Russia has been selling oil to India at nearly $80 per barrel – $20 above the Western price cap – as tight global oil markets have ramped up demand for Moscow’s exports.

Russia’s main export grade Urals has been trading above the $60 per barrel Western price cap since mid-July amid output cuts by OPEC+ producers, including Saudi Arabia and Russia, traders said and Reuters calculations showed.

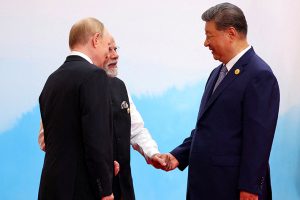

India, which is the world’s third biggest oil importer, has become the top buyer of seaborne Russian oil, mainly Urals, since 2022 after Western sanctions against Moscow.

Also on AF: Evergrande Chief Suspected Of Transferring Assets Offshore: WSJ

Calculated Free on Board (FOB) estimates for Urals cargoes loading from Baltic ports in October were close to $80 per barrel on Thursday for Indian customers, according to traders’ data and Reuters calculations.

“Russia has low inventory levels and their production is also cut,” said an official at an Indian refiner that regularly buys Russian oil, explaining the latest jump in prices.

Cuts have helped narrow discounts for Urals at Indian ports to $4-$5 per barrel versus dated Brent from $6-$7 per barrel two weeks ago, four trading sources involved in the operations said and Reuters calculations showed. The traders referred to prices for cargoes loading in late October.

“Urals prices are on the rise again. Alternatives are much more expensive and not easily available,” a trader familiar with the Russian oil market said.

Indian Oil Corp, Bharat Petroleum Corp, Hindustan Petroleum Corp, Mangalore Refinery and Petrochemicals Ltd, HPCL Mittal Energy Let, Reliance Industries Ltd and Nayara Energy Ltd did not respond to Reuters’ emails seeking comments.

Turkey, China, Bulgaria Also Buying Russian Oil

Russian Urals oil typically gives higher yields of diesel, which accounts for about two-fifths of India’s overall refined fuel consumption.

Meanwhile, Russia’s decision to ban diesel and gasoline exports added to the appeal of Urals crude, amid a looming shortage of the products globally.

The Western price cap on Russian oil allows buyers to use Western services such as shipping and insurance in the event that crude trades below $60 per barrel.

Russian oil has drastically reduced the use of Western shipping and insurance companies since the imposition of the cap, which is also challenged by a spike in global oil prices towards $100 per barrel.

Turkey was the second biggest buyer of Urals oil cargoes in September, followed by China and Bulgaria, according to preliminary LSEG data. Russian oil is also now being sold to customers in new markets like Brazil, the Indian source said.

- Reuters with additional editing by Sean O’Meara

Read more:

India-Russia Oil Deals Erode Dollar’s Currency Dominance

‘Pop-up’ Traders Shipping Half Russia’s Oil to China and India

India Doubles Down on Russia Oil Deals Despite Yellen Visit

US Lets India, China Keep Russia Oil Tap Open For Now – WSJ