The resignation of Japanese Prime Minister Shigeru Ishiba – on Sunday – has spurred speculation that his successor will boost state spending, which caused the Topix share gauge to shoot up on Monday, while the yen weakened.

The broad Topix gauge jumped as much as 1.2% to an unprecedented 3,142 points, while the Nikkei index of blue chip shares gained 1.5% to 43,674.95, close to its own record. The yen softened 0.7% to 148.36 against the US dollar.

Meanwhile, the benchmark 10-year Japanese government bond (JGB) yield was flat at 1.57% and the five-year yield slid 1 basis point to 1.095%.

ALSO SEE: Seoul Bids to Ease Anger Over Mass Arrests at US Hyundai Plant

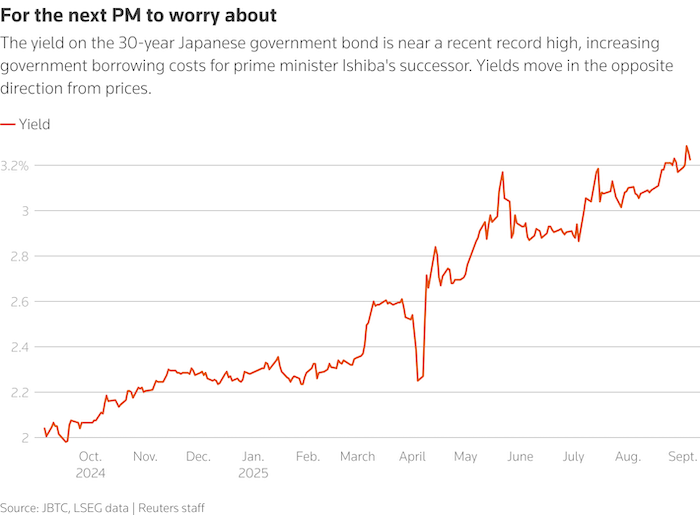

Yields on super-long JGBs hovered near record highs due to global concerns about fiscal deficits and as pressure mounted on Ishiba from within his Liberal Democratic Party (LDP), while the Nikkei recently slipped from last month’s all-time high.

Among top contenders in the LDP leadership race is Sanae Takaichi, a devotee of “Abenomics” policies of Shinzo Abe – Japan’s long-time leader and former PM, who presided over massive stimulus and unprecedented monetary easing.

“Sanae Takaichi, who is considered to have a strong expansionary fiscal bias, could be perceived as more positive for Japanese equities,” Morgan Stanley and MUFG Securities analysts, including Takeshi Yamaguchi, wrote.

“The risk of her favouring excessively dovish monetary policy appears lower than last year.”

Meanwhile, Takaichi has largely been seen as bad news for Japan’s already stressed bond market.

“She’s known to favour stimulus measures and is viewed as wanting the Bank of Japan (BOJ) to take a cautious stance on policy, so that wouldn’t be a great outcome for bond markets,” Skye Masters, head of markets research at National Australia Bank, said in a podcast.

Last week, the 30-year JGB yield reached an all-time high of 3.285% while the 10-year yield hit 1.64%, the highest since July 2008.

There were 200 advancers on the Nikkei index against 24 decliners. The largest gainers were chip designer Socionext, up 7.6%, followed by Mazda Motor Corp, which jumped 6.1%. Coming up third was Mitsubishi Heavy Industries, which stands to gain from any increase in defence spending, surging 4.4%.

Advantest and SoftBank Group, two of the biggest beneficiaries of artificial intelligence (AI) investment in Japan, both soared more than 3.5%.

Ishiba’s relatively conservative fiscal stance has been seen as a positive for the JGB market, where yields are relatively low globally, though Japan’s massive debt pile and widening fiscal deficits continue to raise concerns.

The country’s outstanding debt stands at nearly 250% of its gross domestic product (GDP), the highest among developed economies. Budget requests for the next fiscal year hit a record for the third straight year, the finance ministry said last week.

The JGB market was dealt a blow in mid-July, when Ishiba’s coalition suffered a considerable defeat in upper house polls. Outsider parties, campaigning on tax cuts and increased spending, gained seats, and speculation swirled for weeks about pressure on Ishiba to step down.

That all came to a head on Sunday, with Ishiba saying he must take responsibility for election losses and instructing the LDP to hold an emergency leadership vote.

The Nikkei share index hit a record high of 43,876.42 on August 19, riding a wave of optimism for corporate governance reforms and investment in AI.

Analysts in a poll by Reuters see the index easing off that level to 42,000 by year-end.

- Reuters with additional input and editing by Jim Pollard

ALSO SEE:

US Lowers Japan Auto Tariffs But Some Carmakers Will Still Hurt

Japan and US ‘Finalising Deal on Lower Auto Tariffs, Other Issues’

Japan Wants Issues Sorted Before Trade Rep Seals Big Tariff Deal

US Pushing Bank of Japan to Hike Rates? No, Says Tokyo

Political Uncertainty in Japan Clouding Rate Hikes, Budget

Toyota Slashes Profit Forecast, Sees $9.5 Billion Tariff Hit

Japan Debates How to Handle Rushed Tariff Deal With US

Nikkei Jumps After Trump Strikes 15% Tariff Deal With Japan

Japanese PM Ishiba Vows to Kick on Despite Loss of Upper House