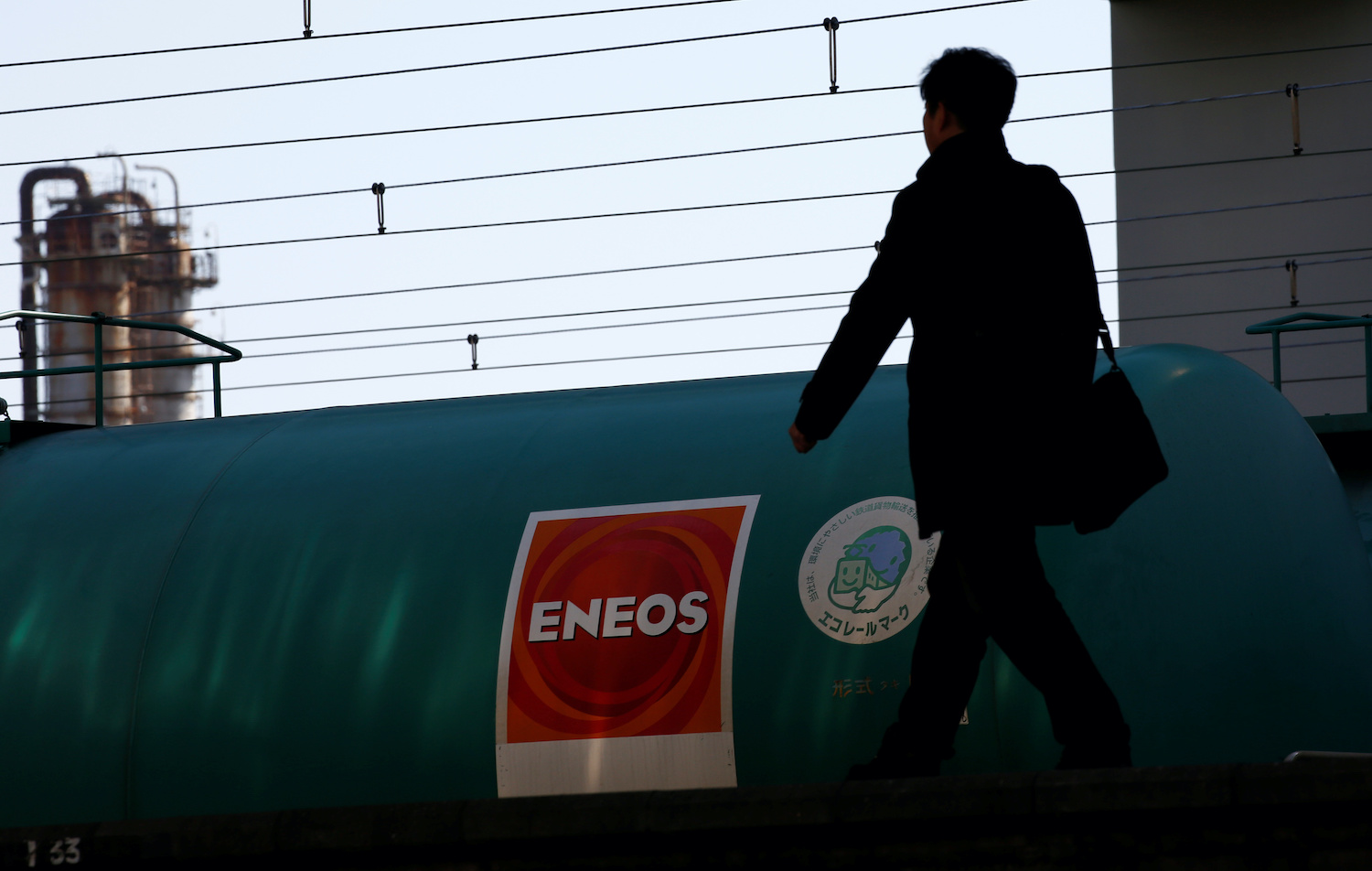

Japan’s biggest oil refiner Eneos Holdings has no plans to buy Russian crude until all problems related to the Ukraine crisis are over and it will purchase alternative supplies from the Middle East, the company’s chairman said on Wednesday.

“For now, we intend to get alternatives from existing trading partners such as Saudi Arabia, Abu Dhabi and Kuwait, but we will continue our efforts to diversify our sources to reduce reliance on the Middle East in the future,” Tsutomu Sugimori said.

Last month, Sugimori said that Eneos had stopped buying Russian crude in response to Russia’s invasion of Ukraine.

The US said in March it would sell 180 million barrels of crude from its Strategic Petroleum Reserve at a rate of 1 million barrels per day starting in May to help dampen the surge in prices following the Ukraine crisis.

This represents the biggest release from the stockpile since it was created in the 1970s. Members of the International Energy Agency, including Japan, are releasing an additional 60 million barrels.

Weak Yen’s Positive Impact on Japan Oil

“It’s a fairly large volume and it will have a certain effect on [the] oil market,” said Sugimori, also president of the Petroleum Association of Japan.

On Wednesday, the yen fell to a new two-decade low against the US dollar, weighed down by Japan’s ultra-low interest-rate policy, which contrasts with the US Federal Reserve’s rate increases.

The weaker yen tends to have a positive impact for Japan’s oil industry, Sugimori said, as it boosts its competitiveness in exports. “Asian petroleum products market is very strong,” he said.

“We want to raise run rate of our refineries as much as possible and increase export as it’s quite profitable right now,” he said.

Japan is expected to face a tight electricity market again this summer and winter.

- Reuters, with additional editing by George Russell

READ MORE:

Saudis to Sell Less Crude to China, India Refiners in May

Saudi Arabia Back as China’s Top Crude Oil Supplier

Crude Oil Prices Top $110 a Barrel as Ukraine Conflict Worsens