Japan’s finance minister has signalled his government’s readiness to intervene in the currency market again if the yen continues to be put under pressure.

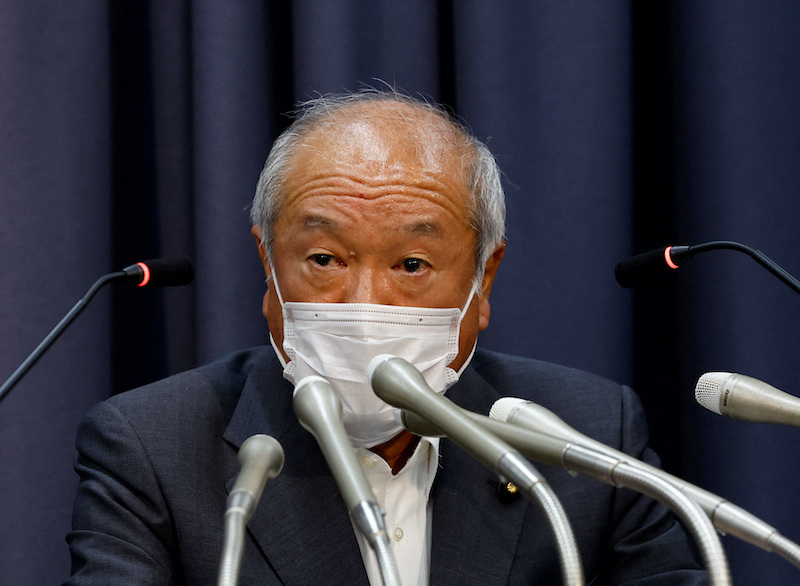

Finance Minister Shunichi Suzuki made the pledge after Tokyo last week intervened in the foreign exchange market to prop up the yen for the first time in 24 years.

That came after after the Japanese currency broke through a 24-year low beyond 145 yen to the dollar. The dollar was last trading at around 144.64 yen.

Also on AF: Asia Markets Mixed on Dollar’s Surge, Sterling’s Slump

“Currencies should be determined by markets and it’s important for them to be stable. Sharp and one-sided moves are undesirable,” Suzuki told reporters on the sidelines of the Asian Development Bank’s annual meeting in Manila.

The issue of currencies was not on agenda at the ADB meeting, he added.

“This time, speculative moves in the market changed the way [currency moves] should be, so it was important to rectify such moves,” Suzuki said, adding that sharp currency swings would cause trouble to businesses and households.

“We remain fully vigilant against currency moves from now on as well, and will take necessary steps when necessary.”

Earlier on Thursday, Suzuki held a bilateral talk with Sri Lankan President Ranil Wickremesinghe, who flew from Tokyo after attending a state funeral for former Prime Minister Shinzo Abe.

Suzuki urged the president to proceed with reform based on a staff-level agreement with the International Monetary Fund (IMF) and provide sufficient information on debt.

“All creditors, including China and India, must participate in resolving debt issues. If such environment is prepared, Japan will be ready to play its role firmly,” he said.

- Reuters with additional editing by Sean O’Meara

Read more:

Japan Warns Against Yen Moves, Markets Wary of Intervention

Taiwan Central Bank Chief Rules Out Foreign Exchange Controls

Why Japan Has Fallen Out of Love With a Weak Yen