Asia’s major stock indexes ended the week in the green thanks to a big tech earnings-fuelled rally on Wall Street and positive forecasts for China’s markets.

Google-owner Alphabet and Microsoft reported quarterly results that beat Wall Street estimates, lifting the mood across the region, and sentiment got another boost after strategists from global investment houses upgraded their views on Chinese shares.

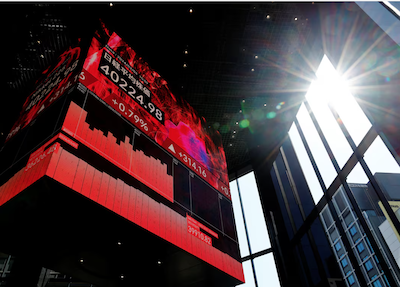

Japan’s Nikkei share average rallied after the Bank of Japan (BOJ) opted to leave interest rates unchanged, as widely expected, and said accommodative monetary conditions are likely to continue for the time being.

Also on AF: China Unveils Brain Chip Similar to Elon Musk’s Neuralink

The Nikkei share average was up 0.81%, or 306.28 points, to close at 37,934.76, while the broader Topix was ahead 0.86%, or 22.95 points, to 2,686.48.

The index has managed to advance 2.3% for the week, recouping part of the previous week’s 6.2% tumble, its worst weekly performance since June 2022.

The BOJ maintained its short-term interest rate target at a range of 0-0.1% in a unanimous vote, and issued fresh estimates projecting inflation to stay near its 2% target in the next three years.

Investors are wary of hawkish signals from the central bank, potentially aimed at propping up the yen, which dipped to a fresh 34-year low of 156.215 per dollar after the BOJ’s announcement.

Real estate vaulted to the top of the Nikkei’s best performing sectors on the outlook for extended low interest rates, with Mitsui Fudosan up 3.6%.

Tech continued to be a bright spot, tracking overnight gains in US peers, with the Philadelphia SE Semiconductor Index jumping nearly 2% even as Wall Street’s three main indexes declined.

Hong Kong and China stocks extended their gains, with the Hang Seng Index set for its best week in 18 months, as sentiment recovered further after strategists from global investment houses upgraded their views on Chinese shares.

Seoul, Taipai Stocks Advance

Meanwhile, BNP Paribas estimated that mainland Chinese investors had bought close to a net $20 billion of Hong Kong equities across March and up to April 23 – the largest two-month purchase since 2021.

China’s blue-chip CSI300 index was up 1.53% with, earlier in the session, its financial sector sub-index higher by 0.19%, the consumer staples sector up 0.94%, the real estate index up 3.79% and the healthcare sub-index up 1.6%.

The Shanghai Composite Index rose 1.17%, or 35.74 points, to 3,088.64, while the Shenzhen Composite Index on China’s second exchange gained 1.78%, or 30.16 points, to 1,728.49.

Chinese H-shares – stocks belonging to companies from the Chinese mainland – listed in Hong Kong rose 2.41% to 6,267.9, while the Hang Seng Index gained 2.12%, or 366.61 points, to 17,651.15.

Elsewhere across the region, there were also gains in Seoul, Taipei and Manila. However, Sydney, Singapore, Wellington, Mumbai, Jakarta and Bangkok fell.

Nasdaq futures advanced more than 1%, while S&P 500 futures rose 0.8%.

Dollar Slips on US Growth

Investors were also digesting the implications of Thursday’s data which showed the US economy grew at its slowest pace in nearly two years in the first quarter, though inflation accelerated.

That reinforced expectations that the Federal Reserve would not cut interest rates before September, while some are also pricing in a small chance of a further rate increase.

US Treasury yields surged to five-month highs in the previous session and remained elevated in Asia. The two-year yield hovered near the 5% level, while the benchmark 10-year yield steadied at 4.7003%.

The dollar, however, slipped on the back of the weaker US growth, and was nursing some of those losses on Friday.

Focus now turns to March’s core PCE price index data due later on Friday – the Fed’s preferred measure of inflation – for further clues on the US rate outlook.

In commodities, Brent edged 0.46% higher to $89.42 a barrel, while US crude gained 0.44% to $83.94 per barrel. Gold rose 0.18% to $2,336.05 an ounce.

Key figures

Tokyo – Nikkei 225 > UP 0.81% at 37,934.76 (close)

Hong Kong – Hang Seng Index > UP 2.12% at 17,651.15 (close)

Shanghai – Composite > UP 1.17% at 3,088.64 (close)

London – FTSE 100 > UP 0.57% at 8,124.68 (0850 BST)

New York – Dow < DOWN 0.98% at 38,085.80 (Thursday close)

- Reuters with additional editing by Sean O’Meara

Read more:

Blinken Urges China to Play Fair With American Companies

Country Garden Wins Onshore Bonds Payments Delay Approval

TikTok Plans Legal Battle as US Senate Passes Divest-or-Ban Bill

Nikkei Slides as US Tech Drags, Hang Seng Lifted by Market Bets