China’s top leaders signalled more policy adjustments and stimulus for the economy late on Monday amid the country’s weak post-Covid recovery.

The Politburo – the top decision-making body of the ruling Communist Party – said the focus would be on boosting domestic demand, confidence and preventing risks, according to Xinhua state news agency.

The world’s second-largest economy grew at a frail pace in the second quarter as demand weakened at home and abroad, raising pressure on policymakers to do more.

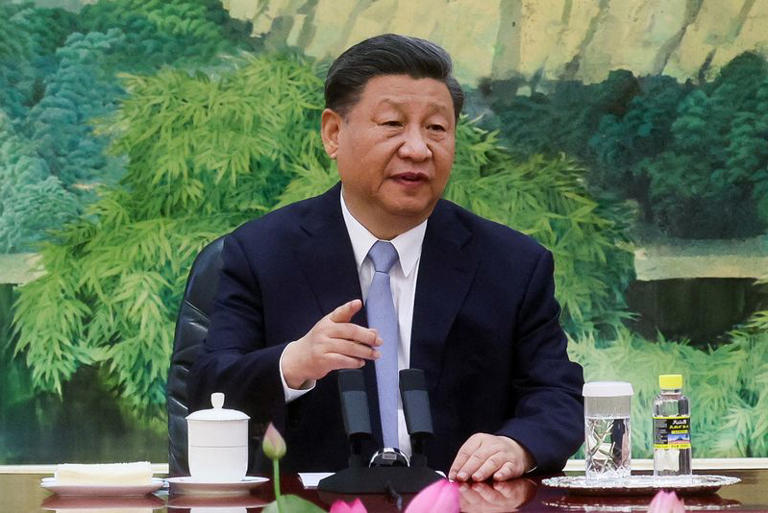

“Currently, China’s economy is facing new difficulties and challenges, which mainly arise from insufficient domestic demand, difficulties in the operation of some enterprises, risks and hidden dangers in key areas, as well as a grim and complex external environment,” Xinhua quoted the Politburo as saying, after a meeting chaired by President Xi Jinping.

ALSO SEE: Chinese Yuan Surges After Beijing’s Vow of Support

‘Precise and forceful adjustments’

China will implement its macro adjustments “in a precise and forceful manner” and strengthen counter-cyclical adjustments, as the government sticks with a prudent monetary policy and pro-active fiscal policy, the Politburo was quoted as saying.

Xinhua quoted President Xi as saying during a separate meeting that China will strive to achieve its annual development targets.

While China is seen on track to hit its modest 2023 growth target of around 5%, there are risks of the annual goal being missed for the second year in a row, analysts said.

Most analysts say policymakers are unlikely to deliver any aggressive stimulus due to worries about growing debt risks.

Capital Economics analysts said that the outcome of the meeting suggested that further policy support would be rolled out in coming months.

“But the absence of any major announcements of policy specifics does suggest a lack of urgency or that policymakers are struggling to come up with suitable measures to shore up growth,” they said in a note.

A senior central bank official said earlier this month the bank will use policy tools such as the reserve requirement ratio (RRR) to weather the challenges facing the world’s second-largest economy.

Last week, the central bank kept its lending benchmarks steady, despite signs of a faltering economic recovery.

Vow to boost autos, adjust property policies

China will actively expand domestic demand, boosting residents’ incomes to enable consumption to drive economic growth, while speeding up local special bond issuance to spur investment, Xinhua said.

The government will boost demand for autos, electronics and household products and promote tourism, Xinhua added.

China will adjust and optimise property policies in a timely manner, in response to “significant changes” in the supply and demand relationship in the property market, it said.

“This is an interesting signal as the property sector downturn is arguably the key challenge the economy faces now,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management.

“It seems the government has recognised the importance of policy change in this sector to stabilise the economy.”

Analysts expect China to ease home purchase restrictions in some cities.

Amid the mounting local debt repayment burden, China will effectively resolve local government debt risks and formulate a basket of plans to resolve local debt issues, Xinhua said.

China will improve the development environment for private firms and stabilise trade and foreign investment, Xinhua said.

China last week also released guidelines to improve the private sector and vowed to make it “bigger, better and stronger.”

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Beijing Tells Law Firms to Scale Back China Risks in IPO Docs

China Property Crisis Intensifies, Cloud Over Country Garden

China’s Dalian Wanda May be Next Property Giant to Fall

China IPOs Plunge in First Half Amid Slowdown, Tighter Scrutiny

China Bankers to Shun ‘High-End Taste’ Fearing Regulatory Ire