Economic events

Financial markets this week will grapple with the fading possibility of a quick stimulus package in the world’s biggest economy as the two sides of the political divide drift further apart. House Speaker Nancy Pelosi said there was a divergence of views on who should be covered by tax credits and President Donald Trump’s economic adviser Larry Kudlow said it was almost impossible to execute a coronavirus relief deal before election.

On the economic front China consumption trends will be tracked as China’s 3Q GDP report is unveiled alongside September activity data on industrial production, retail sales and fixed-asset investment.

Chinese economic growth is expected to have accelerated in the third quarter, with IHS Markit projecting GDP to have expanded at a 5.9% annual rate, up from 3.1% in the second quarter.

“Recent data indicated a broad-based recovery on both the supply and demand sides,” said Bernard Aw, Principal Economist at IHS Markit. “A sustained recovery will add to views that the mainland Chinese authorities have no need for additional stimulus measures.”

A Reuters poll conducted earlier this month said the world’s second-largest economy is expected to have grown 5.2% in July-September from a year earlier, faster than the second quarter’s 3.2%.

This consensus view of an improving economy is fanning expectations of no change to the country’s monetary policy stance when the People’s Bank of China unveils the one-year and over five-year Loan Prime Rate (LPR) .

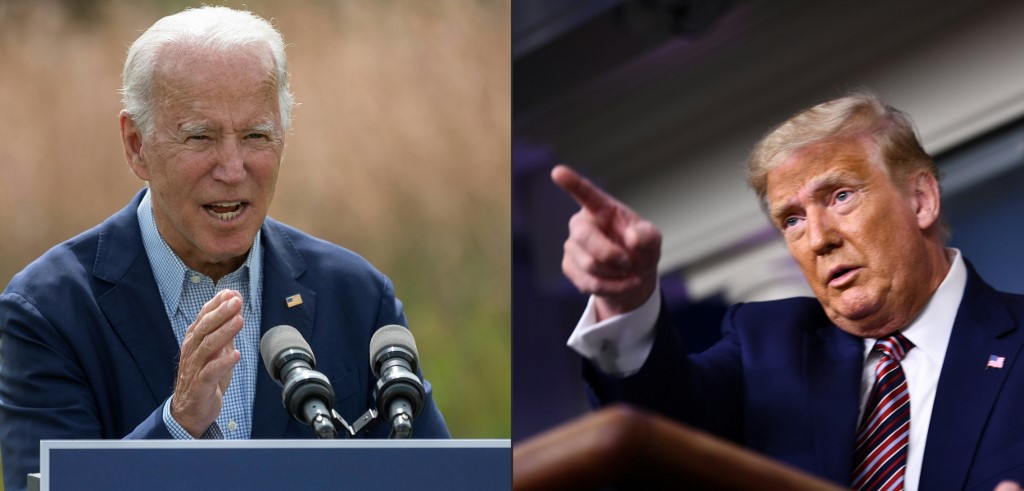

Elsewhere, flash PMI data will also provide insights into how the world’s largest economies started the fourth quarter. Thursday will see the final US presidential debate between President Donald Trump and Democratic nominee Joe Biden. The Commission on Presidential debates has announced the topics for the debate: “Fighting COVID-19,” “American Families,” “Race in America,” “Climate Change,” “National Security” and “Leadership.”

Fund flow

Investors continue to put money to work, fund flow data for the week ending October 14 showed as both US and EM bond and equities funds took in inflows at the cost of outflows from money market funds, according to fund data provider EPFR Global.

“Risk assets continued to record inflows for another week. After three weeks of outflows, IG, HY and equities are now back in positive territory for a second week. Tighter spreads and higher valuations have supported risk taking across credit, government bond, equities and EM debt space,” said BofA Securities analysts.

Bond Funds took in another $17.5 billion during the week ending October 14, with two thirds of that total going to US Bond Funds. Emerging Markets Bond Funds posted their 14th inflow in the past 15 weeks, with China Bond Funds attracting over $600 million having enjoyed consistent retail support since late April. China bond funds current run of inflows stretches back to late March.

US Money Market Funds bled another $26 billion, and the group has lost $225 billion since mid-May but during the same period Europe Money Market Funds absorbed over $100 billion as investors braced for Brexit uncertainty.

Emerging Markets Equity Funds saw inflows for the seventh time in the past nine weeks with the bulk of those inflows going to Asia ex-Japan and the diversified Global Emerging Markets (GEM) Equity Funds.

“The faith in Emerging Asian markets is based on their relative success in containing the COVID-19 pandemic and their early rebounds from the economic shocks caused by the measures taken to tackle the virus,” said Cameron Brandt, EPFR’s Director, Research.

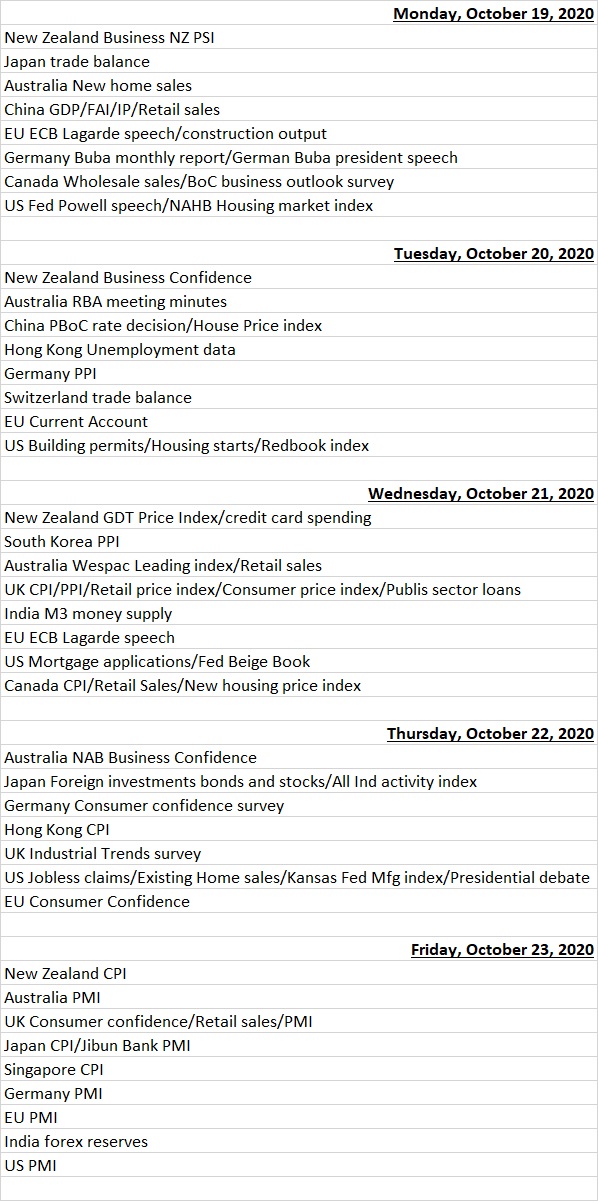

Economic Data Calendar

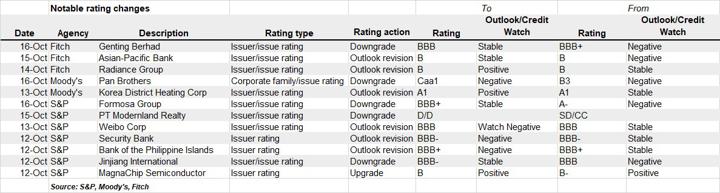

Last Week’s Rating Changes