(ATF) The price of lithium has risen almost 90% since the start of 2021, putting the metal on course to more than double in price by the end of the first quarter. A global commodity boom appears to be underway but even among in-demand metals lithium is seeing particularly keen appetite, driven by China’s thriving market for electric vehicles (EVs).

EV battery needs are overtaking phones as the chief source of demand for lithium, which has pushed the price of battery-grade lithium carbonate as high as $13,000 a tonne in March, a level that is approaching a peak last seen in August 2018.

The sources of lithium are spread across different regions, and attempts to cut deals might have a soothing effect on some geopolitical tensions as companies urge their political leaders to put aside grievances in order to facilitate trade.

A potentially calming effect – harking back to lithium’s former use in anti-depressant pharmaceuticals, which is now less widespread – might seem counterintuitive.

The US remains committed to battling China over its strategic dominance of some commodities, after all, and relations between China and Australia – the biggest source of lithium – deteriorated rapidly last year.

But companies that are important to the economies of their home nations are increasingly bound together in bets on the future use of lithium. This can have downside risk as well as a potential for growth, as Tianqi Lithium’s experiments in foreign investment demonstrate.

The Chinese company made a poorly timed push to secure supplies of Chilean lithium by buying a $4 billion stake in Chile’s SQM in 2018 – just before lithium hit a recent peak of $17,000 a tonne that it has not yet matched, despite the sharp revival in demand this year.

Tianqi Lithium was able to borrow so much money from Citic and other state-backed Chinese banks that its inability to meet a deadline last November for $1.9 billion of debt repayments forced a brokered settlement that involved the sale of part of its Australian lithium holdings.

Tianqi Lithium was effectively bailed out in December by Perth-based nickel and gold miner IGO, which is investing $1.4 billion in the unit that controls Greenbushes, Australia’s and the world’s largest hard rock lithium mine.

IGO Lithium Holdings will take a 49% stake in Tianqi Lithium Energy Australia. with Tianqi retaining control with 51%. The deal reportedly gives IGO 24.99% ownership in Greenbushes, plus 49% in Tianqi’s suspended Kwinana lithium processing plant, both of which are in Western Australia.

Following the agreement with IGO, Tianqi said it planned to extend its loan repayment deadline to November 2022. That should give the firm time to benefit from the current rally in lithium prices, and conveniently avoids an embarrassing default for a major Chinese borrower.

Less dramatic examples of closer cooperation between Chinese and Australian firms to supply lithium are also being seen.

In March, China’s Yibin Tianyi signed a $15-million prepayment agreement with Pilbara Minerals of Australia for up to 40,000 tonnes of lithium ore, for example.

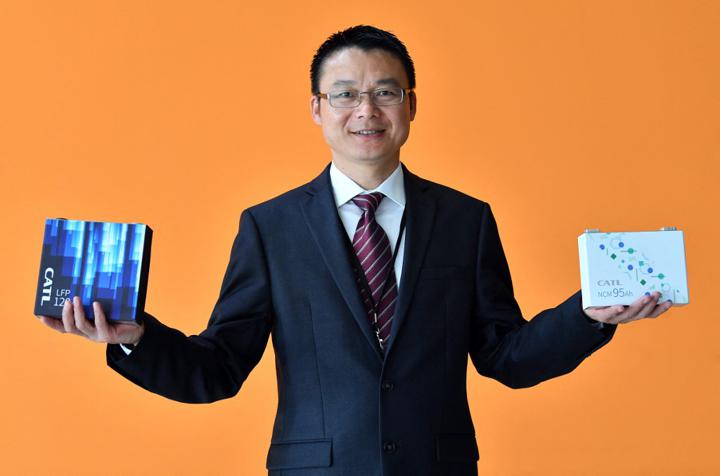

Jason Chen, general manager of European operations for Contemporary Amperex Technology Ltd, shows a lithium iron phosphate battery cell, left, for use in electric buses in China and a nickel cobalt manganese battery cell, right, for use in electric cars, at the opening of a Battery Innovation and Technology Centre in Arnstadt, Germany. China’s CATL group are building a factory for electric car battery cells nearby and it is due to start producing battery cells in 2022. File photo from July 2020 by Martin Schutt/dpa-Zentralbild via AFP.

A rechargeable Lithium-ion battery for the Volkswagen ID.3 electric car is pictured at a Volkswagen car factory in Zwickau, eastern Germany, on February 25, 2020. The Germany car giant said on March 15, 2021 it would set up six battery factories in Europe by 2030 as it ramps up its shift into electric vehicles. Pic: R. Hartmann / AFP.

Tesla’s Model Y is seen in a showroom in Beijing on January 5, 2021. Photo: Reuters.

Tesla, Volkswagen knock-on effect

The explosion in the value of Tesla in the last year has had a knock-on effect on shares of many suppliers of lithium, and the recent sharp rise in the value of Volkswagen’s stock is likely to compound the Tesla effect by giving investors confidence that some traditional automakers will be able to compete with the leader in the EV space – and buy more lithium.

Volkswagen’s most widely traded preferred shares are up almost 40% in 2021 so far, which is a stark contrast to a fall in value for Tesla from recent highs – albeit after a rise of around 700% last year.

Volkswagen shares are rising in large part because it has become more vocal about its goal of overtaking Tesla in EV sales by 2025, and its recent commitment to build six new EV battery factories.

Chinese EV firms such as Nio that compete with Tesla are also finding that a public commitment to battery production can have a positive impact on share prices.

And the race to produce batteries, or close deals for batteries, by EV firms is putting further upward pressure on prices for lithium, as well as other metals that are required in the manufacturing process, such as nickel.

As European and US auto firms try to catch up with Tesla’s global EV revenues, and attempt to generate enough demand in their home markets to rival the current lead in vehicle demand that is enjoyed by China, the issue of environmental standards in metals production is likely to become more important.

Buyers of electric vehicles are by their nature more concerned about environmental issues than consumers who stick with traditional autos, as they are still paying a premium for their choice, even if it is one that is rapidly narrowing.

Javier Calleja, head of bus maker Solaris, stands by one of its electric Urbino 12 buses in Hamburg in a file photo from Feb 2019. This has 70 seats, is powered by lithium-ion batteries (240kw hours). Pic: C. Charisius/dpa, AFP.

This photo taken on November 14, 2020 shows lithium batteries displayed in the workshop of a lithium battery manufacturing company in Huaibei, eastern China’s Anhui province. Photo: STR / AFP.

Japanese scientist Akira Yoshino, who is an honorary fellow with Asahi Kasei Corp in Osaka, shows the Nobel Prize for Chemistry that he (and two others, American John Goodenough and Briton Stanley Whittingham) won in Dec 2019 for developing the lithium-ion battery, which is light, generates high voltage and is rechargeable. This invention contributed to the spread of mobile devices including smartphones and electric vehicles. Photo: Naomi Maeda/ Yomiuri Shimbun via AFP.

Other environmental factors

There are more environmental factors than just vehicle emissions to consider when making a purchasing decision, however.

Mining brings its own environmental costs and there is a growing focus on the different side-effects of various types of mineral extraction.

Hard rock mining, the dominant source of Australian lithium, consumes large amounts of water and involve significant carbon dioxide emissions from its roasting process, for example.

Conveniently, US and European companies are now promoting the idea that they can produce lithium using geothermal techniques that are less environmentally damaging.

In California, the area around the Salton Sea – an inland lake that was once a symbol of economic decay – is being rebranded as “lithium valley” and the state energy commission has projected that the field could meet 40% of global lithium demand.

That lofty goal will depend on the actual cost of its production of lithium, of course, and in the near term the price of the metal will be set by existing reliable supply sources in countries such as Australia and Chile, and the demand which is driven by Chinese firms.

Another step in the development of a more widely traded lithium market will come with the launch of the first futures for the metal, with the LME planning to unveil debut contracts in June.

But the course of the current boom in lithium prices will be determined above all by the rise in global demand for electric vehicles.

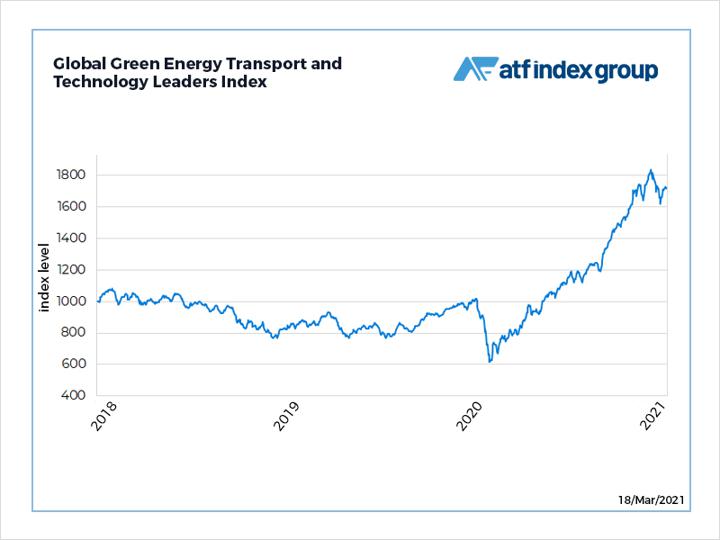

The Global Green Energy Transport and Technology Leaders Index created by Asia Times Financial in collaboration with ALLINDEX, is a benchmark that tracks shares of leaders in electric vehicle and renewable energy production and storage businesses.