(ATF) Stung by an acute shortage of semiconductors worldwide in the face of incessant demand for consumer electronics, India is angling toward self-sufficiency by enticing the who’s who of global high-tech to set up chip factories. Yet a lot of those hall-of-famers might end up staying offshore.

The country has targeted a wish list of companies from Europe, Japan, South Korea and Taiwan. It includes Taiwanese majors Taiwan Semiconductor Manufacturing Company, VIA Technologies and United Microelectronics Corporation. US giants Intel, Micron Technology, NXP Semiconductors and Texas Instruments are on the list along with European chipmaker Infineon and Fuji Electric and Panasonic of Japan.

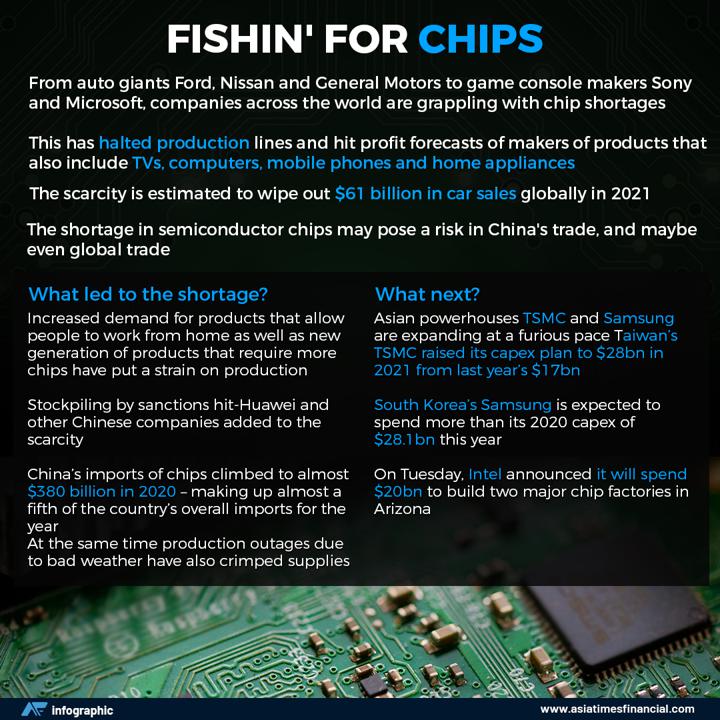

India’s recruitment comes after governments across the world have started subsidising construction of semiconductor plants, a way to ease chip shortages that are hobbling the automotive and electronics industries and highlighting the world’s dependence on Taiwan for supplies.

India wants to establish reliable suppliers for its own formidable electronics and telecom industry so it cuts dependence on China, which today supplies 65% of the country’s $50 billion annual semiconductor consumption.

The proposal is simple on paper: make in India and get $1 billion in cash incentives.

The Indian government is also ready to offer manufacturers assurances by buying the chips and mandating that certain industries buy made-in-India chips from Indian plants. India-based chip makers would be tagged as “trusted sources”.

Not convinced

But even if the offer looks compelling, global chips makers are reluctant.

In Taiwan, at least seven local semiconductor companies have met the island’s deputy economic affairs minister Shen Jong-chin twice to understand how they might invest in India but they reached no conclusion.

“In terms of the fab location selection, there are many factors to consider in order to fulfil our customer’s needs,” a Taiwan Semiconductor Manufacturing Company (TSMC) spokesperson told Asia Times Financial. “TSMC does not rule out any possibility but there is no concrete plan to set up fabs in India at this time.” TSMC is the world’s largest contract chipmaker.

Fellow Taiwanese chipmaker United Microelectronics Corp said the company is “open to evaluating all regions for projects, provided that the opportunity fits with the company’s ROI objectives.”

But company spokesman Richard Yu added that the company “generally prefers regions closer to Taiwan to ease logistics and management while still providing manufacturing risk mitigation through geographic diversity.” The company, better known as UMC, has factories now in Taiwan, China, Japan and Singapore.

Inadequate facilities

India is not always an easy place for setting up a chip fabrication plant.

Experts say semiconductor manufacturing (fab) is a complex techno-commercial operation that requires large investments, business and operational ability. They say it requires grasping all the right ingredients, such as the market, private investment, infrastructure and technology itself.

Putting all that together is a tall order.

“India lacks infrastructure that foreign factories expect and has an incomplete semiconductor supply chain – meaning higher shipping costs,” Taiwan-based boutique market analysis firm Isaiah Research told ATF.

The biggest hurdles are the country’s constantly changing rules and policies, as well as infrastructural bottlenecks, some analysts believe.

“Fluctuation in India’s laws make business people unsure,” Cheng Kai-an, an industry analyst with Taipei-based Market Intelligence & Consulting Institute told ATF, adding that Taiwanese chipmakers have particularly found India’s electricity and water supplies unstable.

Crush to get chips

Yet, the country needs chipset manufacturers – and lots of them. The global semiconductor shortage and geopolitical tensions with China are not only beginning to hurt the country’s manufacturing but those factors also heighten India’s need for attaining self-sufficiency in the semiconductor supply chain.

India’s semiconductor consumption, which was already facing a demand-supply crisis following delays from China after the Indo-China border clash last year, is now facing massive supply chain issues, according to a recent report by professional services firm EY.

The global semiconductor industry relies on a few global players for high-end chips – which led to the shortage following pandemic-era demand for devices to support telework and home study. Automotive chip orders have added to that demand. China and Taiwan own a significant portion of the semiconductor manufacturing market in the world, the EY report says.

Consequently, “fabs assume significance in view of the fact that India is poised to increase its share in global manufacturing of mobile phones, IT hardware, automotive electronics, industrial electronics, medical electronics, IoT and other devices in the near future as it aspires to have $400 billion of electronics manufacturing by the year 2025,” the Indian Ministry of Electronics and Information Technology said when inviting investors from the target list.

For foreign chipmakers, India offers a suite of incentives called the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors to run over eight years. India should attract investors with its “cost-effective” skilled labour, “fast improving” infrastructure and a domestic electronic components market that’s on track to reach $200bn by 2025, about 10 times the amount of 2019, the Indian National Investment Promotion & Facilitation Agency says.

India’s bid could be a big attention-grabber for private and foreign fab investors, say experts.

“The biggest strength India has today is the market for electronics products and domestic manufacturing,” Satya Gupta, the chairman of India Electronics and Semiconductor Association, a trade group with more than 300 members, told ATF.

Domestic manufacturing of electronics products has potential to grow $400 billon — of which $250 billion would be consumed locally and $150 billion exported, Gupta says. That growth “creates a good demand for semiconductors products and makes the business case of Fabs stronger,” the chairman added.

India’s intent and efforts work in its favour too, others say.

While India has already announced various incentive schemes at the national level, many state governments are ready and eager to provide incentives and infrastructure for electronics and semiconductor manufacturing.

“Today, India is the second largest mobile phone manufacturer in the world. Few years ago, no one would have imagined that. The same way, semiconductor manufacturing can happen in India,” Venkata Simhadri, the CEO of MosChip, an Indian fabless semiconductor company, told ATF.

“But it needs lot more support and commitment from the government and the industry.”