Economic events

Financial markets could start on a jittery note as investors brace for more dramatic decisions in in the last week of Donald Trump’s presidency, following his move last week requiring investors to offload their holdings in Chinese companies with military links.

Tensions between the world’s two biggest economies will remain elevated after the US State Department released a statement that stepped up its claim COVID-19 may have escaped from Chinese lab. Washington said several researchers inside the Wuhan Institute of Virology became sick in autumn 2019, before the first identified case of the outbreak and US Secretary of State Mike Pompeo tweeted “Wuhan was COVID-19 ground zero”.

In another move seen raising tensions, the State Department also released a statement criticizing arrests in Hong Kong, and designating the People’s Republic of China and Hong Kong officials in connection with the crackdown.

While investors expect tensions to calm after President-elect Joe Biden takes over the White House, they are settling for the long haul over the Trump administration’s investment bans. Financial markets are resigned to these sanctions remaining in place as expectations are low that Biden will reverse course, leaving investors worried their access to China’s vast capital markets and huge economy will be increasingly restricted.

China GDP

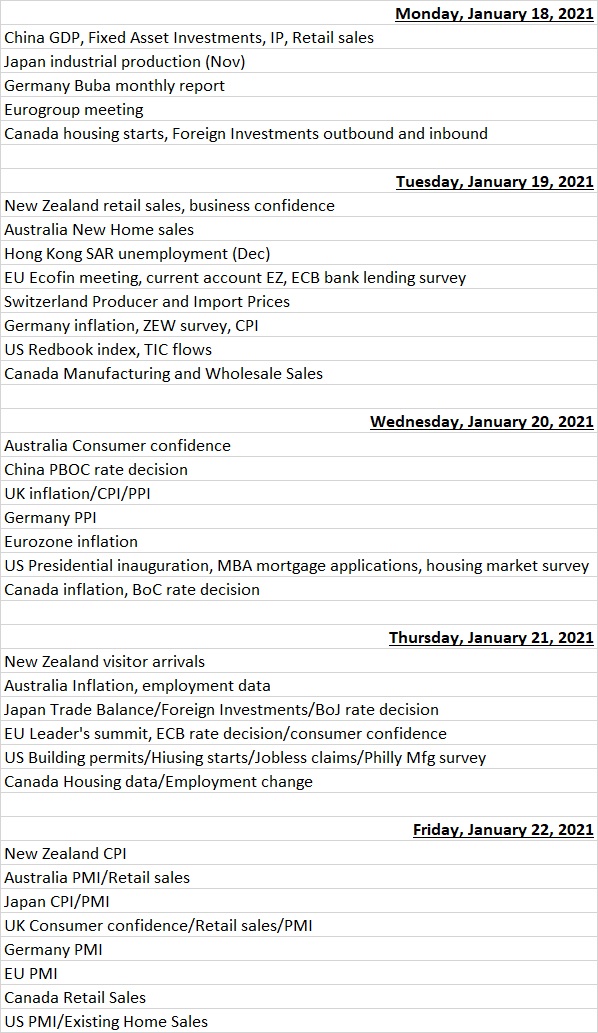

Besides the inauguration of the 46th US president, market focus will also be on China’s GDP, monetary policy decisions from the PBoC, ECB and the BoJ and flash PMIs for the four of the largest developed-world economies – US, EU, Japan and Australia.

China is the only major economy likely to have posted an expansion in 2020 – a Reuters poll showed GDP growth was expected to strengthen to a pace of 5.8% up from Q3’s 4.9%. The strength of the economic rebound could pressure the PBOC to rein in its pandemic stimulus, and there are growing expectations of a rate hike in the second half of the year.

“The PBOC has started steering towards countercyclical tightening, as growth has already returned to the pre-COVID path, while the US is likely to deploy additional fiscal stimulus,” said Morgan Stanley analysts while upgrading their year-end target for the yuan to 6.25 to a dollar from 6.40.

The ECB meets this week for the first time in 2021, after having provided additional stimulus measures in December and reiterating its easing bias.

“After the December decision, it is clear that the ECB will want to stay on the sidelines for as long as possible … any new action would first consist of words, not policy action,” said Carsten Brzeski, ING Bank’s Global Head of Macro.

After the Bank of Japan’s monetary policy meeting, focus will be on whether there will be additional support after the Japanese government declared a state of emergency for Tokyo and some other prefectures that commenced on 8th January.

“As with most central banks around the world, the BoJ’s major concern is ensuring sufficient monetary support given the ongoing downside risks from COVID-19. Policymakers will subsequently be scouring the latest survey data for any signs of a worsening in the situation – especially given Japan’s latest COVID-19 wave,” said Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit.

Fund flow

In the week to January 13, Emerging Markets Equity Funds inflows resumed after the previous week’s break in four months of positive flows, as rising commodity prices, a weak US dollar and hopes for global reflation in the second half of 2021 boosted investor sentiment.

“Despite the renewed interest, fund investors still have an implied underweight position on EM equities,” said Societe Generale strategist Arthur Van Slooten. “The current weight (8.5% of all EPFR equity funds) is below the historical average weighting. While China equity funds remain in high demand, by far the most popular way to invest in EM equity funds is through Global EM equity funds. After three years of continuous outflows, Indonesia equity funds seem largely “under-owned”. Nevertheless, we highlight the market as a major beneficiary of a cyclical recovery.”

In the fixed income space, inflows favoured emerging market and high yield debt. EM debt funds continue to enjoy strong inflows, extending their streak of inflows to 15 weeks and high yield funds enjoyed their strongest inflow in 27 weeks, extending their streak of inflows to ten last week, and the longest since July 2020.

“Investors continue to favour “safety” but also chase yield in 2021, driving “barbelling” in flows space,” said BofA Securities strategists Barnaby Martin and Ioannis Angelakis.

“EM debt and HY funds have been outperforming IG funds. This dynamic is likely to continue amid lack of yield in fixed income. We see flows into higher yielding assets to remain healthy against a backdrop of low yields and supportive central bank’s policies.”

Inflationary undercurrent

But the undercurrent of inflationary angst has started to bubble to the surface amid rising commodity and transportation costs, cash stockpiles in savings and money market accounts, the fiscal agenda of the incoming US administration and signals from the US Federal Reserve that the switch to a tightening bias.

“The possibility that global reflation will be accompanied by an unwelcome inflationary spike continued to shape flows,” said Cameron Brandt, EPFR’s Director, Research while highlighting investor flows that hedge against the capital-eroding properties of inflation.

Inflation Protected Bond Funds extended their current inflow streak to eight weeks and $8.7 billion, and Bank Loan Funds, historically viewed as a play on rising interest rates, recorded their biggest inflow since mid-2Q18.

Bank Loan Funds, historically viewed as a play on rising interest rates, posted their biggest inflow since mid-2Q18 and Inflation Protected Bond Funds took in over $1 billion for the fourth time in the past seven weeks.

Investors looking for yield to offset rising prices committed fresh money to High Yield and Emerging Markets Bond Funds for the fourth and 15th straight weeks respectively.

Economic data calendar

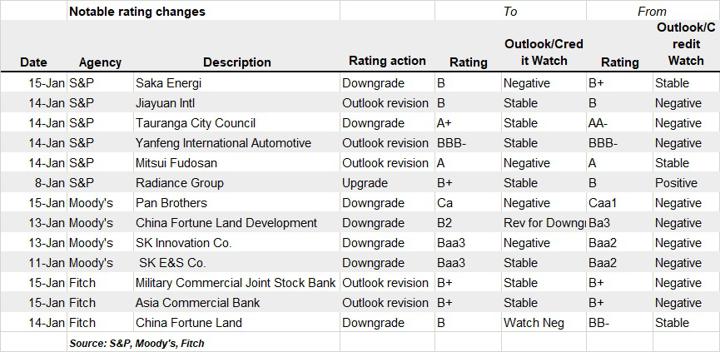

Last week’s rating changes