(ATF) Economic events

Global markets are cautiously optimistic as a slew of vaccine developments lift sentiment but gains will be checked as the rising infection count and a clash between the US Treasury and the Federal Reserve threatens the economic recovery.

In the United States, Treasury Secretary Steven Mnuchin’s decision on clawback of Fed funds was criticised by the central bank and its officials.

The US central bank said it “would prefer that the full suite of emergency facilities established during the coronavirus pandemic continue to serve their important role as a backstop for our still-strained and vulnerable economy”.

Chicago Federal Reserve President Charles Evans told CNBC; “I think our 13(3) facilities have been very helpful. They perform a backstop role for when markets find themselves in a more challenged situation. I think that backstop role might be important for quite some time, so it’s disappointing.”

Markets are worried about the signals this episode is sending.

“Overall, I’m pretty sure that the Fed knows best about the forward-looking risks to markets and the economy at a fragile point at which downside risks are emerging. Even if you don’t accept this point, it’s indisputable that Fed-Treasury coordination is vitally important to markets at points of uncertainty. Creating the perception of a rift is not helpful and creates the conditions for leveraged money to exploit uncertainty,” Derek Holt, Scotiabank’s Head of Capital Markets Economics, said.

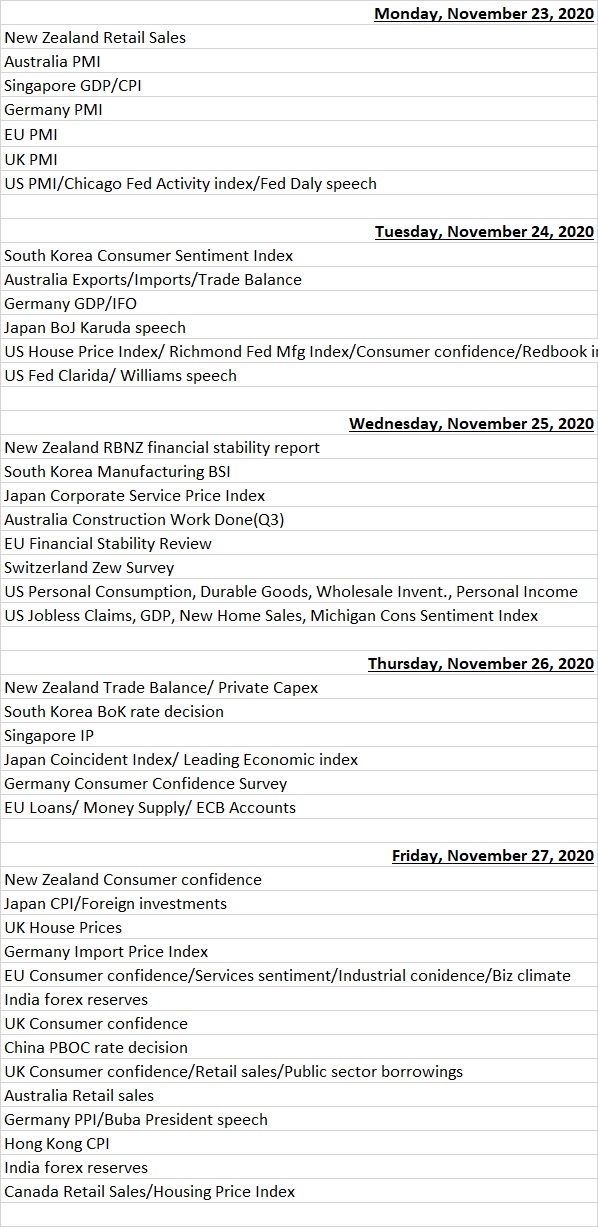

On the data front, markets will track a slew of industrial output data from a number of Asian economies and China’s industrial profits to gauge the strength of the economic recovery while the Bank of Korea will unveil its rate decision.

Japan’s data releases will be of interest after the official GDP data showing a rebound in Q3 – retail sales, industrial production and housing starts for October will reveal whether this recovery continued into the fourth quarter.

“Business sentiment continues to strengthen, with the latest Japan Business Outlook survey indicating that the degree of optimism in Japan reached a survey record, with both services and manufacturing firms projecting stronger output,” Bernard Aw, the Principal Economist at IHS Markit, said.

“That said, flash PMI data indicate that recovery momentum could be difficult to maintain.”

Fund flows

Despite reports of successes from three vaccine makers, investor flows reflected caution as the infection count remained elevated, hampering the near-term economic outlook. Emerging markets remained on the comeback trail boosted by China’s rebound as EM Equity Funds posted their ninth consecutive inflow and Emerging Markets Bond Funds their 19th in the past 21 weeks, data from EPFR Global showed.

“EPFR-tracked Emerging Markets Equity Funds enjoyed another week of above average inflows during mid-November as investors priced in a more benign – and Covid-free – environment in 2021,” its Research head Cameron Brandt said.

He added that interest in China drove the headline number for Asia ex-Japan Equity Funds during the week. Flows into Hong Kong, Greater China, Taiwan and China Equity Funds hit three, eight, 11 and 18-week highs respectively, as China and ASEAN members signed the Regional Comprehensive Economic Partnership.

EPFR data showed developed market investors focused on more conventional US policymaking, the impact of widespread vaccination and improving trade. Flows continued to exit Europe Equity Funds as the second wave of new Covid-19 cases that recently accounted for 40% of the global total, triggering another round of restrictions and lockdowns.

Economic data calendar

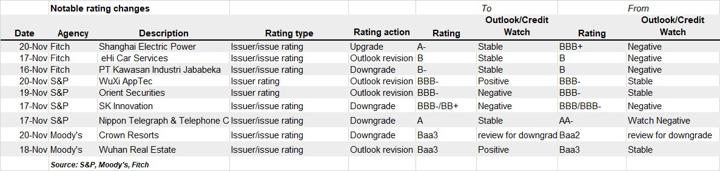

Last week’s ratings changes