before), which will peak in 1Q21.

In a nutshell

The PBoC has ended its easing since 2Q20 and put its policy on hold, and while the next move is data-dependent, credit growth is about to peak soon, although monetary tightening is not visible yet. CGB yields have risen since the 2Q data were released. Yields may have plateaued and are expected to be range-bound between 3.0% and 3.5% in the coming year. The non-inflationary moderate growth with supportive policies are positive for Chinese stocks too in 2021.

China’s growth recovery will benefit global growth

The IMF expects that China would be the only major economy in the world to show positive growth in 2020 and its contribution to global growth would increase from an estimated 26.8% in 2021 to 27.7% in 2025.

But despite this, in my view, one should not expect China to boost significantly commodity and energy prices as the demand intensity for these products has entered a secular slowdown.

How different is this recovery?

The economic recovery is on track and broadening out on the demand side, correcting some of the lopsided recovery problems of production, which was the sole growth driver in 1H20. But even as the demand recovery has remained sluggish, retail sales has been slow too, rising by only 3.3% YoY in 3Q20, which was less than half the growth recorded by production and investment sectors.

China’s has regained its output losses due to the Covid-19 shock, and with GDP rising 0.7% year-to-date basis, authorities have stopped easing too.

But continuing domestic-driven recovery is expected in the coming quarters, with growth in the service sector and consumption speeding up.

The recovery however, has come with relatively restrained policy stimuli compared to both China’s and global standards. Beijing has focussed on targeted easing with much less public investment this time round than in the past.

The policy on boosting new sectors, such as technology, services and consumption though, has improved the quality of GDP growth, making the economic recovery sustainable.

Impact beyond China’s borders

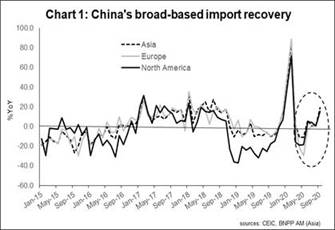

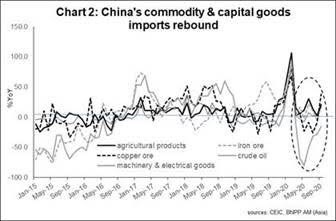

China’s import recovery has benefited the global economy as well, with its impact spanning from Asia to Europe and the US (Chart 1). Commodities and capital goods imports, including iron ore, crude oil, copper, agricultural products and mechanical & electrical goods, also rebounded, thanks to the recovery in domestic demand (Chart 2)

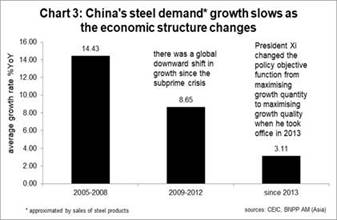

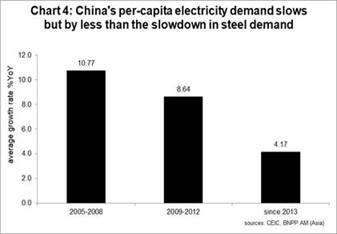

However, the market should be realistic about China’s demand for commodities, as its energy and commodity demand have been falling (Chart 3 & 4) due to economic restructuring that has moved the focus away from manufacturing-led growth to service-led, and tech-led growth. While China’s commodity and energy demand is expected to recover in line with the recovery in the economy, a robust demand growth like those in the 1990s and 2000s could be history

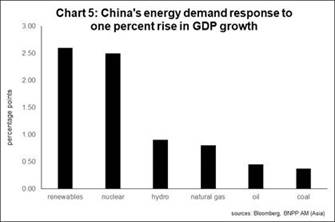

Empirical evidence shows that in the past decade, every one percentage point rise in China’s real GDP growth creates 0.55% growth in overall energy demand. Based on my forecast of 2.2% YoY GDP growth for this year, overall Chinese energy demand could grow by just 1.2% YoY (versus 4.2% YoY growth in 2019). Furthermore, most of the energy demand will come from renewals, such as wind, solar, hydro-electric, nuclear and natural gas (Chart 5) due to the government’s renewable energy policies.

Policy and market outlook

Credit growth in China is expected to peak soon as the economic recover consolidates. The PBoC has put monetary policy in neutral gear; the next policy move is data-dependent. If economic growth disappoints, there will be more policy easing (probability 20%, in my view). A disinflationary steady growth environment is positive for Chinese equities in the coming year.

While recent research [3] reveals an increasing willingness by Chinese household to increase equity exposure, foreign portfolio inflows in China are also expected to continue following the inclusion of newer Chinese stocks and bonds in international benchmarks. That is also expected to improve market sentiment on Chinese assets.

Chinese bond yield has plateaued and is expected to range between 3.0% and 3.5% in the coming year (CGB 5-year yield is at 3.07% at the time of writing). This takes into account steady growth allowing Beijing to resume its deleveraging policy and allowing zombie companies to be flushed out of the system. In my view, the PBoC’s policy is to facilitate financial reform while containing systemic risk and preventing bond yields from moving beyond this expected range.