(ATF) The number of potential “fallen angels” in Asia has surged this year after India’s sovereign downgrade pushed government-related companies to the cusp of non-investment-grade category, Moody’s Investors Service said in a report.

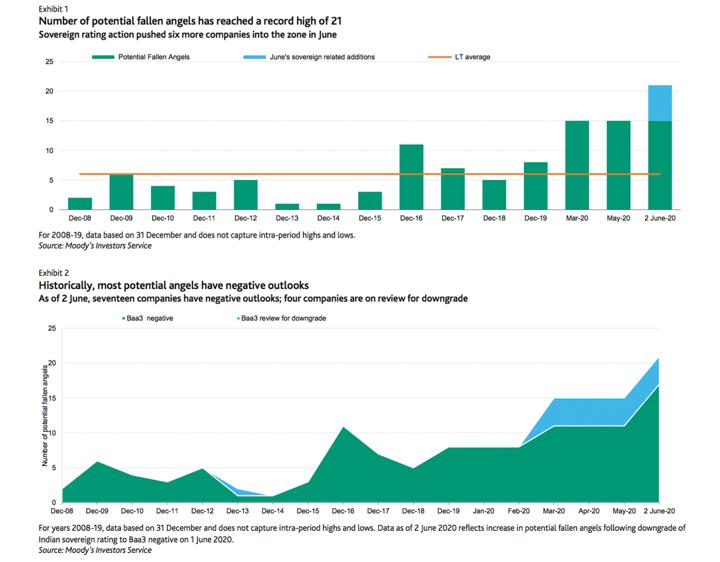

This month, the number of potential ‘fallen angels’ – companies that have sunk to the lowest investment grade rating – rose from eight at the end of 2019 to 21.

Historically, most potential ‘angels’ have negative outlooks and as of June 2, some 17 companies had been given negative outlooks, while four more were on review for downgrade, Moody’s said.

Earlier this month, Moody’s Investors Service lowered India’s credit rating by a notch on expectation the government’s fiscal position would deteriorate. It put India on Moody’s lowest investment-grade ranking of Baa3, while maintaining a negative outlook. It also downgraded several government-linked companies to Baa3.

“If all 21 potential fallen angels were downgraded, rated high-yield bond maturities would increase by $3.3 billion (or 9%) through 2021,” Moody’s analysts Annalisa Di Chiara and Ian Lewis said in a report, while adding that six oil-and-gas government-related or government-linked companies accounted for around $1 billion of rated bonds maturing through 2021.

The report said that if the number of fallen angels was to rise, their refinancing needs would have the potential to crowd out lower-rated companies or increase their refinancing costs.

“This scenario would drive credit differentiation, with refinancing risk for weaker and highly leveraged companies likely to rise. Lower-rated companies have less flexibility to adjust to credit stress arising from reduced revenue, lower margins, supply-chain disruptions and rising interest costs.”

They said potential ‘fallen angels’ now account for around 10% of investment-grade companies, higher than the 9% reached during the commodity crisis in 2016 but below the 16% recorded in May 2009 during the global financial crisis.

“Still, as noted earlier, the absolute number of potential ‘fallen angels’ is at an all-time high. Historically, the transition from potential ‘fallen angel’ to actual ‘fallen angel’ has been quite low, but there have been a few surges since 2008.”

ALSO READ: Migrant worker exodus leaves Indian factories in crisis