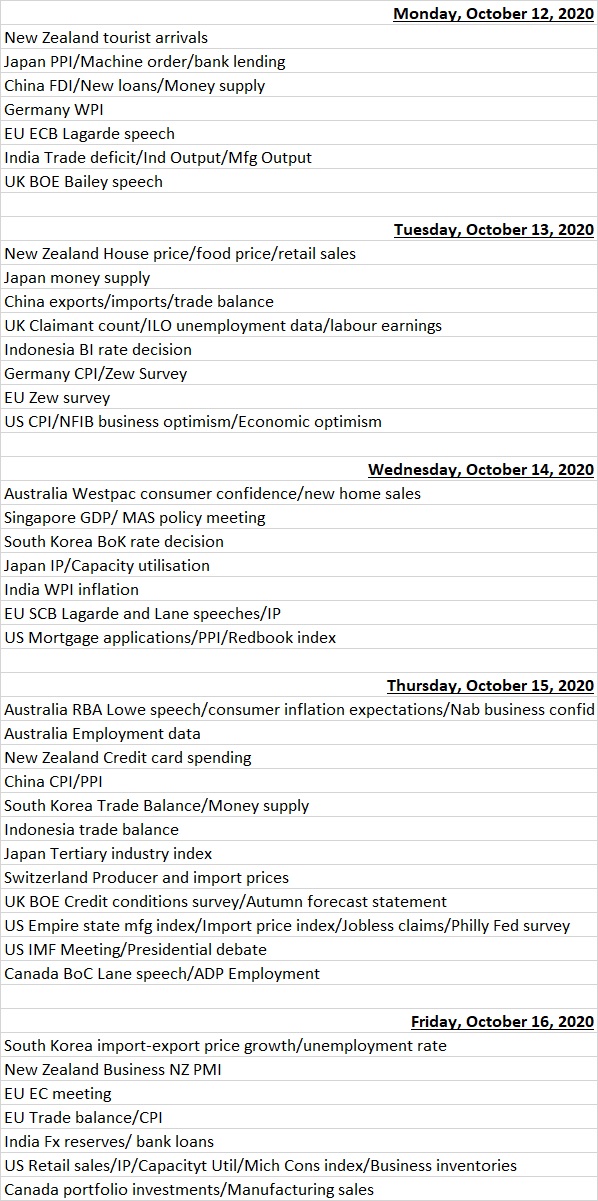

(ATF) Economic events

Financial markets will open on a subdued note after US Democrat and Republican Senators both pushed back on President Donald Trump’s $1.8 trillion coronavirus stimulus offer, dealing a setback to an aid package to support the world’s largest economy. Geopolitics tensions are also seen pressuring sentiment after North Korea displayed a new long-range missile at a military parade on Saturday drawing criticism from South Korea.

In Asia, markets will focus on monetary policy meetings in South Korea, Indonesia and Singapore, besides trade, inflation and money supply data from China and India.

“China’s holiday (1-8 Oct) data showed tourist attractions running close to maximum capacity and more improvement in retail sales, with no new local cases reported,” said Barclays economists in a note.

“This, coupled with strong gains in the September services PMIs, supports our outlook for more catch-up in services and consumption in H2. We expect September data to show the credit expansion continued to gather pace on strong LG bond issuance and export growth to reach double digits.”

Central banks in South Korea and Indonesia are expected to hold benchmark interest rates steady at 0.50% and 4% respectively but the post-meeting statements of the two authorities will be monitored for future movements.

Singapore, which manages monetary policy through exchange rate settings, rather than interest rates, by allowing the Singapore dollar rise or fall against the currencies of its main trading partners within an undisclosed band is unlikely to make changes on Wednesday.

“We do not expect MAS to make any changes to the SGD NEER policy band parameters (the slope, mid-point or width) at the upcoming biannual meeting on 14th October,” said Goldman Sachs economists Zhennan Li and Andrew Tilton in a note.

“However, given uncertainty around the virus path, vaccine developments and global growth, should the depth and duration of the downturn be larger than we currently expect, that could create risks of further downward adjustments to the mid-point of the policy band over the coming year.”

The International Monetary Fund and the World Bank will hold their annual meetings this week from Monday, October 12, through Sunday, October 18 and their statements will be keenly tracked because they come at a time of the worst global recession since The Great Depression. These global financial institutions views on donor relief, revisions in growth forecasts and sovereign indebtedness will be closely tracked even as they are expected to reiterate their appeal to national governments to boost spending.

Fund flow

Investors flocked to bond funds in the first week of the year’s final quarter with EPFR-tracked bond funds attracting a cumulative net inflow of $25.9 billion during the week ending Oct. 7. Korea Bond Fund inflows hit levels last seen in early 3Q17 and Japan Bond Funds recorded their largest inflow in over seven months while flows to Inflation Protected and Municipal Bond Funds resumed after the previous week’s reversal.

Fixed income assets attracted investments across the board – flows into Emerging Markets, Asia Pacific, Global, Europe and US Bond Funds hit five, six, eight, 16 and 18-week highs respectively while, at the asset class level, High Yield Bond Funds recorded their biggest inflow in over three months, fund flow tracker EPFR said.

“Revived interest in emerging markets assets was reflected in the sixth inflow for Emerging Markets Equity Funds over the past eight weeks and the 13th inflow since the beginning of July for Emerging Markets Bond Funds,” said Cameron Brandt, EPFR’s Director, Research.

He added EPFR-tracked Emerging Markets Equity Funds started the final quarter of 2020 with inflows –the sixth in the past eight weeks — as current valuations, future growth prospects and China’s post-pandemic rebound drew investors.

Asia ex-Japan Equity Funds extended their second longest inflow streak year-to-date, with India Equity Funds posting only their second weekly inflow since the beginning of June, flows into Malaysia Equity Funds hitting their highest level in just under a year and China Equity Funds attracting retail commitments for the 16th week in a row during the ‘Golden Week’ market holiday.

Economic data calendar

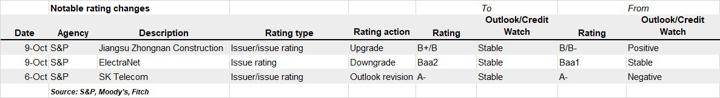

LAST WEEK’S RATING CHANGES