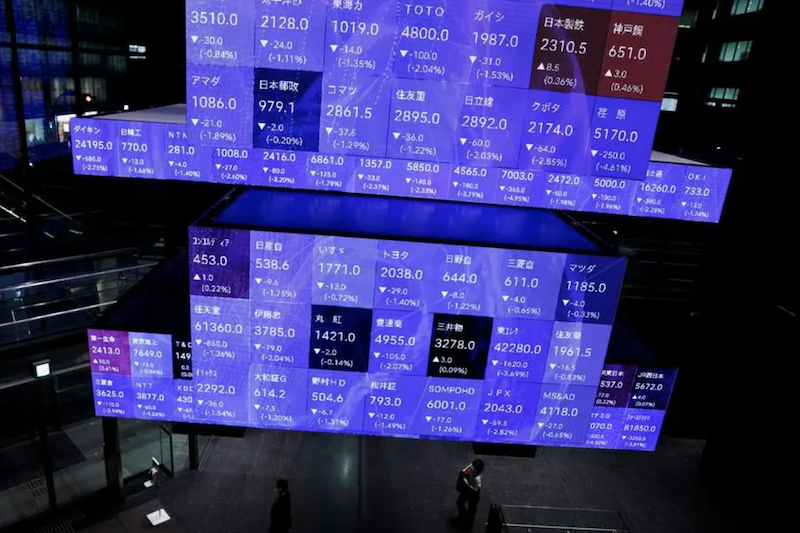

Asian shares slipped on Wednesday with investors locking in profits ahead of central bank meetings and as scepticism took over after initial optimism over Beijing’s stimulus pledges.

Markets across the region were trading mostly weaker ahead of another expected US Federal Reserve interest rate rise later in the day, and as questions started to be asked about China’s economic stimulus package, which had sparked a rally the day before.

Japan’s Nikkei share average inched lower, led by declines in auto and tyre makers, as investors locked in profits ahead of the Bank of Japan’s two-day policy meeting this week.

Also on AF: China, Taiwan Braced as Super Typhoon Doksuri Heads For Land

The Nikkei share average edged down 0.04%, or 14.17 points, to close at 32,668.34, while the broader Topix fell 0.10%, or 2.29 points, to 2,283.09.

The BoJ is leaning towards keeping its yield control policy unchanged as policymakers prefer to scrutinise more data to ensure wages and inflation keep rising.

But market participants were not fully convinced that the BoJ will maintain its current policy at the July 27-28 meeting, as they remember a surprise tweak in the yield curve control in December when it widened the trading band of the benchmark 10-year bond yield.

China and Hong Kong stocks retreated after the previous day’s rally, with investors doubting the strength of stimulus that will be delivered by Beijing after it pledged to support the economy and boost demand.

China’s securities regulator vowed on Tuesday to deepen reforms in its capital markets and open them up further in the second half of this year, as part of moves to implement policy support pledged by top leaders of the country.

However, the market now doubts if the Chinese government will roll out any big stimulative measures that will get investors excited.

The Shanghai Composite Index dropped 0.26%, or 8.49 points, to 3,223.03, while the Shenzhen Composite Index on China’s second exchange retreated 0.52%, or 10.68 points, to 2,037.47.

Hong Kong Property Stocks Fade

Hong Kong-listed China property stocks lost steam after the previous day’s surge, dropping 1.6%, as worries mounted over Country Garden’s ability to repay huge debts.

Tech giants listed in Hong Kong lost 1.4% and the Hang Seng Index slipped 0.36%, or 69.26 points, to 19,365.14. The Hang Seng China Enterprises Index fell 0.83%.

Elsewhere across the region, in earlier trade, there were also losses in Seoul, Taipei and Bangkok, while Sydney and Mumbai gained.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.3%, after US stocks ended the previous session with mild gains. The index is up 3.8% so far this month.

European investors were expected to show similar caution, with the pan-region Euro Stoxx 50 futures down 0.39%, FTSE futures off 0.2% and France’s CAC 40 futures down 0.53%. German DAX futures were flat. US stock futures, the S&P 500 e-minis, were down 0.01% at 4,595.8.

The Fed’s July decision will be announced later on Wednesday following a two-day meeting. The benchmark rate is expected to be lifted to a range between 5.25% and 5.5%, but money market traders are split on the odds of another hike later in the year.

US Dollar Index Down

The yield on benchmark 10-year Treasury notes rose to 3.8945%, compared with its US close of 3.912% on Tuesday.

The two-year yield, which rises with traders’ expectations of higher Fed fund rates, touched 4.8848% compared with a US close of 4.893%.

In the currency market, the dollar rose 0.1% against the yen to 141.04 in afternoon trade. It is still some distance from its high this year of 145.07 on June 30.

The euro was flat at $1.1049, having gained 1.27% in a month. Markets have fully priced in a 25-basis-point rate hike by the ECB at its meeting this week, though the path of future rate increases beyond July remains up in the air.

The dollar index, which tracks the greenback against a basket of currencies of other major trading partners, was down at 101.33.

US crude dipped 0.63% to $79.13 a barrel. Brent crude was down 0.61% at $83.13. Gold was weaker after trading up earlier in the day, with spot gold at $1962.99 per ounce.

Key figures

Tokyo – Nikkei 225 < DOWN 0.04% at 32,668.34 (close)

Hong Kong – Hang Seng Index < DOWN 0.36% at 19,365.14 (close)

Shanghai – Composite < DOWN 0.26% at 3,223.03 (close)

London – FTSE 100 < DOWN 0.25% at 7,672.80 (0934 GMT)

New York – Dow > UP 0.08% at 35,438.07 (Tuesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China Property Stocks Soar After Beijing Support Pledge

China’s Politburo Vows ‘Forceful’ Policy Moves to Lift Economy

Hang Seng Surges on China Stimulus, Nikkei Dips on BoJ Fears